The Hidden Currents of Crypto 🌊🔍

In the vast ocean of cryptocurrency investment, Bitcoin stands as the undisputed giant. Yet, behind its monumental price movements and headline-grabbing news, a quieter, more subtle force is at play: the net ETF (Exchange-Traded Fund) flows. These seemingly benign figures hold the key to understanding the intricate dance between institutional interest and market sentiment. Ever wondered how the ebb and flow of ETF investments influence Bitcoin’s trajectory? Join us as we dive deep into the world of net ETF flows, uncovering how these movements shape the future of the leading digital asset. 🌟🚀

Chapter 1: The Basics of Bitcoin ETFs 📚💡

Hook: Navigating the ETF Landscape 🧭

Before diving into the data, it’s crucial to understand what an ETF is and why it matters for Bitcoin. An ETF, or Exchange-Traded Fund, is a financial instrument that allows investors to buy shares that represent a collection of assets, in this case, Bitcoin. But why should you care? ETFs offer a way for institutional and retail investors alike to gain exposure to Bitcoin without directly purchasing the cryptocurrency. This accessibility can lead to significant shifts in market dynamics. 💼📉

What is a Bitcoin ETF? 🔎📊

A Bitcoin ETF tracks the price of Bitcoin and trades on traditional stock exchanges. It provides an avenue for investors to gain Bitcoin exposure through familiar financial instruments. Unlike directly buying Bitcoin, which involves setting up a digital wallet and navigating crypto exchanges, an ETF simplifies the process by trading on standard stock exchanges. 🏦💻

Why ETF Flows Matter 🌐📈

Net ETF flows represent the total amount of money entering or leaving these ETFs. Positive net flows suggest that more money is being invested into Bitcoin through ETFs, signaling bullish sentiment. Conversely, negative net flows indicate potential bearish trends. Understanding these flows helps gauge market confidence and institutional interest in Bitcoin. 📈💵

Chapter 2: Daily vs. Cumulative Net Flows: The Key Distinctions 📅📊

Hook: The Day-to-Day Drama 🎭

Imagine tracking a sports team’s performance not just by their overall season record, but also by each game’s score. Similarly, analyzing Bitcoin ETF flows involves looking at both daily and cumulative data. Each offers a unique perspective on market trends and investor behavior. ⚽📅

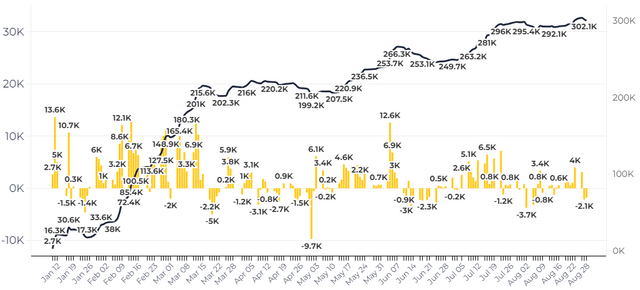

Daily Net ETF Flows 📉🕒

Daily net ETF flows provide a snapshot of how much capital is moving into or out of Bitcoin ETFs each day. This short-term view reveals immediate market reactions to news, trends, or economic indicators. For example, a sudden influx of capital might indicate a positive reaction to favorable regulatory news, while a sharp outflow could signal investor caution. 📰📉

Cumulative Net ETF Flows 📈📆

On the other hand, cumulative net ETF flows aggregate daily data over a longer period, offering insights into long-term trends. This measure helps identify whether there is a sustained increase or decrease in investment. A consistent upward trend in cumulative flows may suggest growing institutional confidence and long-term bullish sentiment. 📊🔝

Chapter 3: Deciphering Market Sentiment Through ETF Flows 🤔📉

Hook: The Psychological Pulse 🧠💬

ETF flows are not just numbers; they’re a reflection of market psychology. Understanding these flows can reveal broader investor sentiments and expectations about Bitcoin’s future. 🧩🔮

Bullish Indicators 📈🚀

Positive net ETF flows can signal optimism among investors. When large sums of money flow into Bitcoin ETFs, it often indicates that institutions are confident in Bitcoin’s future performance. This confidence can drive further investment and potentially push Bitcoin prices higher. 💵💪

Bearish Signals 📉🔻

Conversely, negative net ETF flows might suggest that investors are retreating from Bitcoin. Such outflows can occur due to market corrections, regulatory concerns, or macroeconomic factors. Monitoring these negative trends helps in assessing potential downturns and preparing for market volatility. ⚠️📉

Chapter 4: Case Studies: Historical ETF Flow Trends and Market Impact 📚📈

Hook: Lessons from the Past 📜🔍

History often provides the best lessons. By examining past ETF flow trends, we can better understand how these flows have impacted Bitcoin’s price and market dynamics. ⏳📉

The 2020 Surge 🚀📈

In 2020, Bitcoin saw a significant rise in ETF inflows, coinciding with the broader adoption of cryptocurrencies and institutional interest. This surge was instrumental in driving Bitcoin’s price to new heights. Analyzing this period offers insights into how increased ETF investments can correlate with bullish market movements. 🌟💰

The 2022 Dip 📉🔻

In contrast, the year 2022 saw a notable dip in ETF flows amid regulatory crackdowns and market corrections. This decline in investment was reflected in Bitcoin’s price movements, demonstrating how ETF flows can influence and often predict broader market trends. ⚠️📉

Chapter 5: The Future of Bitcoin ETF Flows: What Lies Ahead? 🔮🌟

Hook: Gazing into the Crystal Ball 🔮🔍

As Bitcoin continues to evolve, so will the dynamics of ETF flows. What does the future hold for these investments, and how might they shape Bitcoin’s path? 📈🌐

Regulatory Developments 🏛️⚖️

Future regulatory changes could significantly impact ETF flows. Positive regulatory advancements might boost investor confidence and increase ETF investments, while restrictive policies could have the opposite effect. Keeping an eye on regulatory news is crucial for predicting future flow trends. 📜🔮

Technological and Market Innovations 💡🚀

Emerging technologies and market innovations, such as new financial instruments or platforms, could alter how investors interact with Bitcoin ETFs. These developments might open new avenues for investment and affect ETF flow trends in unexpected ways. 🧩🌐

###Navigating the Waves of Bitcoin ETF Flows 🌊📈

As we’ve explored, the world of Bitcoin ETF flows is a dynamic and revealing landscape. From understanding the basics of ETFs to analyzing daily and cumulative flows, and decoding market sentiment, these flows provide crucial insights into Bitcoin’s market behavior. By staying informed about ETF trends and their implications, you can better navigate the ever-changing waters of cryptocurrency investment. Whether you’re a seasoned investor or new to the crypto world, keeping a pulse on ETF flows will help you make more informed decisions and grasp the broader market dynamics shaping Bitcoin’s future. Dive in and stay ahead of the curve—your investment journey awaits! 🌟💹