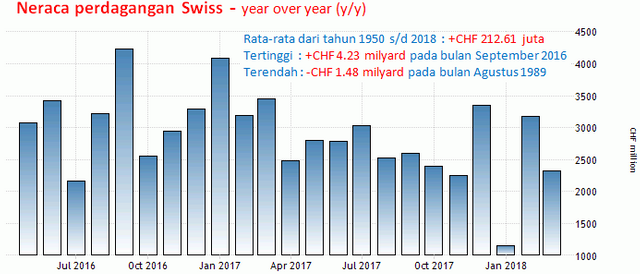

13:00 WIB: Swiss trade balance data of April 2018 (Medium impact on CHF).

This indicator measures the difference in the value of Swiss exports and imports over the same month in the previous year (year over year or y / y). Due to Switzerland's relatively small population with very limited natural resources, foreign trade becomes very important for the Swiss economy. The major Swiss trading partners are Germany, France, Italy, and the United States. The level of demand from these countries will have an impact on Swiss trade.

Since June 2014, the Swiss trade balance has always been surplus. In March, the report was a surplus of CHF2.32 billion (y / y), lower than the expected surplus of CHF2.90 billion, also lower than the previous month's surplus of CHF3.18 billion. In March 2018, y / y exports stagnated at CHF19.36 billion, while y / y imports rose 5.4% to CHF17.05 billion. For April 2018, Swiss trade is forecast y / y will return a surplus of CHF2.23 billion. A higher-than-expected surplus will tend to support the strengthening of CHF.

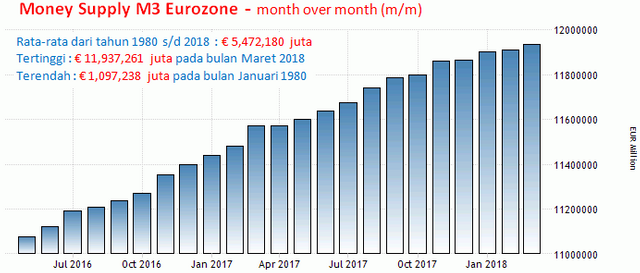

In March, the M3 Money Supply of the Euro area rose 3.7% to € 11,937,261 million (the highest since January 1980), lower than forecast to rise 4.1%, and is the lowest percentage increase since February 2015. For April 2018, it is estimated that M3 Money Supply Euro area will rise 3.9%. A higher-than-expected release will likely support EUR's strengthening

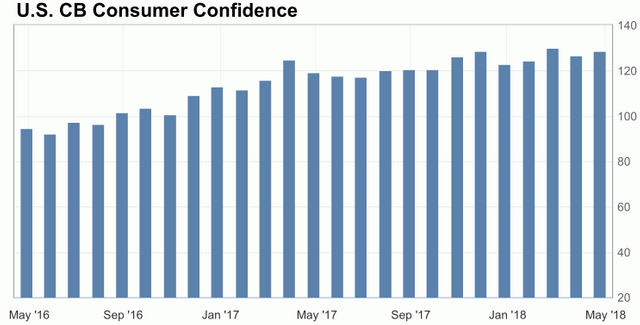

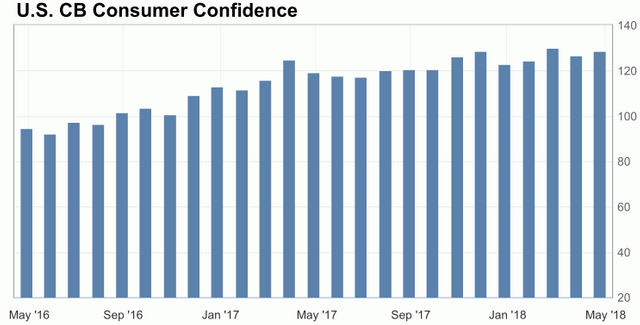

Hours 21:00 am: US Conference Board consumer confidence index (CB) in May 2018 (High impact on USD).

This consumer confidence index was released by The Conference Board Inc. (CB), based on a survey of 5,000 households as respondents representing consumers in general. The results of this survey show the level of consumer confidence in the current condition of the US economy (present situation) and the time to come (expectations), especially on business conditions and availability of employment. The index reflects financial confidence and is an early indicator of consumer spending that accounts for nearly 70% of US economic activity.

The CB Consumer Confidence index in April was at 128.7, higher than the 126.0 forecast, also higher than the previous month's 127.0 (revised from 127.7 previous data). In April 2018, the expectation index rose from 106.2 to 108.1, and the present situation index rose from 158.1 to 159.6. For May 2018, it is expected that the consumer confidence index will decline slightly to 128.2. A higher-than-expected release will likely cause the USD to strengthen.

Wednesday, May 30, 2018:

At 04:00 WIB: Financial Stability Report RBNZ (High Impact on NZD).

The report is released 2 times a year and has a high impact because it contains the views of New Zealand's central bank, on inflation and growth rates that will greatly influence the decision to determine interest rates.

Kuroda is scheduled to speak at the annual conference of the Bank of Japan Institute for Monetary and Economic Studies in Tokyo. The contents of Kuroda's speech can be read here.

At 08:10 am: testimony of RBNZ governor Adrian Orr (High impact on NZD).

Adrian Orr is scheduled to hold a testimony before parliament in Wellington.

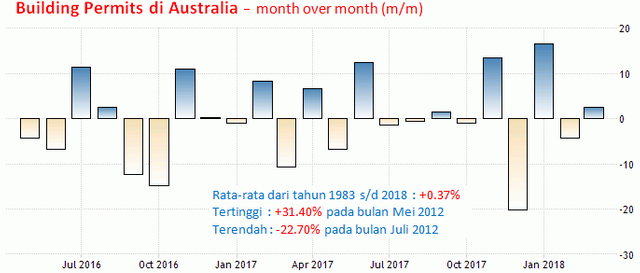

8:30 am: Building Permits data in Australia in April 2018 (Medium impact on AUD).

The number of building permits (Building Permits) is an indicator for the activity of building construction work that will affect the increase of manpower, purchase of building materials products, and housing investment. The data release is the percentage change in the number of building permits compared to the previous month.

Last March, the number of building permits in Australia rose 2.6%, higher than forecasts of a 1.1% rise, also higher than the previous month's 4.2% drop. For April 2018, it is estimated that the number of building permits will drop 2.9% (or -2.9%). Higher-than-expected release results will likely support AUD's upside.