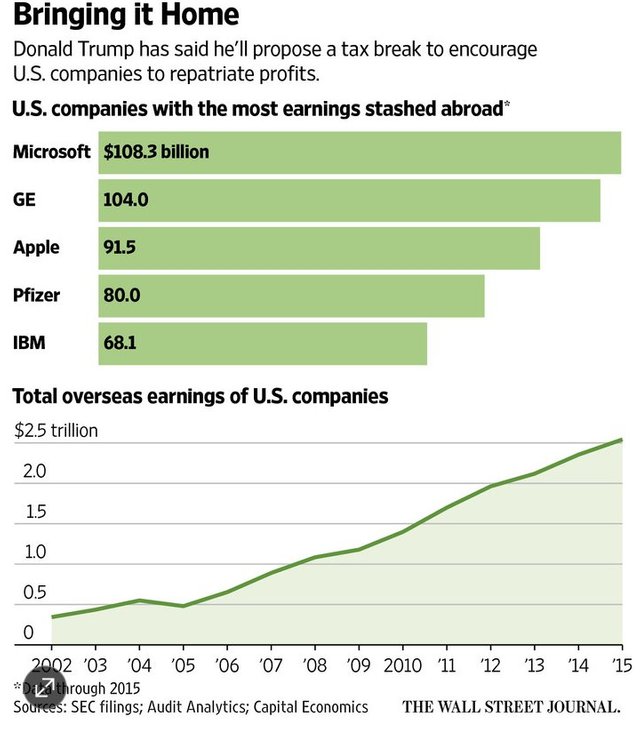

The USD has recently broken multi-year highs, mostly fueled by a highly anticipated rate hike by the FOMC coming up on Dec the 14th. Trump repatriation, there are around $2.5 trillion dollars in profits from some of the United State's largest corporations currently being held over seas, mainly in avoidance of US tax rates. Some of that money could be on its way back to the United States within the next year.

As things currently stand, US corporate tax rates are around 35%, so, many companies opt to not spend portions of profits in the US and do in countries that will tax them at lower rates. Donald Trump has said that he plans to offer companies a 10% repatriation tax cut, to bring some of this money back home. Should companies bring this money back into the US, it can then be reinvested in the companies, easily bringing jobs, research and development back into the US.

Some small part of this may already be priced into the USD with this rally, but there is a lot of uncertainly around this piece of legislation because, first, it has to be passed and second, companies have to participate. So, should the whole thing go swimmingly there will be an abnormally large need for US dollars when this takes place, pushing the value of the USD compared to the rest of the currency basket, up, yet again.

The Homeland Investment Act of 2004, had a very similar tax cut in it. It brought more than $360 billion back into the United States and the USD rose about 13% against the other 6 major currencies in the basket as a result. Analyst have said, this time around should not be as much of a shock for the USD and would be likely to bring in close to the amount brought in by the cut in 2004. The game changer here, would be if congress makes the repatriation mandatory, in that case inflows would be much larger.

In addition to giving US companies the opportunity to reinvest in their US locations, repatriation and the rising USD will likely bring overseas investment dollars and help to pare down the US current-account deficit of $120 billion. While bond premiums may take a hit, coupon rates will increase and the main street side of the economy will see additional relief.

Quote

TD estimates that a repatriation “holiday” would spur around $330 billion in inflows, though the bank thinks only $100 billion would need to be swapped for the dollar.

Analysts at Bank of America Merrill Lynch estimate closer to $400 billion in foreign currencies would need to be exchanged for the dollar.

For further reading: "Dollar to Benefit if $2.5 Trillion in Cash Stashed Abroad Is Repatriated"

Original Post at TradersCommunity.com

Check out the latest oil market news and data at OOTTNews.com

Thank You!

This will be very interesting to watch unfold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been ranked within the top 50 most undervalued posts in the second half of Nov 25. We estimate that this post is undervalued by $10.19 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Nov 25 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit