Content adapted from this Zerohedge.com article : Source

The passage of the tax cuts by Congress and sign by Donald Trump comes with a huge pricetag. How much? $10T.

Moody's is now considering downgrading U.S. debt.

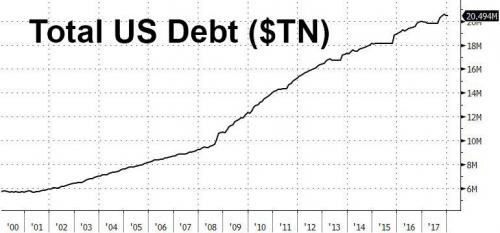

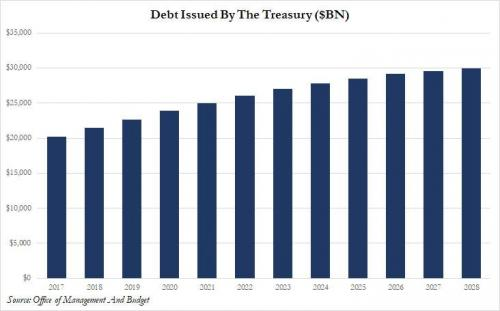

Moody's will have even greater motivation to downgrade the US as according to the forecast, total US debt is projected to rise from $20.5 trillion today to an unprecedented $29.9 trillion in 2028.

At least Congress will shoot down the proposal to opt for one that is likely more expensive.

he good news, as noted earlier, is that Trump’s proposal, which calls for higher spending on military and immigration enforcement and abandons the GOP goal of balancing the budget over decade, is expected to be ignored by Congress. What is unknown is what alternative Congress will come up with, and how much higher the 2028 debt total will end up being.

Non-adapted content of this Zerohedge.com article:

https://www.zerohedge.com/news/2018-02-12/trump-budget-sees-us-debt-hitting-30-trillion-2028

I think that there is $1.5 trillion earmarked for infrastructure improvements that is significantly beneficial. Otherwise, I would really prefer to see more spending geared toward basic necessities for our citizens like food and healthcare.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I cheered and celebrated after the passage of the tax cuts by Congress and Donald Trump later signing. I felt this was a historical moment for the average middle income american who saw their wages go up because of the slash on the rate paid by the corporations.

But looking deeper into it after reading this post, I see America is heading for a looming disaster of deficits and debt. The bill signed by Trump is only boosting the US economy in the short term as it is boosting the growth of the total size of the US GDP by 0.8%.

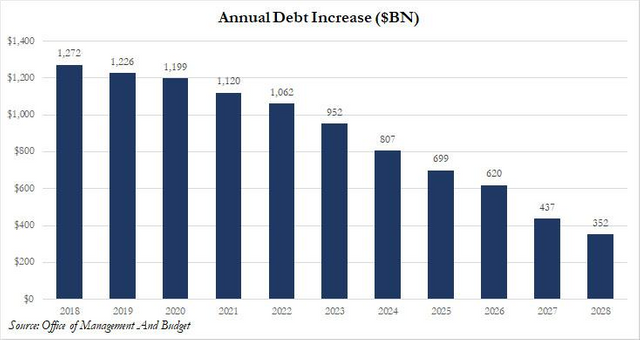

But in the long run, we see huge spending which is causing deficits as I see it, with deficits reaching $1trillion in the current or next fiscal year double what the congressional budget office had projected less than a year ago for 2018. The US debt being projected to rise from $20.5 trillion today to an unprecedented $29.9 trillion in 2028.. over 100% of projected GDP well into the danger zone. This debt is going to kill the american economy. These debts have been historically low for years but are now going up and may continue to rise for some time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There was no criticism when Barry blew out another 9 trillion dollars onto the stack of I.O.U.'s during his terms. So even though we've been screwed since about 1983, it's too late to fix it now, so why bother to scream and shout? Congress doesn't give a damn. Not even Alexander Hamilton could straighten out the banking and Wall St. mess from this point.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Screw that man and his government. Seriously, what they're planning to try and do to the SNAP program, what's happening to funding for public education, like, the list is endless. I thought the R were supposed to be for small govt spending? Increasing the deficit...guess we shouldn't be surprised by the people who are in office taking it for all they can. I can hear the cash register ringing for them every.damn.day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What's another few trillion in this crazy budget! Money for everyone! I've been waiting for this to fall apart for years if not decades now. It is stunning to see how big of a hole is being dug.

And almost NONE of the future obligations are in these numbers. There are all kinds of off-the-books liabilities upcoming. Such a nightmare for everyone and no one seems for care - especially not those in power.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Govt debt continues to rise? What else is new?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Big numbers This is very unfortunate I have been amazed at these debts and now will increase, after absorbing the shock of elections in the next few weeks will turn the attention of the United States to the economy. Despite the FBI's announcements, secret emails, scandals and scathing criticism covering everything else, economic problems emerged clearly in 2017. The Congressional Budget Office expected the public debt to increase to more than $ 20 trillion, with no An appropriate plan to slow this increase. The so-called debt ceiling, which is temporarily suspended in late 2015 to avoid electoral year turbulence, usually in March 2017 but does not control spending or debt. Compulsory spending (where allocations grow automatically without Congressional approval) is on the rise, Depleted military forces as future challenges, according to Forbes.

Low growth is associated with low business investment. Wrong policies and weak official growth prospects reduce business risk. Perhaps the Federal Reserve has lowered its medium-term growth forecast to 1.8%, while the Budget Office predicts that annual US growth will be only 2% until 2026 and a low labor force participation rate of 60.2% due to the suspension of millions of workers. In the final debate for the presidential candidates, Clinton saw poor economic performance due to the 2008 crisis, although Robert Barrow's research showed that the magnitude of the crisis was directly proportional to the speed of the reforms. But in an old letter, Federal Reserve Vice-President Stanley Fischer justified the slow growth. Pointing to aging statistics, poor productivity, investment in business and lack of technological innovation. And not to the Fed's poor allocation of capital to issuers of very low yield bonds. After all, there are three major reforms out of the impasse: the debt ceiling is strengthened, so the president and Congress commit themselves to restricting spending when debt goes beyond limit: the federal constraint is crucial to bolster private sector confidence in future taxing. Improved checks and balances are necessary to comply with the 10th constitutional amendment and correct federal spending allocations. Simplifying the tax system and lowering tax rates, especially the 35% corporate rate: this would improve US competitiveness, encourage economic growth and create a more attractive investment climate. There is an added advantage: the profits of foreign companies can be brought into the country and the number of US companies that are expected to relocate overseas is reduced. He urged the Fed to stop manipulating interest rates and bond yields. While the Fed needs independence from politicians, it should not be oblivious to its weak economic performance or its rate decisions coincide with the end of the political cycle. As part of its two main tasks: price stability and maximum employment, it must clarify its responsibility for monetary integrity regardless of policy. @zer0hedge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think America is heading for a looming disaster of deficits and debt. The bill signed by Trump is only boosting the US economy in the short term as it is boosting the growth of the total size of the US GDP by 0.8%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome to the bitcoin revolution!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

century ago when the banksters staged their coup and gave themselves the power to print America’s money & charge interest on it. It was inevitable that those banksters would use their privilege to eventually buy up & control the media, education, politicians, bureaucrats, the courts, etc.

To keep the Ponzi scam going the ‘debt’ is constantly rolled over and grown larger. The ‘credit’ money in the overall system is always less than that credit + interest due on the ‘loans’. In reality, it was all made up outta thin air Nothing. (Quite a clever & successful con !)

Ron Paul was the only presidential candidate that even brought up this root problem of America. And even Paul would only go so far. - I had hoped that with his media and t.v. experience, Trump would give a series of talks direct to the American people explaining the truth of our situation. On that score he has been no different than every president from Woodrow Wilson on.

thanks for share @zer0hedge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They're going after social security to pay for it.

The government counts close to $1 trillion of it's budget for social security pay out, it's because social security holds $3 trillion of the national debt and the government must pay dividends on that money.

Cutting social security pay out lowers the deficit. A 25% reduction in pay out means around $250 billion lower deficit.

One would think the redundant agency form of government could use some house cleaning, but not congress or the president. A federal government reform is way over due, the agencies perform the same function as state agencies. Maybe all the talk about the federal agencies being the Deep State is true, because these agencies should have been jerked out by the roots a long time ago.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We are 20 trillion in debt, with over 112 trillion in unfunded liabilities (legislation which Congress has passed, yet cannot afford to fund). There is only something like 35 trillion in circulation, and around 90 trillion available in the entire world.

It gets complicated beyond that when you factor in bitcoin, gold, derivatives, you are around a quadrillion or so.

we are well past the point of things being unsustainable, and it would appear we are due for a currency reset, possibly to usher in a new global digital currency we will all be forced to spend the rest of our lives as debt slaves in pursuit of

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@zer0hedge Very nice and congratulations👌

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's almost 30 times Russia's GDP.

While Trump deserves flak for continuing to increase the debt, the issue of ever increasing US national debt is far from his fault alone.

It has increased every year outside of I believe 2 years in which Bill Clinton’s admin gets to lay claim to running an annual surplus. That was thanks to the advent of the internet though and a technological/commercial innovation like that isn’t something that can be relied on to reverse course on the debt or even happen again at all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i love they you guys are detailed , with your articles nevertheless i believe that we will not get to that point before we get a market crush.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

when will they admit that they have a spending problem at 100 trillion? they are trying to collapse this economy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcleaners

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good news i will go to that ceremony.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit