reed index has kept away from converting its outlook from the ‘excessive worry’ quarter. but, after a drop in the direction of the $zero.04-level, Tron [TRX] saw a revival even as compressing among the 2 up-sloping converging trendlines (yellow).

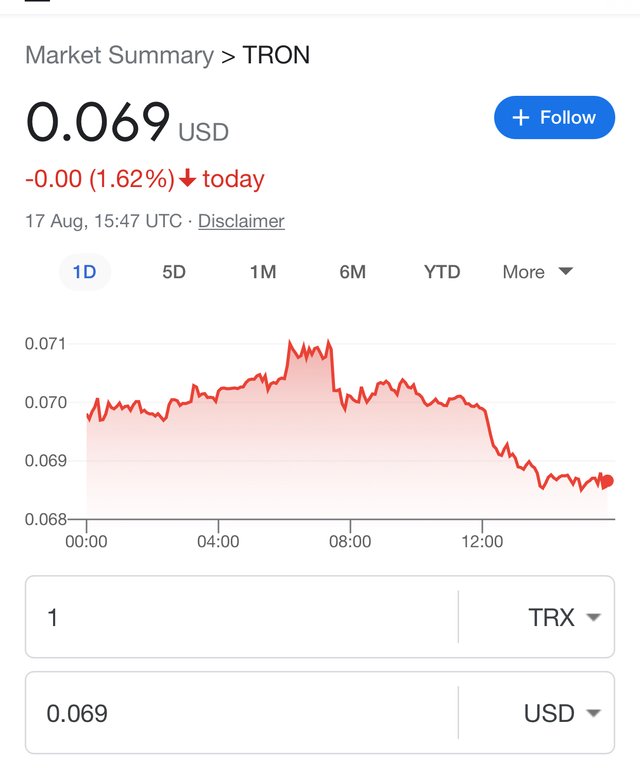

A vigorous bearish enterprise to prevent a close above the $0.069 resistance can cause a brief-time period setback at the chart. At press time, TRX changed into trading at $0.0678, up by means of 1.94% inside the remaining 24 hours.

on the every day timeframe, TRX noticed enhancements after dropping towards its every year low on 15 June. The healing from its long-term help entailed a bearish rising wedge-like setup.

With the 20 EMA (purple) falling underneath the 50 EMA (cyan) and the two hundred EMA (green), the sellers assumed a stronger manage within the current marketplace shape. but the latest growth noticed a near above the 20 EMA.

in addition, the $zero.069 degree can undermine the instant shopping for effort to check the $zero.07-sector. In this example, any reversals from the modern-day pattern would open a doorway to check the $0.057-$zero.06 variety.

investors/investors have to carefully investigate the wider macro-monetary sentiments affecting setting lengthy bets. Any bearish invalidations ought to see fairly quick-lived gains from the $0.071-$0.half variety.

Given the bearish divergence on the CMF along the durability of the $0.069-resistance, TRX ought to see a setback on its charts. In this case, the take-earnings levels could remain similar to above.

but, the buyers/investors should keep in mind Bitcoin’s motion and its effect on broader market notion to make a profitable pass. An analysis of this will aid the buyers in looking forward to the possibility of any bearish invalidations.