The 1000TURBOUSDT Perpetual Contract has recently garnered significant attention, reflected in its bullish trend and strong buy signals across various technical indicators. Here's an analysis of the factors contributing to this hype:

Technical Indicators:

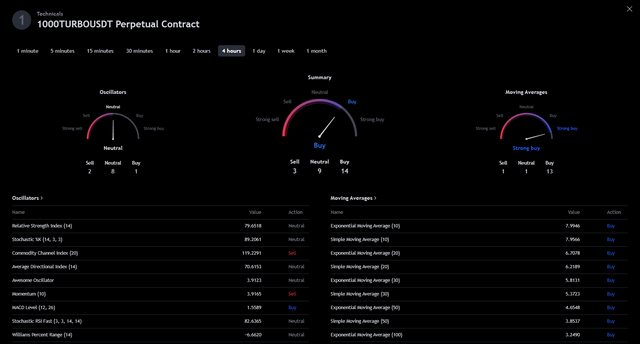

Summary of Oscillators and Moving Averages:

Oscillators: The overall sentiment from oscillators is neutral, with 8 neutral signals, 2 sell signals, and 1 buy signal.

Moving Averages: A strong buy sentiment is indicated, with 13 buy signals, 1 neutral, and 1 sell. This suggests a robust upward momentum.

Detailed Oscillators Analysis:

Relative Strength Index (RSI): The RSI value is at 79.65, placing it in the overbought zone, which usually signals strong buying pressure.

Stochastic Oscillator and Commodity Channel Index (CCI): These indicators show neutral to sell signals, suggesting a need for caution.

Awesome Oscillator and Momentum Indicators: These provide a buy signal, reflecting positive momentum and increased buying interest.

Detailed Moving Averages Analysis:

All exponential and simple moving averages (10, 20, 30, 50, 100) indicate a buy signal, reinforcing the bullish trend.

Candlestick Chart Analysis:

The candlestick chart shows a strong upward trend, characterized by consecutive green candles indicating sustained buying pressure. The dynamic linear regression channels highlight a consistent price increase within a defined range, suggesting a strong bullish sentiment.

Factors Contributing to the Hype:

Technical Signals:

The overwhelming buy signals from moving averages and certain oscillators indicate a strong technical foundation for the price increase.

Market Sentiment:

The strong buy indicators and the upward trend in the chart suggest positive market sentiment and investor confidence.

Potential News or Announcements:

External factors such as positive news, partnerships, or developments related to the coin might be driving the hype. Monitoring recent news related to 1000TURBOUSDT could provide more context.

Volume and Liquidity:

High trading volume and liquidity can amplify price movements. Increased trading activity can lead to rapid price increases.

Speculative Interest:

In the cryptocurrency market, hype and speculative interest can significantly impact price movements. If traders believe the price will continue to rise, they are more likely to buy, further driving up the price.