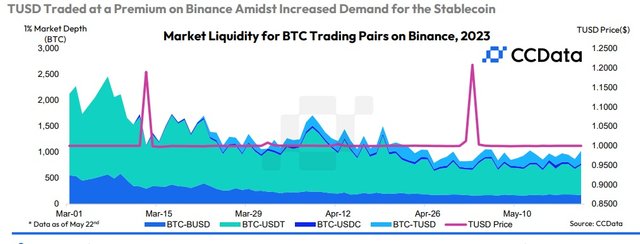

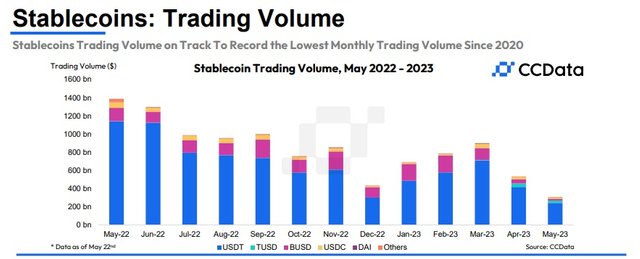

The stablecoin market is going through hard times, as evidenced by its 14 consecutive months of decline. In May, the sector's capitalisation fell by another 0.5% to $130 billion. TrueUSD, however, avoided the negative trend. Its market capitalisation increased 2.7 fold to $2 billion, and, due to high demand during certain times, the coin was worth 20% more than the US dollar.

Image source: ccdata.io

Demand for the stablecoin jumped after Binance decided to offer zero commissions in mid-March when trading pairs with TUSD. It's now the only stablecoin with 0% commission on the largest exchange by trading volume. A similar decision was made by Huobi and a number of other crypto exchanges.

In April, TUSD's trade volume jumped by 670% to 38.4 billion, second only to USDT. In terms of market depth, the BTC/TUSD pair on Binance also ranked second behind BTC/USDT.

Image source: ccdata.io

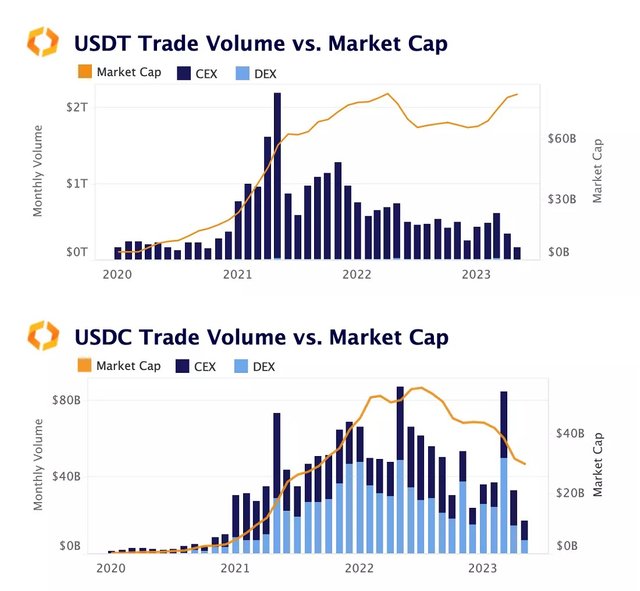

Despite achieving significant success in gaining acceptance, the stablecoin has a market share of just 1.5%. At the same time, more questions are arising for USDT, whose market share has reached 75%. Its trading volume has been declining over the past two months, and its market capitalisation is close to setting an all-time record. In contrast, Kaiko has identified a natural decrease in market capitalisation as the trading volume for BUSD and USDC falls.

Image source: kaiko.com

According to Kaiko Research Director Clara Medalie, this discrepancy may be due to market makers' use of USDT in transactions between Tron, Tether and Binance. However, even when taking this assumption into account, the growth in its market capitalisation growth still looks doubtful. Tether's representatives have not yet commented on issues in the community.

Image source: StormGain.com

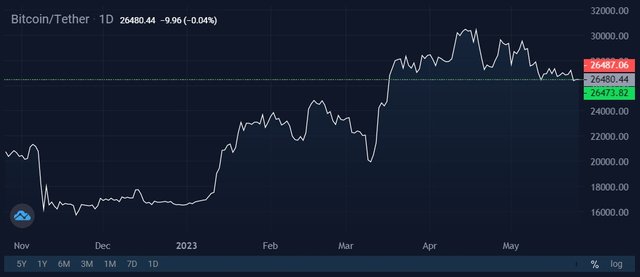

The ongoing litigation against Tether over claims about the quality of its reserves and allegations of potential manipulation of Bitcoin's price is casting a shadow over the entire cryptocurrency market. If allegations of misconduct by the company are confirmed, the impact would hit a wide range of crypto assets due to the stablecoin's widespread use.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)