- Basic Tutorial

It is no secret to anyone that in the 80's Wall Street was spitting millionaires, the stock markets were in full swing, every day a new rich was born. So much was the fame of this era, that we still see films with references to that time as it is the Wolf of Wall Street, starring Leonardo DiCaprio. Many were lucky people who managed to get hold of big capitals, but, of course, not by magic: there were several methods that these people used to become millionaires, and one of them was the speculation among the shares of companies, seeking profits between the sale. In a nutshell. buy cheap, sell expensive.

With regard to the above, with the growth of the cryptocurrency market and the diverse variety of currencies that have been created, specialized exchange houses have started to appear where you can make exchanges between cryptocurrencies, speculating among their prices to obtain profits. We clarify something: we do not promise that this practice will turn you into a millionaire overnight, but with great effort and dedication you will be able to obtain great results.

After the explosion of the mother cryptocurrency, Bitcoin, in 2009, and its variations in subsequent years, the exchange market was latent, and it was at that moment when specialized exchange houses came into play, portals where we could not only change our crypto currency for fiat, but also allow us to play a little with the purchase / sale price to obtain dividends. It is at that moment when Poloniex comes into play, a specialized exchange house that allows us to trade with more than 80 cryptocurrencies, offering us an interface rich in graphs and real-time operations tables, which give the user a better experience and confidence. .

Poloniex is a very broad and complete platform as far as exchange operations are concerned. Therefore, in this tutorial we will learn in a basic way how to perform the elementary operations for its use.

REGISTRATION IN POLONIEX

To start, the first thing we must do is create an account on the platform. For this we will go to the main portal of Poloniex.

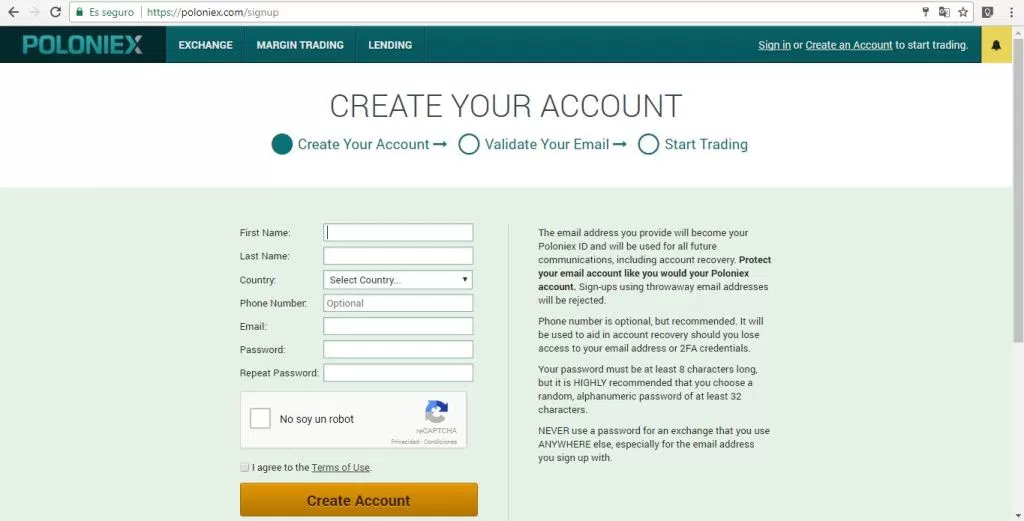

Here we go to click on the "Create your account" button, where we will open the following form:

There we will place our personal data. Fictitious data should not be placed as we will later validate our account, and if the name we provide does not coincide with that of our identification document, we will not be able to complete the validation. We must also remember that the email that we will provide must exist, since there we will be sent a link for the subsequent verification of the email.

Once the registration is complete, a link will be sent to our email to verify it. After doing the latter, we will be ready to begin our exchange of cryptocurrencies, but first we must validate our account. Poloniex allows us to make transactions without the verification of our credentials, but with a limit of $ 2,000 in daily transactions; so if you need to manage a larger amount you must validate the account.

To validate we will need to login to our account - in case you have left - by clicking on "Sign in", which is located below our button to create a new account on the main page. Once we log in, this will be what we will find:

Later we will analyze what we are seeing on the screen; for now we will concentrate on validating our account. To begin we will click on the icon shown below:

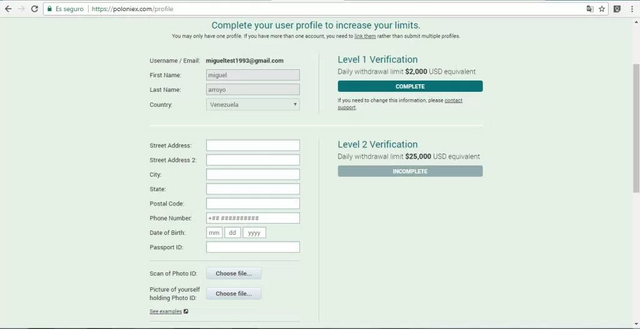

After this, we will click on "My Profile" that will take us to the following:

Here we must fill in our personal data each box, and in the lower options we must upload 2 photos, one of some identification document, and another photo in the foreground holding the identity document we send, along with a paper where we will write "Poloniex" and the date when we took the photo, where the document and our face are clearly visible. The portal offers some suggestions from this link.

Once this process is finished, we will go down and select that we accept the terms of service, and then we will click on "Save profile". Keep in mind that this validation process is done manually, so we must wait a maximum of 72 hours. After the credentials are approved, we can manage up to a maximum of $ 25,000 per day.

BEGINNING WITH POLONIEX

WHAT ARE WE WATCHING?

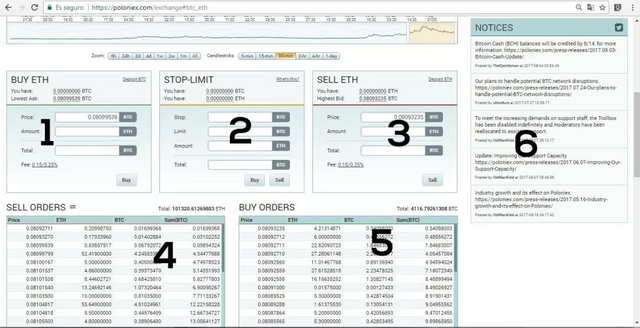

First of all, we must understand the interface that we are seeing, so let's detail section by section.

In this section we will find the coins available for exchange. In the upper tabs we will select which currency we will have or the currency of origin, and in the list we will choose which one we want to exchange. The meaning of each column is:

- Coin: universal acronym of the cryptocurrency for which we want to exchange.

- Price: refers to the lowest sales offer currently in the system. In this example, the price of 1 ETH in BTC is represented.

- Volume: this reflects the amount of cryptocurrencies that are currently being marketed in the exchange.

- Change: percentage of growth or decrease of the price in a period of 24 hours.

- Name: name of the original platform of the cryptocurrency.

These graphs show the evolution of the price of the cryptocurrency in a certain period of time. This period can be modified in one of the options that appear at the bottom of this graph. The lower opaque gray bars refer to the volume of cryptocurrencies processed at that time.

Here is described: a first box that is the last price in 24 hours, the second is the percentage change in price, the third is the highest price on the last day and, finally, the lowest price. In the box below we will find the volume of cryptocurrencies processed at that time.

In this box we can make our purchase orders, setting the amount we want to buy and the price indicated. It is necessary to take into account that if you want to carry out a direct operation, that is, make the purchase at a price of a sale offer from another user, we must select it in the lower lists; Later we will explain how.

The stop limit section is one of the characteristics of Poloniex. There we can set a limit price in case there is a drop in prices; If so, at the time the price exceeds our limit, the order will be automatically closed.

Like the purchase, sales have their section. In this box we can make sales orders, where we will set a price in case we want to sell only when someone is willing to buy at that price, or select an open purchase order from the lower boxes.

- And 5.

Here we find the purchase and sale orders open. When making a direct purchase or sale, we must click on any of these orders that are appropriate to the price and the amount of cryptocurrencies they offer.

6

This is the news section referring to the cryptocurrency that we are trading.

In this table we can see the market depth, that is, the more orders there are for a deeper price.

Here you will see the history of transactions made with this cryptocurrency in real time. If we click on "My trades" we can see our history.

From here we can see our purchase / sale orders open, and in this same table we can edit or cancel our orders.

ASSIGNING ASSETS TO POLONIEX

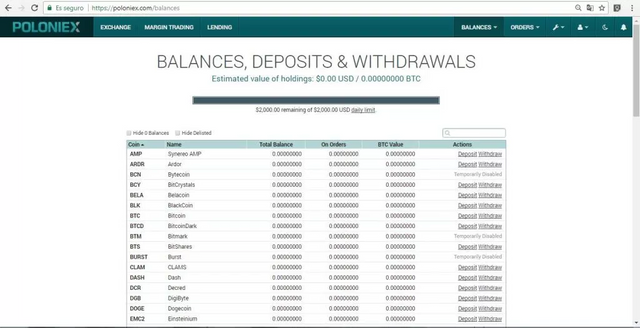

To start trading we are going to need capital. For this we need to make a deposit to our Poloniex account from our personal portfolio. These deposits can be in any cryptocurrency that Poloniex manages. To go to the deposit window, click on the menu in "Balance" and then "Deposits & Withdrawals". which will take us to the next window.

Una vez aquí veremos el listado de criptomonedas soportadas por Poloniex. Entonces sólo debemos buscar cual será la criptomoneda que deseamos depositar, y haremos clic sobre la última columna en “Deposit“, que nos generará la dirección a la cual enviaremos nuestros fondos. Es importante destacar que cada vez que se vaya a depositar se deben realizar estos pasos para que se genere una nueva dirección, ya que si enviamos a una dirección vieja podremos perder nuestros fondos y Poloniex no se hace cargo por pérdidas de dinero en este tipo de casos.

Finalizado el envío y confirmado, podremos visualizarlo en la barra superior que nos mide la cantidad de dinero, al igual que en el historial al cual podemos acceder desde el apartado de “Balance” del menú superior.

Ya con dinero en nuestra cuenta podemos comenzar a intercambiar.

CREANDO ÓRDENES DE COMPRA Y VENTA CON POLONIEX

Para comenzar a intercambiar, debemos posicionarnos sobre “Exchange” en el menú superior.

Once here we will see the list of cryptocurrencies supported by Poloniex. Then we should only look for the cryptocurrency that we want to deposit, and we will click on the last column in "Deposit", which will generate the address to which we will send our funds. It is important to note that each time you are going to deposit you must take these steps so that a new address is generated, because if we send an old address we can lose our funds and Poloniex does not take charge for losses of money in this type of cases.

After the shipment and confirmed, we can see it in the top bar that measures the amount of money, as in the history to which we can access from the "Balance" section of the top menu.

Already with money in our account we can begin to exchange.

CREATING PURCHASING AND SELLING ORDERS WITH POLONIEX

To start exchanging, we must position ourselves on "Exchange" in the top menu.

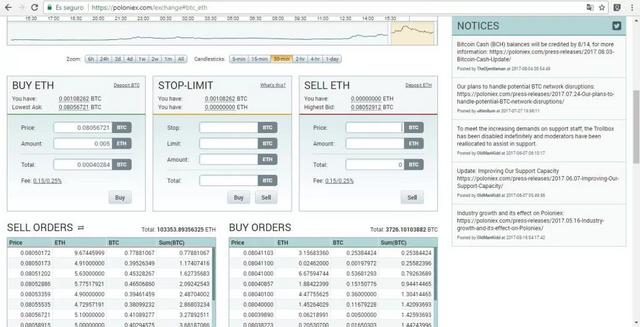

TO BUY

The first thing we must do is select the cryptocurrency for which we want to exchange; in our case we will choose Ethereum. After that we will go to the purchase section to open a new order. If we want to make a direct purchase, we will only select from some of the orders opened in the lower list: when we select it, it will be automatically loaded into our purchase box, the only thing that we have to change is the quantity we want to buy, keeping clear the amount that the seller is offering.

Once the information has been corroborated, we will click on "Buy" and the order will remain open. In case it is a direct purchase it will be confirmed immediately. We can observe our open orders from the list at the end of the page or from the top menu by clicking on "Orders" and then "Open Orders".

TO SELL

Now it's time to sell. For this we must position ourselves on the "Sell" sales box and do the same purchasing procedure. In the case of a direct sale we will select an order from the lower table; In case we want to sell at a fixed price we just have to place it in our box. If we want to sell all the cryptocurrencies that we have, we only have to click on the amount that appears in top of the box of the amount of currencies that we have and we will be charged in the corresponding box; The same happens with the price.

Finished this, we will click on "Sell" to open the order, or execute the direct sales order that we indicate.

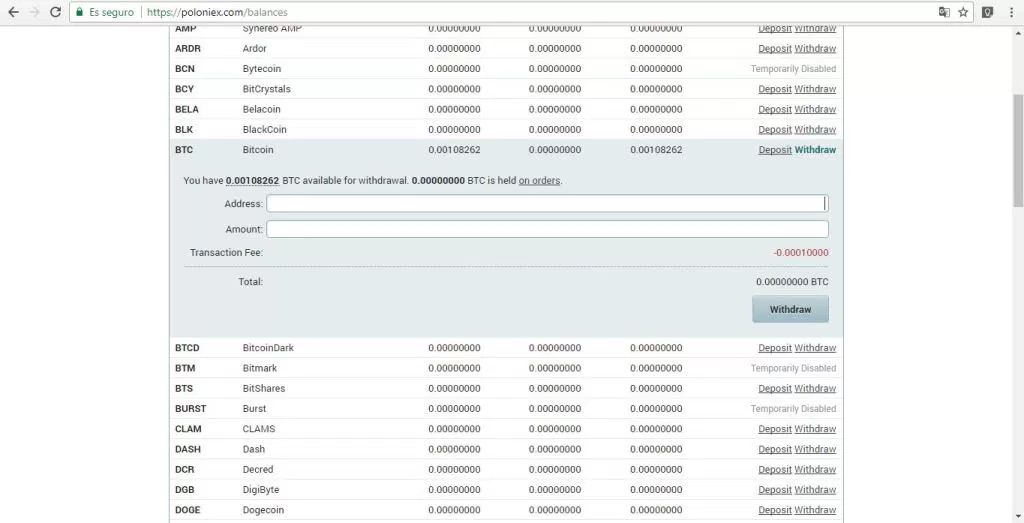

WITHDRAW FUNDS

Having finished with the transactions it is time to take out the funds. For this we will go to the same section as when we deposited the funds, "Balance", and then "Deposits & WithDrawals". Here we are going to look for the crittic currency that we wish to withdraw, for this bitcoin example, and after that we will click on "withdraw", which will open the following.

This exchange house may be scary at first because of its complex interface full of charts and graphs, but it's all about practice. It should also be noted that, for the moment, Poloniex is not operating in New Hampshire or Washington, and recently changed its terms and conditions; text that must be studied carefully before joining the platform.

Advanced Tutorial - CREATING STOP LIMIT TYPE ORDERS

If we noticed in the previous tutorial, between the boxes of purchase and sale of the exchange is a box called "Stop Limit". But that it does? Well, in a basic way, it is used to buy and sell, but more intelligently.

To explain it better remember that the cryptocurrency market operates 24 hours a day and does not have holidays, that is; It never stops. This means that we can not always be aware of the changing markets, in which we lose the juicy profits or avoid many losses. To do this enter Stop Limit.

In the previous tutorial we learned how to create normal orders, which at the time of purchase set a price and an amount, and the order was executed when someone thought our price was fair; But, what happens if we buy many crypto currencies and the price comes down? or if a cryptocurrency is having a significant rise and we want to enter, but all this happens when we are not? Well let's play a bit with Stop limit.

Stop Limits are orders that allow you to set a "limit" to generate a new order, that is, the purchase / sale order is not going to be made until certain requirements that we fix are met. Some of these are the Stop or virtual limit for the order to be generated, and the Limit, which is the price that will be placed on the order after the limit is exceeded. To see this more carefully let's see the box of Stop limit

In the central box we see the section of Stop Limit, which exists for each of the crypto currencies that are traded in Poloniex. Let's understand it little by little, before generating an order.

Stop: refers to the virtual limit that we are going to cast, that is, when the price of cryptocurrency touches this limit the order will be executed according to the price that we place.

Limit: refers to the price of the order that will be generated once the Stop has been exceeded.

Amount: here the amount of cryptocurrency that you want to buy or sell in the order will be placed.

Total: is the total price of the operation.

To generate a Stop Limit type order we only have to place the corresponding data in each box, and click on Buy or Sell, depending on the order we want to generate. When creating these orders we can see them either in the table at the end of the My Open Orders page, or in the top menu, by clicking on Orders and then on My open orders.

Poloniex offers a quick guide to what Stop Limit is. You can visualize it here.

MARGIN TRADING

In the basic exchange, we will risk and generate profits from our own funds, but with this section we can generate even more profits "asking for a loan", this means that other users will lend us their funds so that we can market them and pay them a percentage for the time we have used these funds.

That is why Margin Trading becomes a very striking option, since obviously more funds are greater profits, but beware, losses may also be greater, so before moving on to this section we recommend you have good practice in the basic exchange.

Similarly, something to take into consideration is that we will not work with 100% of borrowed money, since we will work leveraged to 2.5, which means that of 100% of the money in Margin Trading, 40% of that money it must be from our personal funds. This is to protect the loans in case someone does not want to respond.

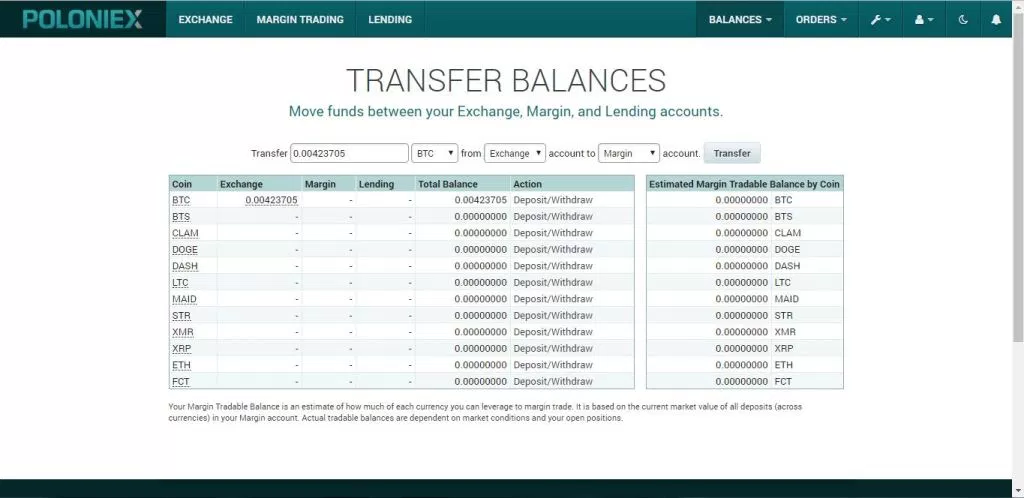

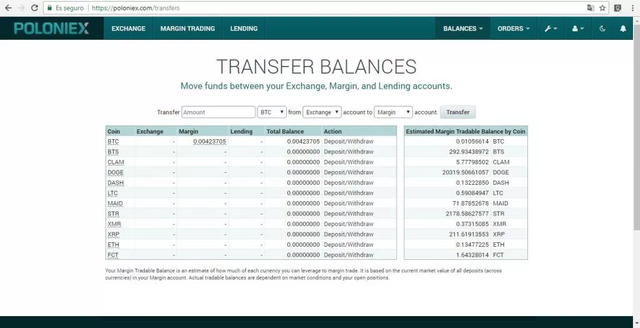

But before we start with Margin Trading we are going to deviate a bit and we will learn about the Transfer Balances section. To go to this section we are going to click on the top menu in Balances, and then in Transfer Balances.

Here we will find the different balance sheets of each section of Poloniex, that is, the balance sheets that we currently have in the Exchange section. To be able to transfer them, we will go to the box in top of the table that is in screen and in the text box (Amount) we will place the amount that we want to transfer.

Later we will select the unit (BTC, ETH, XMR, ETC) to then select the destination and the origin of the transaction, which in our case would be Exchange to Margin Tranding. Once this is placed, we will click on the Transfer button, and voila, we will have transferred our funds. These operations can be done as many times as we like, since no commission is charged. At the end we can see our funds as shown below.

It may seem curious to see so few cryptocurrencies available to transfer between the different sections (Exchange, Margin Trading, Lending) but here lies one of the disadvantages of both Margin Trading and Lending, because there you can only work with these few cryptocurrencies; Otherwise Exchange, which does have a much larger amount than these two.

With this balance in Margin Trading we can start this type of exchange.

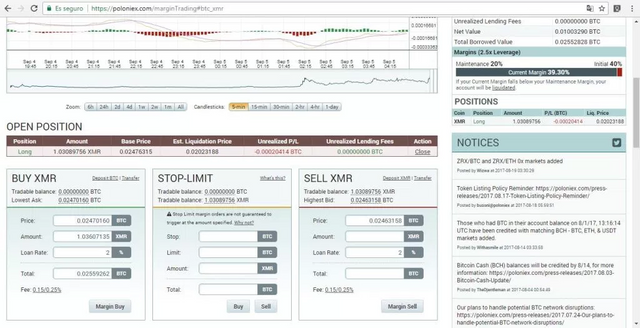

Let's go to the section by clicking on the top menu, in Margin Trading. Once here we will see something very similar to Exchange, but with a particularity: at the top of the boxes of Buy, Stop Limit and Sell is a section called Open Position, where we will see our order opened with a series of data that we will analyze later.

As we mentioned at the beginning, in Margin Trading we work at 2.5, that is, the total amount of cryptocurrencies that we have in this section will be multiplied by 2.5, which will give us the total of currencies that we will have available. But where do these extra currencies come from? Well, in the Lending section we can borrow or lend our funds (we will see this in depth later). Now, when creating an order from Margin Trading, the platform will automatically take a loan depending on the percentage amount we are willing to pay for it.

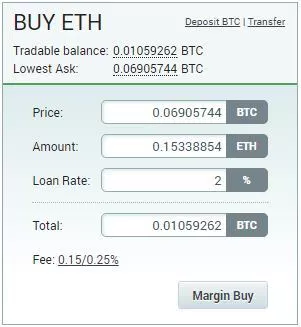

We are going to create a new order, in our case of purchase, and for that we are going to go to the box of purchase "Buy" and we are going to fill the following data.

As it happened in the Exchange the data are:

Price: is the price we want to pay per unit

Amount: amount we want to buy from the cryptocurrency

Loan Rate: refers to the maximum interest rate that we are willing to pay for the loan that we are going to request, that is, if we do not currently have a loan, the system will automatically take the lowest loan, depending of the interest rate that we place.

Total: is the total cost of the operation.

These operations have a cost between 0.15 and 0.25 depending on the volume of cryptocurrency that will be moved in the operation. Before creating the order we have to remember that the minimum amount to create an order in this trading mode is 0.02 BTC per order.

To create it, we will click on Margin Buy, and automatically the following will be generated.

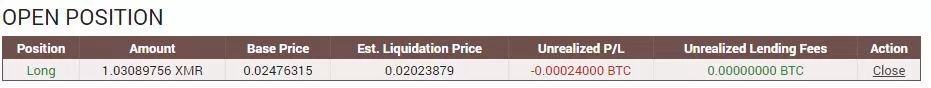

As we can see, a bar or a "position" is opened in the Open Position section, which we will study in detail.

Position: refers to the position of the order, Long (Long) refers to a purchase position; Short (Short) refers to a sales position.

Amount: it indicates the amount of cryptocurrencies that we buy or sell in this position.

Base Price: this is the price at which we made the purchase, that is, the base price.

Est. Liquidation Price: this column tells us the minimum price that the cryptocurrency can reach before the platform gives us a Forced Liquidation, that is, that we run out of funds, remembering that Margin Trading works with borrowed money at 2.5 leverage.

Unrealized P / L: shows us the amount of next gains or losses that we have generated for the order.

Unrealized Lending Fees: here we will be shown the interests we must pay for the money we have borrowed for this order.

Action: allows us to close the order.

Once the order is finished we can click on Action, which will close the order, that is, in case of purchase it will liquidate the funds we buy, selling them, and otherwise it will only close the order normally.

There is another section to which we must pay attention, and this is the Margin Account, where we will be informed of the details of our Margin account.

Total Margin Value: refers to the total value of cryptocurrency that we have in our section of Margin Trading.

Unrealized P / L: is the sum of the profits minus the total losses in the Margin section.

Unrealized Lending Fees: as in Open Position it indicates the interests still unpaid.

Net Value: is the sum of Total Margin plus the sum of the gains or subtraction of the losses, subtracting the interests that we have not yet canceled.

Total Borrowed Value: refers to the amount of loans that we still have and we have not closed.

In the lower part we see that the initial capital is 40% plus the positions that are currently open. The good use of this section requires a lot of practice, so it is advisable to start with a good basic Exchange practice first before moving on to this level.

LENDING

There is a way in the Poloniex platform where we can easily take out dividends by just lending our money, and this is Lending, an option that we will find in the top menu. From this section we will be able to lend or borrow to work in Margin Trading our cryptocurrencies.

To begin we need to first transfer from Balance Balances as we did in the previous section, to our Lending section. Once transferred, it's time to get down to work.

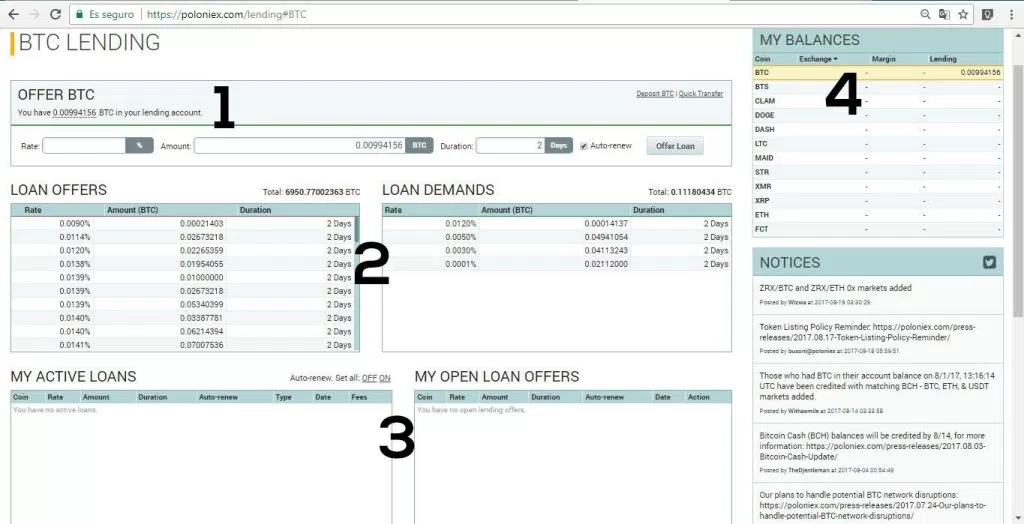

The first thing we will find when we open the Lending window will be the following.

Here we will see:

1

In this section we can generate new loan offers depending on our available capital.

2

In these tables we will see the offers and current demands of loans that are in the platform. At the top of each table we will see the total cryptocurrency that are currently on loan.

3

In My Actives Loan we will see the offers of the current loans that we have and in My Open Loan Offers our offers of active loans.

4

In this Balances table we can see the amount of money that we have distributed between Exchange, Margin Trading and Lending.

To create a new offer we just fill in the data in the first box ..

Rate: we will place the interest rate we want to receive per day.

Amount: the loan amount is placed.

Duration: we will place the duration in days.

Auto-renew: when selecting this option, the loan, once returned, will be renewed and automatically appear in the offer orders again.

Once the data is filled, we will click on the offer loan button that will generate the new order list, and it will be reflected in the table below. It should be remembered that the minimum offer for a loan is 0.01 BTC.

SOME RECOMMENDATIONS

The tools we saw in this advanced tutorial are much more powerful than the basic tools we saw earlier. With Stop Limit we can increase profits or reduce losses if we use it wisely, but in the same way you must be careful since the risk of losses can be high; perhaps not so much in Lending, since the system is responsible for protecting our money by liquidating the user in case of a price fall, but in Margin Trading because we can make very good profits, but we can see ourselves wrapped up in trouble if We do not do a good market study and we force the platform to give us a forced liquidation that is the same as leaving us without funds. So you must be very careful when experimenting with this section.

It remains for us to take great advantage of this platform and always remember the maxim of "practice makes perfect". That is why we recommend practicing first in basic Exchange before moving to this level.

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit