Singapore will finish up its explore different avenues regarding blockchain innovation and its own particular advanced cash one year from now before choosing whether to popularize the trial, the nation's controller has told CNBC.

In 2016, the Monetary Authority of Singapore (MAS) reported "Task Ubin," an investigation of blockchain or dispersed record innovation.

The venture is part into five stages. The principal, which took a gander at setting up a proof-of-idea configuration to lead between bank installments utilizing blockchain innovation, was finished not long ago. The second stage, which completed not long ago, saw the advancement of three unique models for between bank installments utilizing blockchain.

Presently, the MAS trial is taking a gander at conveying securities, cross fringe installments and, at long last, utilizing an advanced form of the Singapore dollar to complete genuine exchanges and purchase resources.

"I trust one year from now we will be finished with every one of the components," Sopnendu Mohanty, boss fintech officer at MAS, told CNBC by telephone Thursday.

A few noteworthy banks, including Bank of America Merrill Lynch, Citi and Credit Suisse, are engaged with the task.

Mohanty said this is an approach to "unite the more extensive biological community so we as a whole learn together."

The MAS fintech boss did not state how the trial could influence direction around advanced monetary forms, or whether it would wind up in a business item. Rather, the expectation is to indicate different controllers that exploring different avenues regarding new innovation is sure.

"Try not to fear doing tests and don't fall into traps of flagging approach changes. A few controllers are reluctant to do tests in view of this huge outside weight on them. We are endeavoring to drive that culture internationally," Mohanty told CNBC.

Bitcoin's rally and the expansion of other advanced resources is drawing in according to controllers all inclusive, however numerous national banks have still abstained from managing digital forms of money. China and South Korea have restricted starting coin offerings (ICOs), while Russian President Vladimir Putin has required the segment's control.

Singapore as of now requires virtual-cash mediators, for example, trade administrators to consent to prerequisites to battle tax evasion and fear mongering financing, the MAS boss noted. "This will be formalized in the coming installment administrations direction which we are dealing with."

Bitcoin costs broke US$6,000 (S$8,179) out of the blue a week ago, an ascent of more than 500 for every penny since the begin of the year. The rally proceeded even after late feedback from national investors and other best money related officials.

MAS now has an unbiased position of zero thankfulness in the cash. It manages the Singapore dollar against a wicker bin of its partners and modifies the pace of its thankfulness or devaluation by changing the slant, width and focal point of a cash band. It doesn't uncover subtle elements on the wicker container, band or pace of thankfulness or devaluation.

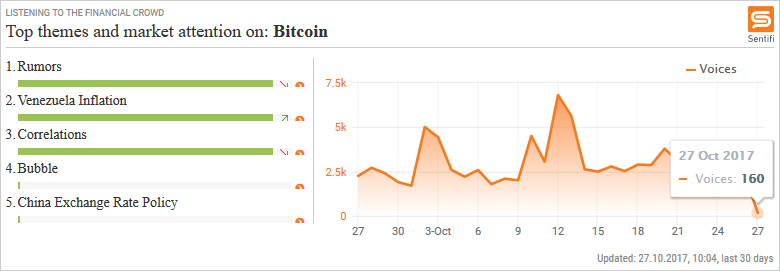

Enthusiasm for advanced monetary forms like bitcoin has risen pointedly this year. Numerous controllers are investigating how to deal with the ascent of digital forms of money. China, for instance, has prohibited digital money trades, while Japan has permitted bitcoin to be acknowledged as a technique for installment.

Nations are additionally investigating issuing their own advanced cash like Singapore. Estonia said it is investigating propelling its own particular digital money.

Follow us and please Upvote!!