Weekly euro fundamental forecast

Christine Lagarde’s uncertainty and Jerome Powell’s decisiveness should have crashed the EURUSD. However, the markets went on to wishful thinking, expecting a slowdown in US inflation to reduce the chance of a 75-basis-point rate in September, weakening the US dollar. In summer, the stock indexes rally turned into a crash. How will the situation develop this time?

The ECB’s decision to go for the biggest rate hike in history, by 75 basis points, did not come as a surprise to investors, as they expected exactly such a move. The EURUSD bulls hoped for a hawkish surprise from Christine Lagarde. However, the ECB president didn’t look much confident. She doesn’t know how much borrowing costs could rise, saying that markets should not consider September’s sweeping moves the norm. The ECB officials expect more than two rate hikes but less than five.

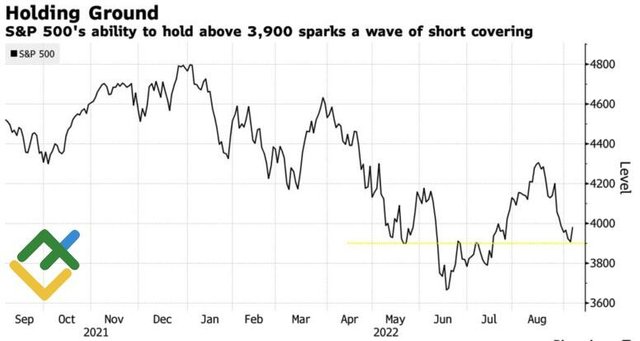

Dynamics of S&P 500

For more information follow the link to the website of the LiteForex

https://www.litefinance.com/blog/analysts-opinions/what-saved-euro-forecast-as-of-09092022/?uid=285861726&cid=58534