What are Chit Funds?

Chit Funds is a Non-Banking Financial Institution originated in India which comes under the RBI Act 1934. These companies are governed by the Chit Fund Act 1982. "Chit", as characterized by the act, implies an exchange by the method of which a foreman goes into a concurrence with various subscribers that all of them will buy in a specific amount of cash in periodical portions over some period of time i.e. Chit funds are a traditional means of savings and borrowing in which members or subscribers agree to contribute a fixed amount of money for a fixed duration of time. The total amount collected (by foreman) is then auctioned and given out as prize money to the member or subscriber in need. So, this allows the members to save a part of their earnings for the times when needed. This framework, with various inbuilt preferences, viz., simple openness, easy to understand administrations; and liberated from idle cost, occasional interest climbs, extravagant pre-conclusion charges, is the most favoured alternative, for those, who intend to spare limited quantities. The concept of the chit funds is exactly similar to that of the Kitty Party except the part that in chit funds auction takes place instead of lucky draw. Chit Funds are beneficial for not only large-scale industries but also small-scale industries that need financial support to expand their businesses. These institutions have been playing a vital role in the National Financial Inclusion program even before banks came into play.

Why It Stands Out From The Crowd

The objective of Uma chit funds is to be the best chit fund company in the world. This will help the people to save money and also avail loans when necessary. Apart from this, they can also make some extra income with the help of their chit funds. Here are some of the features of this chit fund company. All you have to do is invest in them and enjoy a better financial life.One of the advantages of Uma is that the business is transparent and decentralized. In addition to that, the platform is backed by cryptocurrency. This means that it provides a secure source of funds during emergencies or other financial calamities. The Uma chit fund is also backed by blockchain technology. It's also a good option for people who are unbanked in India.A chit fund is a mutual fund where people pool their money for a specified period of time. The purpose of a chit fund is to provide financial support to people. During difficult times, the investor may need money in a hurry. This chit fund will provide them with the needed funds. And, if the investor wants to invest in a chit, the chit fund will protect the investor's money.As the name suggests, Uma aims to become the leading chit fund company in the world. It will be the first chit fund company to use blockchain technology. The platform will be based on cryptocurrency and will allow chit funds to be listed on the site. This will give the investors increased

transparency and security while giving them an additional source of reliable funds for financial emergencies.

More About It

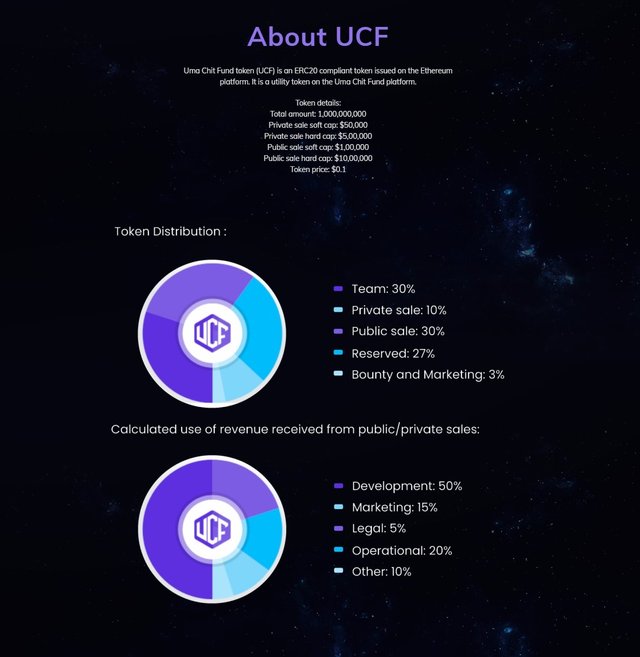

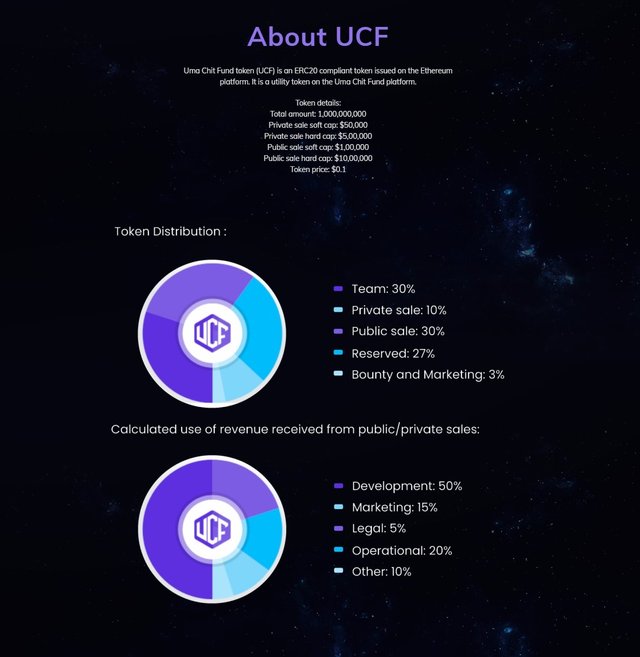

The Uma chit funds aims to become the leading chit fund company in the world. The chit funds allow individuals to save a lump sum and pay it back over a period of time. However, in recent years, the chit fund industry in India has become notorious for scams. This has led to the establishment of formal investment avenues.The Uma chit fund token is an ERC20 compliant utility token. The Uma chit fund is an ERC20 compliant utility token that enables the users to participate in the chit fund industry. The chart is a type of savings and credit system that allows members to save money. It is also a popular way to lend money to the poor.

● A book composed by Edith Jemima Simcox, entitled the 'Malabar Kuri' fortifies the way that the framework existed from ancient Dravidian times, being too similar to the frameworks in China. In China, it formed into what is prominently referred to today as the ‘Chinese lottery’.

● Another form of the inception of Chit finance is connected with Portuguese ministers, who visited Muziris (Kodungallor) for proselytizing and built up a theological school at Vypeencotta town in 1577. They apparently energized the advancement of the chit fund in Kodungaloor.

● There is additional proof to propose that in prior days, farmers participated in 'grain funds' (Dhanya Chittu), where grains were utilized instead of money.

Conclusion

The Uma chit fund aims to become the leading chit fund company in the country by providing loans to people in preset amounts. Its customers can use these funds to buy cars, houses, and education. Unlike moneylenders, chits require little or no paperwork and are convenient to use. The value of a chit fund is predetermined and the duration is set by law.

More Info:

➤Website: https://umachit.fund/

➤Facebook: https://www.facebook.com/umachitfund

➤Instragram: https://www.instagram.com/umachitfund

Author

➤Forum Username: sidneycrypto6

➤Profile url: https://bitcointalk.org/index.php?action=profile;u=2231249

➤Telegram username: @Sidneycrypto6

➤ETH Wallet : 0x9ed4D73b3FcF89095B16e8490d58e241Fb34B4c9