#Uniswap, whose first version was released in November 2018, plans to launch its third version on May 5. Uniswap, a popular #AMM (Automated Market Maker), will activate its update on the #Ethereum #mainnet . Two great innovations and many privileges are coming to the platform, covering liquidity and transaction fees. How will Uniswap, which has been using V2 for the past year or so, be affected by this change?

First of all, Uniswap is a platform that can exchange tokens #decentrally and works on the Ethereum blockchain. To put it briefly, Uniswap is the #DeFi (decentralized finance) protocol and exchange. Unlike central exchanges, it is also an automatic market maker with which DeFi tokens can work comfortably. Uniswap users can benefit from financial services without intermediaries. Uniswap, which has the ideal characteristics of immutability, reduction of counterparty risk and high security and decentralization, attracted a lot of attention in the period when the DeFi market was in demand last year.

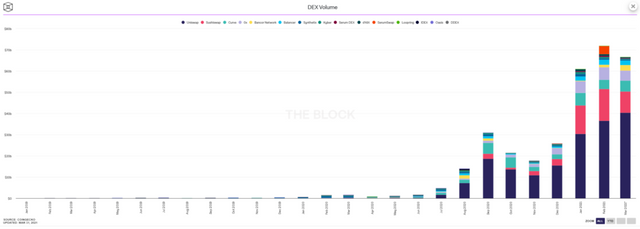

➡️DEX volumes per month, The Block

According to The #Block's data, the decentralized exchange Uniswap has the highest transaction volume and has been maintaining its first place since July 2020. As of March 31, 2021, between decentralized financial exchanges with a monthly volume of $ 66.67 billion, a transaction of $ 40.34 billion was made in Uniswap.

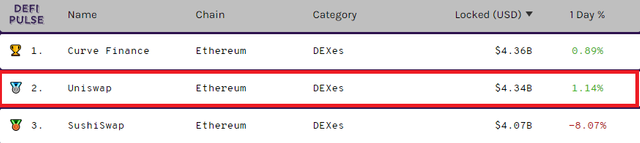

➡️Locked USD amount, DeFi Pulse

According to data from DeFi Pulse, Uniswap ranks second with $ 4.39 billion in terms of the amount locked on decentralized exchanges.

➡️Uniswap V3

Uniswap's developer team started working on the third before releasing the second version, but they did not reveal the details until March 23, 2021. The third version will also bring second layer solutions to solve the scalability problem in Ethereum. According to their calendar, we will be able to see this development in early May 2021.

With the update, it brings an innovation named "Business Source License 1.1" (Business Source License 1.1) in order to solve the problems caused by open source. With this feature, open sources for advertising and production will be limited for two years. After two years, it will turn into a general public license.

➡️Major changes

Focused liquidity: The feature that offers liquidity providers more control opportunities plans to reach its target by expanding the price range. In addition, individual opened positions are clustered and dropped into a single pool. Thus, capital is expected to move more effectively and quickly than version two. In addition to increasing the profit of liquidity providers, it significantly strengthens the flow of transactions.

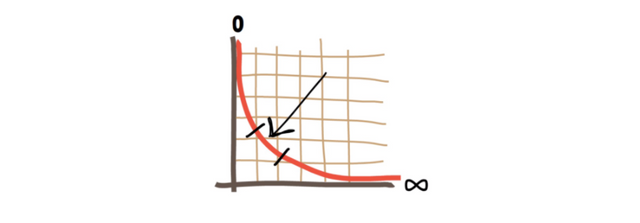

➡️Price range example in V3, Finematics

The liquidity providers used to create separate curves in version one and two and create different pools for each curve. Failure to combine pools and as a result of this, transfer between pools causes high transaction fees. Uniswap aims to overcome the current problems with the third version in which it has been prepared for almost a year.

Active liquidity: One of the innovations brought by the third version is the active liquidity feature. If the value of the cryptocurrency falls outside the range set by the liquidity provider, the providers are removed from the pool and their earnings are stopped. In this case, there are two possibilities:

Waiting for the crypto asset to return to its old price range,

Reconstructing the range based on current prices.

➡️DAI / USDC price range curve

DAI / USDC price range curve. Retrieved from uniswap.org/blog/uniswap-v3.

Flexible transaction fees: In the second version of Uniswap, transaction fees were set at 0.3%, but the developers designed a tiered system. The planned transaction fees on three separate percentages (0.05%, 0.3% and 1%) are transferred to the pool at different levels according to the risk taken. Levels are named as stable, standard and exotic, from small to large.

Uniswap Oracle: TWAP, time-weighted price average, developed by Uniswap, was available in version two. The difference to the third version is that any TWAP indicator can be calculated, provided the blockchain has been in the last nine days. Uniswap cut the oracle cost in half compared to the second version.

➡️Uniswap breaks the game with V3

Finally, the innovations introduced with Uniswap V3 will allow even a simple token swap (SWAP) to be made at 30% less cost. High transaction fees are highly criticized by Blockchain communities. Therefore, planning all innovations considering the " gas fee" problem enables us to define Uniswap V3 as a game changer update. Recently, the NFT def remaining behind the trend, Uniswap of developers working on for a long time and it seems likely that the V3 with a quick render it effective.