News continues to pound the cryptocurrency markets stifling attempts to a recovery. The news of the Binance exchange being hacked and the SEC has requested trading platforms dealing with digital assets to register as exchanges.

Later, Binance reported that the irregular trades were reversed. They also had an interesting observation stating that the hackers had lost a few coins during their attempted hack.

The possible SEC’s regulation is a much-debated issue with both sides having their own opinion about its pros and cons. But regulations have also proven positive for cryptocurrencies, attracting institutional money, which has stayed away from the markets until now.

In another news, the Japanese regulators have come down heavily on Coincheck and six other exchanges. Bogged down by these news, most cryptocurrencies are struggling to hold on to their support levels.

Let’s see if the downside is likely to extend or is a bottom around the corner.

BTC/USD

Bitcoin has failed to cross above the $12,200 on three occasions in the past month and a half. Therefore, this level assumes significance. The cryptocurrency will gain momentum only after it breaks out and sustains above $12,200.

In the last two days, the BTC/USD pair has broken down of the ascending channel and the two moving averages. Its next major support lies at $9,500. If this level breaks, a fall towards the $8,404 levels is possible, which is the 61.8 percent Fibonacci retracement levels of the pullback from $6,075.04 to $12,172.43 levels.

Both the moving averages have flattened out, therefore, if the $9,500 levels hold, a range bound trading can be expected.

Intraday traders are likely to get an opportunity to play the small bounce at the $9,500 levels, but the swing traders should wait until the cryptocurrency shows sustained buying interest.

ETH/USD

Ethereum has corrected according to our expectation. The $723.48 level is the 61.8 percent Fibonacci retracement level of the recent pullback. Yesterday, March 7, the cryptocurrency fell to a low of $725 from where it bounced.

However, the bounce hasn’t been impressive. If the bulls don’t break out of the 20-day EMA and the resistance line of the descending channel within the next few days, the ETH/USD pair is likely to fall to $654 and after that to $565 levels.

The cryptocurrency will become positive when it breaks out of $980 levels.

BCH/USD

Though the bears broke below the support levels of $1,150, they have not been able to sink Bitcoin Cash to $950 levels, as we anticipated.

If the bulls are unable to push the BCH/USD pair back above $1,150, within the next couple of days, we might see a fall to $950.

The cryptocurrency remains bearish as long as it trades below the moving averages.

XRP/USD

Ripple is looking weak. Yesterday, March 7, the bulls recovered from below the $0.85 levels but could not build on the gains.

As a result, the price has again broken down of the $0.85 level. If the bears succeed in sustaining below this support, there’s a possibility of a fall towards the $0.7 levels.

The lack of buying at lower levels points to a possibility of a further downside in the XRP/USD pair.

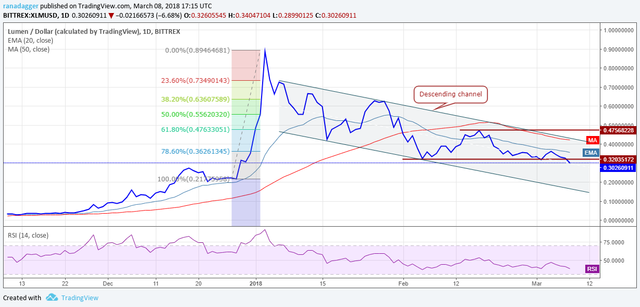

XLM/USD

Stellar is in a downtrend and is not looking strong. It finds it difficult to bounce off the $0.32 critical support level. The bears do not allow it to even cross above the 20-day EMA.

Today, March 8, the bears have pushed the XLM/USD pair below $0.32. If the breakdown sustains, a fall towards the lower end of the descending channel at $0.22 is likely; where we expect buying to emerge.

On the other hand, if the bulls defend the $0.32 levels, a range bound action between $0.32 to $0.47 should ensue.

LTC/USD

After showing promise a few days back, Litecoin has become negative. We expected it to fall towards the 50-day SMA and that is what happened.

The LTC/USD pair has formed a descending triangle pattern, which will complete on a breakdown and close (UTC) below $185. This gives a pattern target of $115 on the downside, though, we can expect some support at $160 and $140.

Our bearish view will be invalidated if the cryptocurrency breaks out of $215.

ADA/BTC

Cardano is in a firm bear grip. Yesterday, March 7, the price broke down of the critical support level of 0.00002460. The selling has continued today and prices are sustaining below the support level. This is a bearish sign.

Now, there is no major support level on the charts, and a fall to 0.00001690 levels is likely. The first sign of a change in trend will be when the ADA/BTC pair breaks out of the downtrend line. Until then, bears have an upper hand.

NEO/USD

March 7, NEO fell to a low of $88.6, where buying emerged. The zone between $86 and $93 is important for the bulls.

If they fail to hold this support zone, the NEO/USD pair will slump towards the February 6 lows of $63.62.

The cryptocurrency will become positive once it breaks out and sustains above the downtrend line 2.

EOS/USD

In our previous analysis, we had forecast EOS to retest the February 6 lows, and that is what happened.

If the bulls fail to hold the $5.97 levels, the next support lies way lower at $3. Our bearish view will be invalidated if the EOS/USD pair climbs and sustains above $8 levels.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/bitcoin-ethereum-bitcoin-cash-ripple-stellar-litecoin-cardano-neo-eos-price-analysis-march-8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit