But like with Charles Schwab's CDS, you really should be careful doing that. Parties will use CDS to hedge their positions. In some cases that hedging will be mandatory too. So the actual true risk of default is usually lower. In the case of the US government, I think the chance of actual default is essentially nil.

That of course doesn't mean this debt ceiling fight can't be costly. The US saw its sovereign credit rating get downgraded by S&P during the 2011 debt ceiling fight. The US didn't default in 2011, and it didn't even go past the X date. But the brinkmanship caused S&P to downgrade.

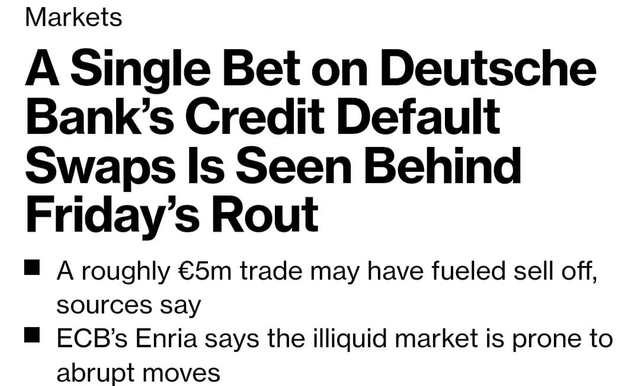

Also these markets are pretty thin even with sovereign CDSs. Deutsche Bank for example saw a surge just from one trade.

The CDSs are triggered by Credit Events. Namely the failure to pay, which is different than a technical default. So missing the X-date would be a technical default, but it'd probably be cured during the grace period and not result in a pay out for the CDS.

IMF uses the terms technical, contractual, and substantive (restructuring) defaults. Contractual and substantive would trigger CDSs. Technical would mean missing the X-date. We didn't get to that in 2011, but I'd say the risk is higher under this GOP.

And the credit rating agencies generally are less sanguine with these things in terms to downgrading or changes in outlook. So we don't even have to get to a technical default for there to be fallout in terms of our borrowing costs.

Yellen has previously estimated the X-date as roughly June. However there's wiggle room in that estimate. It is a bit conservative, mainly because the other means available to the Treasury to extend the X-date are less predictable to forecast. I believe she is going to revise the estimate soon.