The Plain Bagel is an excellent YouTube channel that shares a lot of concise yet articulate educational videos explaining topics like accounting, stocks, derivatives, the yield curve, and historic financial crises.

In today's post I want to share their video on the Greek debt crisis, because I believe that story was an indication of things to come: Greece was first, but USA will be last. Most of the world is in the same boat Greece was in during the early 2000's, and when one domino falls they all will.

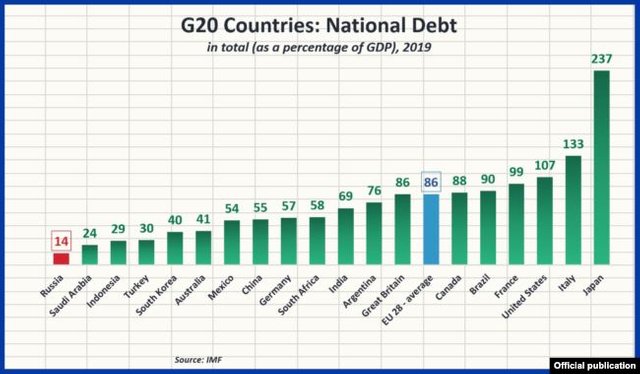

Debt/GDP ratio data for the G20 Nations:

Greece was first, USA will be last:

The USA has terrifying debt levels, and the data shown above does not even account for their unfunded obligations like retirement and medical benefits. Medical and retirement debts amount to between 80 - 200 trillion, in excess of all savings, and expected future incomes for these plans. Then you still have to consider Fannie Mae and Freddie Mac, and they owe another 8 trillion, and state and local government debt which is about another 3 trillion. All debt considered, the USA is already bankrupt, the creditors just don't know it yet.

The US is the linchpin of the global economy and therefore this conversation is desperately important.

Unfortunately, USA is exactly where Greece was in the late 90's early 00's, and default is coming. So, let's look back to Greece, and see what we can learn.

America's Debt/GDP ratio being well over 100% is concerning. If the US ever defaulted on its debt, it would trigger a global economic crisis far worse than 2008. Yet, despite unsustainable debt levels, the US continues to deficit spend to support social programs, and military efforts, living well beyond its means. At this point there are only two possible outcomes:

- Austerity: deflation, economic recession, and significant suffering, followed by eventual recovery.

- Economic collapse: "Business as usual" is far more likely, and that can only lead to eventual hyperinflation, then default and complete global economic collapse.

Sadly, former Fed chairmen Alan Greenspan was mistaken when he said, "the United States can pay any debt it has because we can always print money to do that... so there is zero probability of default.

His claim was false because at some point inflation leads to reduced confidence in any fiat, USD included. Fiat currency is by its nature a con-game, and when people finally lose confidence in the USA's ability to pay their debts, that is when USD dies, the USA defaults, and global economic collapse occurs.

Furthermore, as with Greece, the only way the US have kept their con-game going so far is by projecting economic strength, through misleading and misrepresenting the economic data: jobs, inflation, employment, etc.

With all this in mind, watch The Plain Bagel with me and hopefully we can all better prepare for the future by remembering the past.

The Greek Debt Crisis - 5 Minute History Lesson | The Plain Bagel

Concluding Remarks:

The Greece debt crisis is at its heart a tale of how deficit spending gone awry, inevitably leads to hyperinflation and default. America can learn from that lesson... sadly I don't know if anyone is paying attention.

If you're interested in content like this, please consider following myself, and sub'ing The Plain Bagel on YouTube. We are in no way affiliated, I just love his stuff. :)

Thank you for your time and attention. Have an awesome day and God bless.

More from me:

🔴 Steemit: https://steemit.com/@infidel1258

🔴 Steemit # 2: https://steemit.com/@itisfinished

🔴 YouTube: https://www.youtube.com/channel/UCOoOxEybRJm_iK7EtL11YNw

🔴 Instagram: https://www.instagram.com/infidel1258/

🔴 Minds: https://www.minds.com/register?referrer=infidel1258

Referral Links:

▶️ Brave Browser: https://brave.com/dwa705

▶️ Steem Monsters: https://steemmonsters.com?ref=infidel1258

▶️ Actifit: https://actifit.io/signup?referrer=infidel1258

▶️ Partiko: https://partiko.app/referral/infidel1258

▶️ CoinSquare: https://coinsquare.com/register?r=lbdcL

▶️ Coinbase: https://www.coinbase.com/join/59bbe24dd0e8a800f12e7b93

The US can not keep doing what we are doing and expect to resolve the debt issue. Either more money needs to come in (I hear some boos) or less money needs to go out (( hear even more boos). We've got a problem and we won't be able to keep pushing it off forever.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're completely right, and yet the politicians don't expect it to go on forever, just long enough for their political term to end... then its someone else's problem.

When its all said and done, some people should be imprisoned because there are some bad actors who are maliciously driving us to this dangerous place, knowingly, and without care for the future, simply because they desire freebies today.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @infidel1258!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 3.024 which ranks you at #10932 across all Steem accounts.

Your rank has improved 712 places in the last three days (old rank 11644).

In our last Algorithmic Curation Round, consisting of 111 contributions, your post is ranked at #67.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit