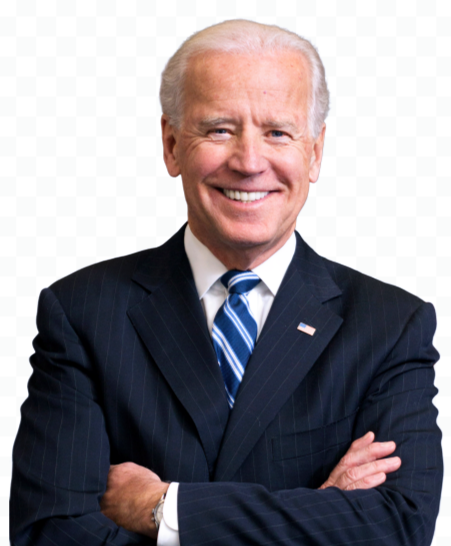

The Biden administration has called on Congress to pass laws to clarify how cryptocurrencies should be regulated, as officers advised that detainments on Capitol Hill could put investors at threat.

The US Financial Stability Oversight Council — a group of the country’s top fiscal controllers including the Treasury — issued a report on Monday prompting politicians to come to agreement on a number of areas including how to regulate bitcoin and other crypto means vended on the spot request.

The report comes as members of Congress debate proffers covering the$ 140bn stablecoin assiduity to duty rules for crypto brokers. But while Biden administration officers worry about a reprise of the collapse of now- ignominious stablecoin terraUSD, those close to the congressional accommodations said they were still months down from passing legislation.

Please use the sharing tools set up via the share button at the top or side of papers. Copying papers to partake with others is a breach ofFT.com T&C s and Brand Policy. [email protected] to buy fresh rights. Subscribers may partake up to 10 or 20 papers per month using the gift composition service. further information can be set up at https//www.ft.com/tour.

https//www.ft.com/content/9fbed8c2-086f-4fee-923c-990953a2a184

The FSOC’s report came as the crypto assiduity rolls from a major collapse in prices and with several prominent companies falling into ruin, raising questions about who should carry out principal oversight of the unpredictable request.

Regulatory agencies similar as the Securities and Exchange Commission and Commodity Futures Trading Commission have pressed for governance over the assiduity. SEC president Gary Gensler has argued that utmost cryptocurrencies and the platforms where they're traded — should be regulated by the SEC because numerous of the commemoratives qualify as securities under US law.

A Treasury functionary said the report’s authors — who included Gensler and Rostin Behnam, president of the CFTC — didn't intend to back one agency over another.

The report advised that numerous crypto asset conditioning demanded “ introductory threat controls to cover against run threat or to help insure that influence isn't inordinate ”.

also, “ cryptoasset prices appear to be primarily driven by enterprise rather than predicated in current abecedarian profitable use cases, and prices have constantly recorded significant and broad declines ”, the report said.

The FSOC’s report suggestedinter-agency co-operation to close being loopholes that allow crypto asset businesses to find the most favourable regulation for their business.

“ Some crypto asset businesses may have cells or accessories operating under different nonsupervisory fabrics, and no single controller may have visibility into the pitfalls across the entire business. ”

To that end, FSOC recommended Congress pass rules that would give civil requests controllers authority to make rules on crypto asset requests that aren't covered under being US securities laws.

The rules should cover conflicts of interest, vituperative trading practices, client asset isolation, cyber security and record- keeping.

The council’s report also calls on Congress to pass legislation to allow controllers visibility into crypto platform accessories, as well as to produce a civil frame for stablecoin issuers.

The group of controllers added that while traditional finance’s exposure to crypto exertion was limited, this could “ increase fleetly ”. Stablecoin exertion, leveraged trading and asset guardianship are cited as exemplifications of implicit interconnectedness between traditional finance and crypto.

This summer, crypto exchange Coinbase forged a deal with asset operation mammoth BlackRock to give the latter’s guests easier access to crypto.