Last week, after Ethereum finally went through the Merge as scheduled, the ETH price plummeted, which matches market expectations. Without the favorable conditions it desperately needs, the market remains bearish, and it seems like there have been fewer new narratives. Although Web 3 games and new public chains look exciting, the market response has fallen below expectations, which is possibly related to the fact that worldwide inflation has made investors more cautious.

Data released by the Fed on September 13 shows that the U.S. inflation rate has reached 8.3%. Meanwhile, inflation in Europe has hit 9.1%. In particular, the high inflation has severely affected Germany, where prices have come to a new high in 30 years.

On September 21 (UTC-4), the Federal Reserve will convene another meeting to adjust the benchmark interest rate. According to Powell’s speech at the end of August, the meeting is likely to increase the rate by 75 basis points. If true, it would be the Fed’s third consecutive rate hike this year. On the evening of September 19, word had it that the hike could bring the interest rate up by 75 to 100 basis points.

The continued tightening of global monetary liquidity by the Fed is also one of the major reasons behind today’s crypto decline. After all, with its current volume, cryptocurrency is unlikely to stay independent of the U.S. stock market and thrive on its own. Most currencies in the world are correlated with market sentiment. For instance, in the case of Bitcoin, based on the market reaction to the previous Fed meetings, the BTC price fell after each interest rate hike, except for the first hike announced on March 17.

Source: CoinEx

After the Fed meeting, the market is likely to keep falling. However, it should be noted that the short-term interest rate of U.S. treasury bonds has now become significantly higher than the long-term interest rate, leaving little room for the Fed to conduct more hikes. Bluntly put, if the Feb were to keep raising the interest rate, there would very likely be a massive default on U.S. treasury bonds. In the worst scenario, the dollar would lose its credit, triggering a more devastating financial crisis.

Studying the macro environment is like observing a river. Although you can predict its flow and carry out trading operations based on your prediction, no one knows how each drop of water in the river will move. The same also applies to investment analyses.

Next, we will turn to the trend of Bitcoin and Ethereum based on recent statistics.

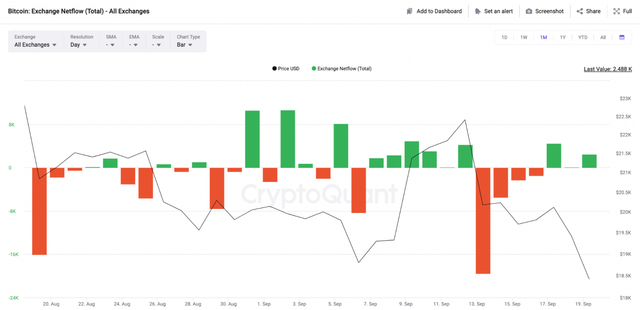

Let’s first look at the BTC price and exchange netflow. In the past 30 days, there have been 15 days during which the BTC exchange netflow was negative. Moreover, the figure recorded on September 13 is apparently abnormal, which indicates that the market remains volatile. In addition, the market sentiment has also been unstable, and the statistics showed no downward/upward trends.

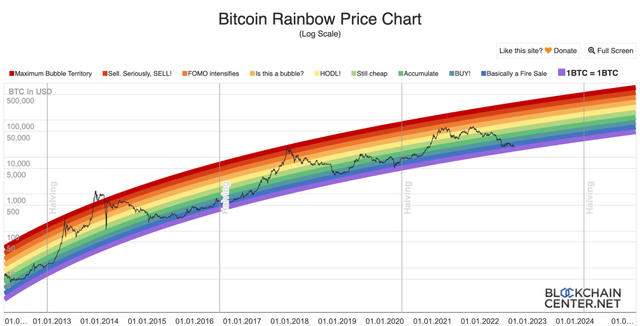

Next, we come to Bitcoin’s Rainbow Price Chart, which says that the BTC price is close to “1 BTC=1 BTC”. The previous bubbles and sentiment-driven valuation have been removed by the crypto bear. In other words, as they put it, the BTC price has “bottomed out.” To achieve a rebound, Bitcoin will need massive funds, favorable macroeconomic conditions, as well as flywheels in the market.

That being said, it should be stressed that all indicators are for reference only, statistics alone are not crucial when investing in cryptos. In today’s bear market, many previously valid indicators have failed to help investors capture the market trend. For instance, everyone used to agree that, whether fast or slow, the global economy will definitely grow. Now, that prediction no longer stands.

We must realize that the growth period enabled by the Industrial Revolution might have ended. Today, we are heading towards a future filled with uncertainties. In this volatile future, CoinEx’s financial services help investors regain certainty. With CoinEx’s financial services, investors can start earning interest the next day and withdraw their returns instantly. Moreover, on CoinEx, financial services don’t have any minimum deposit requirements, which allows you to easily earn profits by depositing idle cryptos. In addition, since its inception five years ago, CoinEx has never suffered any security breach, which is evidence of its outstanding security performance.

When it comes to investment, it is often said that the less you do, the more you earn. In the current bear market, investors must properly use their assets because although many hit projects were launched against bearish market conditions, most projects that suffer from a crypto bear are extremely risky. Therefore, Taleb’s barbell strategy is a good approach for today’s crypto investors. In other words, you could put most of your assets into products like CoinEx’s financial services that feature low risks and steady returns and invest the remaining money into risky projects that promise high rewards.

If you’ve got idle cryptos, consider investing them into CoinEx’s financial segment: https://www.coinex.com/financial

Disclaimer: This article offers no investment advice, and all statistics mentioned herein are for reference only. The information provided herein may not be relied upon for investment decisions, for which you will be fully liable.