I am absolutely thrilled to see the USD making a rally, yet gold is holding above $1,310.

Even more bullish is the fact that gold eagle sales are down to their lowest levels in years.

The determining factors for the spot price of gold are:

- Mining supply.

- Investment demand.

- Cost of production.

So, it is incredibly unique to see how spot price is staying elevated while both coin sales are slow, and the Dollar is actually looking good from a technical perspective.

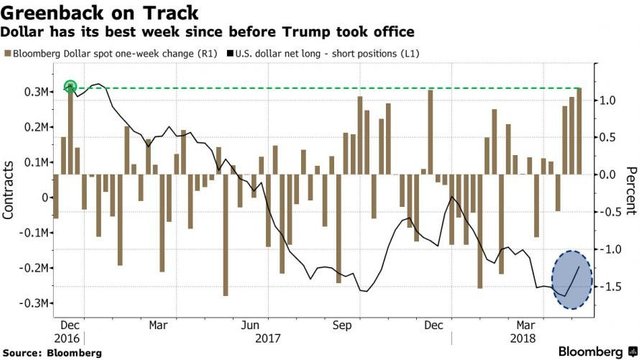

Take a look:

Whenever you see a USD rally so late in the cycle, it can only mean one thing: investors are cashing-up.

When businesses are reporting record earnings, wages are increasing fast, consumer demand is on the rise, tax cuts are stimulating corporations, and stocks are flat for the year (so they’re definitely not expensive), the sole reason to sell assets and move to cash is UNCERTAINTY.

The majority of investors are under the impression that this might be the end of the bull market for stocks, but I actually bought the shares of three world-class companies today, which trade at a discount of 10%-20% to their intrinsic value.

When bull markets end, there’s euphoria, so this is definitely not it, but we might have just seen the top for 2018.

Nevertheless, cash is bountiful, credit requirements are easing, and Portfolio Wealth Global sees at least another year or two of expansion. In fact, if things continue like this, President Trump will likely be easily re-elected.

The fact is that, for now, the U.S. is not feeling any blowback from running record deficits, so it’s been all gravy since he has taken office.

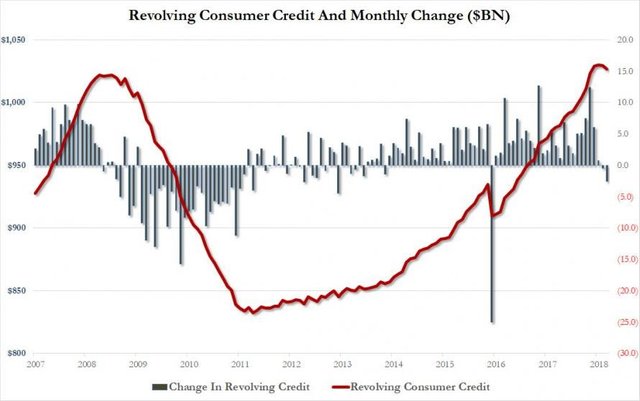

In fact, consumers have so much money in their pockets that they’re using less credit card debt these days.

Courtesy: Zerohedge

As you can see, 2008 was the last time credit card debt was this high.

We’ve come full circle, but this time the economy isn’t as leveraged. The complete opposite is true. We’ve been deleveraging for years.

So, what does this mean, going forward?

Looking at today’s markets, bargains are not plentiful. Hedge funds are not looking forward to buying the dip, since they do not, as I do not, see favorable risk/reward plays with traditional stocks.

In the real estate market, yields are definitely not where they were 5-7 years ago. I used to buy rentals for cash and earn an 18% yield, cash-on-cash.

Today, it’s been cut to 11%-12%, a 33% reduction.

Not only are commodities the only cheap sector out there, but now it’s ALSO the most attractive.

The USD will reach its top soon. If gold can remain strong and above $1,300, while this is happening, there will be a day of epiphany for funds worldwide.

Exploration for resources has been terrible for 20 years.

Geologists have been unable to discover gold since the 1990s, zinc since the 1980s, and cobalt is truly in severe shortage.

The resource sector is tiny and can turn around in a heartbeat.

It wouldn’t surprise me to see commodities rallying and outperforming all other asset classes.

The equation is clear – if oil and gold continue rallying, despite the dollar strength, the market will notice.

Keep your eyes on this unique set of condition, which are now playing out.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

To get off this list, please chat with us in the #steemitabuse-appeals channel in steem.chat.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit