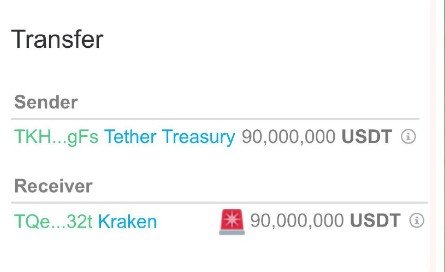

The extremely scandalous appearance of an additional 90 million USDT on Kraken Exchange has once again drawn attention to a widely discussed cryptocurrency phenomenon. Similar cases of new USDT appearing have been seen on Binance, Bitfinex, Poloniex and other exchanges in recent weeks. These centralised platforms, under investigation by regulators, currently depend on Tether for over 85% of their volume and liquidity.

In fact, Tether, considered a cryptocurrency cartel, is single-handedly influencing the markets by artificially propping them up. Analysing bitcoin's movements above the $38K mark along with the emergence of new USDT on centralised exchanges, one can see a direct correlation in all cases.

Despite Tether's claims that their issuance is backed by USDT reserves held in a bank and the existence of an audit conducted by the company, this approach is questionable. The report submitted by Tether is a modest 6 pages, despite the fact that a typical audit of reserves is usually over 100 pages long and is conducted in accordance with international accounting standards.

The difference between the actual audit and the submitted reserves report is huge. An audit evaluates both assets and liabilities according to set standards. Whereas Tether's report is limited to evaluating only assets based on criteria developed by the company itself, without taking liabilities into account.

Information from the founder of crypto platform Celsius Network, who views Tether as an investor, emphasises that the company issues USDT in exchange for well-known cryptocurrencies against collateral. These transactions contradict Tether's claims that they issue stablecoin solely based on real dollars.

Regardless, the cryptocurrency market has been using and trusting USDT for a long time, although in 2023, US regulators fined Tether for providing false reserve information. Despite the uproar surrounding these events, Tether continues to operate, though questions about USDT's collateralisation remain unanswered.