Hello fellow students and Professors

@utsavsaxena11 of crypto academy. Let me start by wishing us all a happy new year. And thanks to Professor for this assignment. This is my homework post.

)

What do you understand by ultimate oscillator indicator. How to calculate ultimate oscillator value for a particular candle or time frame. Give real example using chart pattern, show complete calculation with accurate result.

Developed in the 1970s by Larry Williams, the Ultimate oscillator is a technical indicator used all over the world by traders to trade the financial market. The ultimate indicator is a measurement of the momentum of price over different combination of timeframe.

The ultimate oscillator indicator is much more accurate as compared to other oscillator Indicators even though it gives fewer trading signals. The ultimate oscillator is more accurate due to the use of three different weighted average timeframe, and thus the indicator has less volatility.

The Ultimate oscillator indicator generally has 3 timeframe as we earlier stated, and they are 17, 14, and 28.

I am going to show the calculations of the Ultimate oscillator indicator using the default timeframes which are 7, 14 and 28. To calculate the Ultimate oscillator indicator, we are going to first of all calculate the

Buying Pressure. By calculating the Buying Pressure, we will get an overall sense of the movement of price in the market. The buying pressure is calculated by subtracting the close price (or the period lowest which ever is lesser)

Formula

Buying Pressure (BP)=Close−Min(Low,PC)

PC=Prior CloseTrue Range. When then calculate the current period high ( or the previous close which ever is highest) and subtract the lowest value between the prior low or the current period low.

True Range (TR) =Max(High,Prior Close)− Min(Low,Prior CloseAverages of the 3 timeframe. The next step is to create the averages of the three timeframe, the 7, 14 and 28

The last but not the least step is to calculate the weighted average of the three timeframe.

Below is a calculation of BP and TR. Manually collected and computed the figures. I will present the calculations below

The live example I will be using will be the MANA/USDT chart on the Tradingview platform. The image below is taken from Tradingview.

| Period | BP | TR. |

|---|---|---|

| 1 | 0.03 | 0.12 |

| 2 | 0.05 | 0.05 |

| 3 | 0.03 | 0.07 |

| 4 | 0.05 | 0.07 |

| 5 | 0.03 | 0.02 |

| 6 | 0.01 | 0.04 |

| 7 | 0.02 | 0.03 |

| 8 | 0.05 | 0.05 |

| 9 | 0.02 | 0.04 |

| 10 | 0.02 | 0.05 |

| 11 | 0.04 | 0.04 |

| 12 | 0.03 | 0.02 |

| 13 | 0.02 | 0.04 |

| 14 | 0.01 | 0.04 |

| 15 | 0.06 | 0.06 |

| 16 | 0.02 | 0.02 |

| 17 | 0.03 | 0.05 |

| 18 | 0.03 | 0.07 |

| 19 | 0.01 | 0.04 |

| 20 | 0.01 | 0.06 |

| 21 | 0.01 | 0.02 |

| 22 | 0.04 | 0.06 |

| 23 | 0.01 | 0.04 |

| 24 | 0.01 | 0.03 |

| 25 | 0.02 | 0.02 |

| 26 | 0.02 | 0.07 |

| 27 | 0.01 | 0.06 |

| 28 | 0.03 | 0.02 |

Now we will calculate the Average of the 7,14 and 28 timeframe. But before,let's get the summation of the periods.

| BP | TR |

|---|---|

| BP7 = 0.19 | TR7= 0.40 |

| BP14=0.38 | TR14=0.68 |

| BP28=0.69 | TR28=1.3 |

Calculation of Average of the various timeframe

A7= BP/TR

A7= 0.19/0.40

A7= 0.475

A14 = BP/TR

A14 = 0.38/0.68

A14 = 0.53

A28 = BP/TR

A28 = 0.69/1.3

A28 = 0.53

The overall Formula for calculating Ultimate oscillator is

UO = [((A7 x 4) + (A14 x 2) + A 28 ) / 4+2+1] * 100]

So imputing the above figures into the formula we have.

UO = [(0.475 x 4)+(0.53 x 2) + 0.53/(4+2+1)] x 100

UO = [(1.95 + 1.06 + 0.53)/7] x100

UO = 50.571428571

UO = 50.57 (2 s.f)

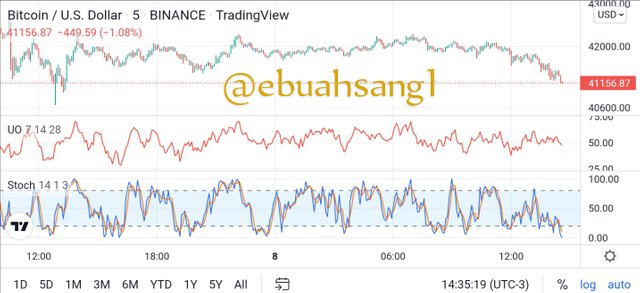

As you can see from the image above. Our Ultimate oscillator is at 50 with a 0.57 difference.

)

How to identify trends in the market using ultimate oscillator. What is the difference between ultimate oscillator and slow stochastic oscillator.

The Ultimate oscillator is very similar to the RSI but unlike the RSI indicator, the Ultimate oscillator gives lesser Signal and trend. The use of three different timeframe reduces the volatility of the indicator.

Now, the ultimate like the RSI indicator is made of a range of numbers beginning from 0-100.

Oversold positions or Zones Like the RSI indicator, Numbers 0-30 signal an oversold zone. So when the Indicator is below 30, it means the asset is being oversold and a potential price reversal.

Overbought position or zone. Ok the other hand, the numbers from 70 to 100 in the market shows an overbought position. Meaning there is buying and there is a potential price reversal.

Difference between Ultimate oscillator and Slow Stochastic oscillator

<center

| Ultimate oscillator | Stochastic oscillator |

|---|---|

| The Ultimate oscillator uses three different timeframe | The Stochastic oscillator has only one timeframe |

| The Ultimate oscillator doesn't give a signal line except added by the trader | While the Slow Stochastic oscillator gives a signal line the %K and %D. |

| In the Ultimate oscillator, overbought positions is from 70-100 and oversold positions is between the range of 0-30 | While in a Stochastic oscillator, overbought positions is range 80-100 while oversold zone is 0-20. |

| The Ultimate oscillator provides few trading signals | The Stochastic oscillator provides more trading signals. |

)

How to identify divergence in the market using ultimate oscillator, if we are unable to identify divergence easily than which indicator will help us to identify divergence in the market.

As we earlier mentioned, the Ultimate oscillator indicator through the use of the 3 timeframe, the 7, 14, 28, filters a lot of noise in the market and gives fewer trading signals. A trading signal using the Ultimate oscillator indicator is produced when there is a Divergence.

What is a Divergence then. Divergence is a period where the price chart and the Ultimate oscillator moves in opposite directions. That is, when price chart is moving in an upward direction while the Ultimate oscillator moves in a downward direction or vice versa. For example, the price chart forming a Lower low while the Ultimate oscillator forms a higher low.

Bullish Divergence

The Bullish Divergence usual occur in a bearish market when the market is forming lower lows or lower highs. Now the bullish divergence occurs when the price chart forms lower high while the Ultimate oscillator indicator forms a higher high. That is when price chart and the oscillator are moving in opposite directions.

Bearish Divergence

Conversely to the bullish divergence is the Bearish divergence. The bearish divergence usually occur when the market is in a Bullish trend forming consistent highs. Now the bearish divergence occur when the market price is forming higher high while the Ultimate oscillator indicator is forming lower lows.

If we are unable to identify divergence easily than which indicator will help us to identify divergence in the market

It is a fact that no matter how good an indicator is, it can never be 100 percent accurate. So it is always important to combine two or more Indicators.

In the case of the of the Ultimate oscillator indicator, we can use the RSI indicator or Stochastic oscillator indicator to identify areas of Divergence when we can't identify it using the Ultimate oscillator.

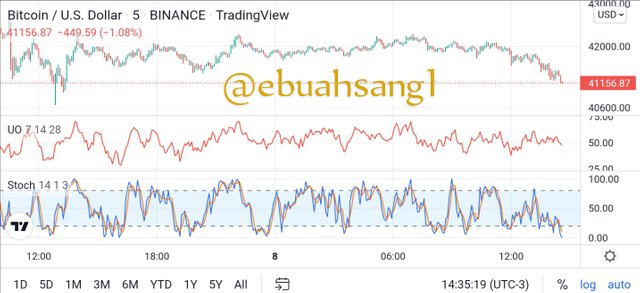

The Stochastic oscillator indicator like we saw in the above explanation is quite similar to the Ultimate oscillator and so in a scenario when I can't identify divergence, I will use the Stochastic oscillator indicator.

)

what is the 3 step- approach method through which one can take entry and exit from the market. Show real example of entry and exit from the market.

To answer this question, I will be looking at the 3 steps that are involve in making a Buy entry and a Sell entry.

Buy Entry

To place a buy order using the Ultimate oscillator, the market should be in a downtrend. The following steps must occur in order to place a Buy order.

Step one. Formation of a Bullish Divergence. That's, price chart should form a lower low while the Ultimate oscillator forms a higher low.

Step two. The first low in the Ultimate oscillator must be below 30. Remember we said when a reading is below 30, it means the asset is oversold. When the ultimate oscillator is in this zone, there is a potential for price reversal.

Step Three. The Ultimate oscillator must rise above the divergence high which happens to be the formation of the highest point of the two lows of the divergence.

Sell entry

The following steps should occur in order to place a Sell order in the market.

Step one. Bearish divergence. Conversely to the buy entry when a Bullish Divergence is formed, a bearish divergence occurs when price forms a higher high while the Ultimate oscillator forms a Lowe high

Step two. The first high in the divergence must be above the 70 line zone. That's, the market should be in an overbought position signalling a bearish reversal.

Step three. The third step is about the divergence low. The Ultimate oscillator is supposed to drop below the divergence low which is the lowest point between the two highs of the divergence.

When the above rules are complete, then we can enter a sell trade.

)

What is your opinion about ultimate oscillator indicator. Which time frame will you prefer how to use ultimate oscillator and why?

In my opinion I think the Ultimate oscillator indicator is a great and unique indicator. For the following reasons.

Uses 3 timeframe. The use of the 3 different timeframe by the oscillator indicator is one of its uniqueness. This gives it the ability to filter out unnecessary noise in the market.

Stronger Signal. Unlike most other momentum Indicators, the Ultimate oscillator indicator produced stronger trading signals. Even though it produces fewer of them but they are more accurate than other Indicators.

The preferred timeframe to use the Ultimate oscillator is the default timesframes of 7, 14 and 28 as explained by the professor. Also, inorder to increase the accuracy of the Indicator, it is advisable to use smaller timeframe for candlestick like to 5 min, 15 min or 30 min. This is because the Indicator stays to give trading signals.

So, the Indicator is one I will start using as it promotes patients in traders, a trader should be patient enough to the signals produced here.

)

As can be seen from the explanation of the lecture by the professor and from the assignment, the Ultimate oscillator indicator like the name goes is ultimate amongst indicators. It's ability to use 3 different timeframe and produce fewer but strong signals is what makes it unique.

I say a big thank you to Professor

@utsavsaxena11 for the wonderful lesson.