As you may have heard on the news, Venezuela is today a deeply troubled country. Lacking official statistics, inflation is estimated by the IMF at 700% for 2017 and expected to rise to 2000% in 2018 (http://www.imf.org/external/country/ven/). The government has imposed exchange controls, where the official “preferential” exchange rate is 1 USD - 10 VEF, the official “other uses” rate is 1 USD ~ 3,100 VEF, while the black market rate is 1 USD ~ 18,000 VEF (https://dolartoday.com/).

With this rate of inflation, people’s savings have become, or are rapidly becoming, worthless. Salaries and pensions likewise. If you had the VEF equivalent of 100 USD saved last year, this year it will be worth 14 USD. Next year, you're lucky if they're worth a single dollar.

Basic food and essential goods are price controlled, with retail prices fixed below the cost of production - leading to a sharp reduction in national production of these goods, and severe scarcity, with hunger, long food queues, and a lack of medicine as tangible consequences. The Swedish Foreign Ministry recently highlighted the grave situation, with a lack of respect for democracy and human rights, and severe scarcity. (https://www.facebook.com/margot.wallstrom/posts/1312912585424468). Numerous international voices have done the same for years.

EFFECTS OF HYPERINFLATION

In this environment, the basic salary is 97,531 VEF (http://money.cnn.com/2017/07/02/news/economy/venezuela-minimum-wage-hike/index.html). This is less than 6 USD at the black market rate, which is the most used rate. Taking into consideration subsidised food stamps, the total value reaches ~250,531 VEF, which even so is only worth ~14 USD. In July 2017, a basic family shopping basket cost more than 1,700,000 VEF (http://www.finanzasdigital.com/2017/07/cendas-fvm-canasta-basica-familiar-subio-1-738-15055-bolivares/).

That’s right - the numbers don’t add up. If you’re single in Venezuela, earning minimum wage, including subsidies, you need seven monthly salaries to go buy one single family shopping basket.

During one year 2016-2017, 74% of the population lost an average of 8.7 kg. (http://www.economist.com/news/finance-and-economics/21720289-over-past-year-74-venezuelans-lost-average-87kg-weight-how) They simply don’t have enough food.

TURNING TO TECHNOLOGY

In this environment, it is not surprising to see desperate people searching for desperate solutions. Some search for food on trash heaps. Others turn to technology. Bitcoin and other cryptocurrencies provide such a solution.

There are no official statistics on the number of bitcoin users in the country, but according to the brokerage website Surbitcoin.com – a platform allowing Venezuelans to buy and sell bitcoins in exchange for VEF – the number of users increased from 450 in August 2014 to more than 85,000 in November 2016. (https://www.theguardian.com/technology/2016/dec/16/venezuela-bitcoin-economy-digital-currency-bolivars).

Since then, Surbitcoin was shut down by the Venezuelan government, even though Bitcoin formally isn’t illegal in Venezuela. Several Bitcoin miners have been arrested and jailed on charges such as “electricity theft”. (http://reason.com/blog/2017/02/03/venezuela-surbitcoin-arrests-mining)

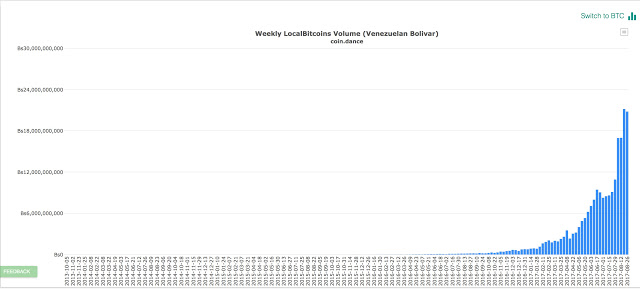

The number of users will be sure to have risen even higher since then. We can look at Bitcoin trading volume over time on localbitcoin.com, expressed in VEF. A clear trend.

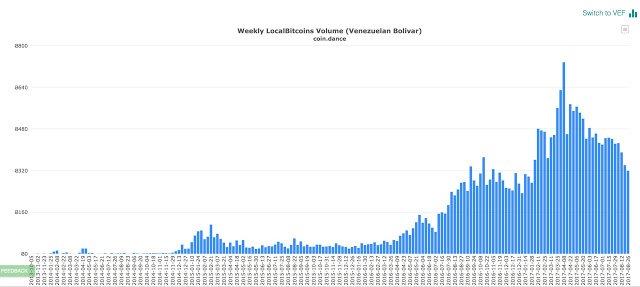

However, if we look at the trading volume expressed in BTC, we see a different story. Trading peaked 2017-04 and has since contracted though still significant.

(https://coin.dance/volume/localbitcoins/VEF)

THE ECONOMY OF A VENEZUELAN FAMILY

Lots of statistics and numbers - still doesn’t feel real, does it? So let me tell you about a friend of mine who lives in Venezuela with his parents, wife, and son. I will give no names, you will soon understand why.

- His mother is retired. Her pension is a total of 84,000 VEF, or ~5 USD per month.

- His father has a small business, and is the main family provider, but even so has problems making ends meet every month, and is nearing retirement age. His income varies greatly but let’s put an average of 2M VEF, or ~111 USD per month.

- His wife earns near-minimum wage, a total of 320,000 VEF with food stamps, or ~18 USD per month.

- My friend is studying and earns no income.

In total, the family earns 2.4M VEF total, or ~133 USD per month. As you can imagine, the family has little or no savings - the hyperinflation would quickly have rendered them worthless.

Their monthly income is enough to buy 1.5 basic shopping baskets per month. They have survived so far thanks to the father being able to pass inflation on to his customers. In this way, this family is more fortunate than most. Salaried workers and retirees in Venezuela don’t have this option.

They starve.

BLOCKCHAIN BEGINNINGS

I got interested in blockchain technology in 2015, in particular in the Ethereum blockchain, and proposed to my friend that he begin mining Ethereum about a year ago, in June 2016. I purchased a computer for him on Amazon, something that would have been prohibitively expensive for him to do inside the country. Fortunately, it wasn’t “confiscated” by corrupt customs officials just as poor as his family. He started mining Ether - an alternative to Bitcoin. (https://ethereum.org/)

Little more than a year later, in August 2017, at current Ether prices, his monthly mining income is ~1.8M VEF, or ~100 USD. No big amount by Swedish standards, but compare this to his mother’s pension or his wife’s minimum salary.

That mining computer I sent him a year ago is now worth an entire family shopping basket a month - again not much by Swedish standards, but equal to seven minimum wages in Venezuela. A big deal.

WHAT SCARCITY REALLY FEELS LIKE

Now I want to stop for a second. Let’s do an exercise. I want you to visualise taking your entire monthly pay check, before you have paid rent or anything. You go to the supermarket. You fill up your shopping basket. Then you realise you can’t pay for it. Not even half. A fifth. So you put back deodorant, eggs, bread, fruit, vegetables, butter, detergent, …and more... on the shelves. Because you can’t afford them. When you’re done, your shopping basket contains only toilet paper, toothpaste, soap, corn flour, cheese, cooking oil, milk, salt, and a bony chicken. That’s what you will be bringing home to your family this month.

You would need to save all of your salary for seven months to be able to buy one complete family shopping basket. In Sweden, assuming a low wage of 9000 SEK after taxes, this would be 63000 SEK, or ~7900 USD.

How does that make you feel? Now imagine you’re part of a family, with a young child. You love them above anything. And you can’t feed them. How does that make you feel?

RISKS AND REWARDS

The value of my friend's mined Ether, part which he exchanges and stores in Bitcoin, is highly volatile since Ether and Bitcoin are volatile, and carries significant risk - but it's less volatile and risky than the hyper-inflated Venezuelan VEF. Using cryptocurrencies,

- He has found a way to protect himself from the country’s rampant hyperinflation.

- He has found a way to be able to save money in case someone in his family becomes ill.

- He has found a way to have a reserve, to be able to buy food on the black market, to provision basic necessities for his 5-year-old son.

So far, he has used his mined income to - via a fairly long and convoluted series of transactions which I won’t go into here - purchase mobile phones for himself and his wife, pay daycare, repair house appliances, buy clothes for his son, and food. I’m so grateful he hasn’t, as of yet, needed to purchase medicine, and I hope with all my heart he never will.

HERO OR VILLAIN?

Without cryptocurrencies, without the blockchain technology spearheaded by Bitcoin, this would have been impossible. And while he is desperately trying to save money for his family, facing a very concrete situation of extreme scarcity, risks attracting the attention of an authoritarian government who’s cracking down on cryptocurrency mining even though there is no law forbidding it, risks being branded a criminal, risks going to jail without breaking any laws…

...at the same time, he is also one of thousands who mine, and therefore provide cryptographic security, trust and consensus in the Ethereum network, helping to spread network's worldwide reach, crossing borders, connecting individuals directly as peers. As equals.

Let’s go back to that visualisation, of being there in the supermarket, of buying food. If you were there, even knowing you risked unwanted attention from an authoritarian government, what would you have done?

THE FUTURE

How many people like my friend do you think there are in the world today? In Venezuela? In Zimbabwe? In India? In Russia? In China? What would they have done? What will they do?

When they grow numerous, from thousands to millions - then no corrupt government will be able to enforce scarcity for its people anymore through currency controls, and citizens everywhere will always have an alternative to inflation-stricken national currencies. It's not a perfect alternative, it's volatile, it's high risk, it's immature - but it is an alternative. These people will have a way to start saving that is completely decentralised. No bank or government is required. All they need is the Internet and a computer.

It will be a bumpy ride at times and there will be speculation - which is why I’m personally more interested in actually contributing. There are many things you can do: Mine, or teach others how to mine. Contribute to the open source blockchain ecosystem. Write smart contracts. Create new businesses. Do research. Transfer money. Promote clean energy (https://theworldenergyfoundation.org/). Donate to auditable charity (http://giveth.io/, http://www.charity-dao.org/). All these things will lay the real foundations for long-term adoption.

Can you imagine the potential this has to improve life so much, for so many? I can, and it makes me full of hope for the future - on a grand scale, but just as much on a small scale, for my friend and his family. I hope you can imagine it too, and I invite you to join the growing blockchain movement.

(All links in this text were referenced 2017-08-31 unless otherwise noted).

I have been saying something similar. I believe cryptocurreny prices are driven by fiat currencies with the worst inflation rates. People who live in countries where the local currencies are somewhat stable enjoy huge relative increases in the value of their crypto positions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't think the adquisitive power of Venezuela is high enough to significantly influence the Bitcoin price. It's more a matter of pure survival - they found something that doesn't become worthless in a few months that they can use as a store of value. But when your store of value is so small, you have to take from it to survive in day-to-day life, it also becomes a medium of exchange. 10 years ago, the black market was all about USD. Now, bitcoin is right up there with USD on dolartoday.com. They have a real need and Bitcoin & co solves a real problem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I would expect some people with wealth are buying a lot of cryptocurriencies in Venezuela, Greece and India. India has enacted very strict currency controls.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @singularityguy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit