India Venture Capital Investment Market Overview

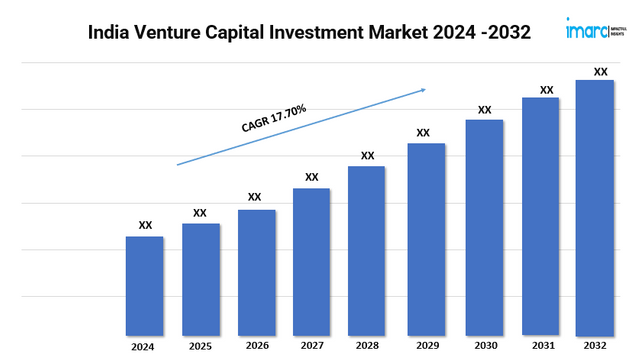

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 17.70% (2024-2032)

The proactive initiatives by the governing body are playing a pivotal role in encouraging the startup ecosystem in India. These initiatives provide various incentives, including tax benefits, easier compliance norms, and funding support, which are leading to the establishment of new enterprises. According to the latest report by IMARC Group, India venture capital investment market size is projected to exhibit a growth rate (CAGR) of 17.70% during 2024-2032.

India Venture Capital Investment Industry Trends and Drivers:

Additionally, the rapid penetration of the internet and mobile connectivity is opening vast opportunities for tech-based startups, especially in sectors like financial technology (fintech), education technology (edtech), healthcare technology (healthtech), and e-commerce. The adoption of digital payments and the shift towards a cashless economy are leading to higher investments in the fintech sector. Besides this, the growing awareness about environmental issues and climate change is resulting in higher interest in investing in startups that offer sustainable solutions. Clean energy, electric vehicles (EVs), and agriculture technology (agritech) are some of the sectors that are getting attention from venture capitalists who are looking to invest in environmentally responsible technologies.

Moreover, the increasing younger population is another crucial factor supporting the market growth in the country. The young and dynamic population is more inclined towards entrepreneurship, leading to a rise in innovative startups across various sectors. The entrepreneurial spirit among the youth is further encouraged by the availability of mentorship programs and incubators that provide the necessary guidance and support to budding entrepreneurs. Universities and educational institutions are fostering an entrepreneurial mindset, integrating entrepreneurship courses and workshops into their curricula, thus nurturing a new generation of innovators. In addition, startups are leveraging digital platforms to reach a wider audience, create brand awareness, and scale their businesses more efficiently. Apart from this, the rise of alternative investment platforms and crowdfunding are democratizing access to capital for startups, allowing a broader range of investors to participate in the market. This is increasing the pool of available funds and providing startups with more diverse funding options. These platforms are also making it easier for startups to connect with potential investors, facilitating a more efficient and streamlined fundraising process.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-venture-capital-investment-market/requestsample

India Venture Capital Investment Industry Segmentation:

The report has segmented the market into the following categories:

Sector Insights:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Fund Size Insights:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

Funding Type Insights:

- First-Time Venture Funding

- Follow-on Venture Funding

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit