작년 달러의 약세로 이머징국가들의 주식시장은 많이 상승했습니다. 특히 아시아국가들이 약진했는데 그중에 제일은 베트남 펀드입니다 (37.1% (2017), 10.3 % (1/29/2018)) . 그중에 하나인 VNM ETF 와 미국달러의 움직을 보며는 그관계가 확연히 드러납니다. 베트남은 현재 경제성장률이 7.65% (2017 4분기 기준) 으로 중국보다 높으며 인플레이션도 2.65% 으로 양호한 편입니다. 앞으로 세계경제가 지속적으로 확장한다면 당분간 좋은 투자처로 보입니다.

The dollar weakened last year and stock markets in emerging markets have risen a lot in 2017. Especially, Asian countries have made great strides, among which the first is the Vietnam Fund. The relationship between the Vietnam (VNM) ETF and the US dollar is evident. In Vietnam, the current annual economic growth rate is 7.65% (as of Q4 2017) which is higher than China's growth rate (6.8%) and inflation is also stable at 2.65%. If the global economy continues to expand, it will be a good investment in Vietnam.

The following chart shows the historical prices of VNM ETF since 2010.

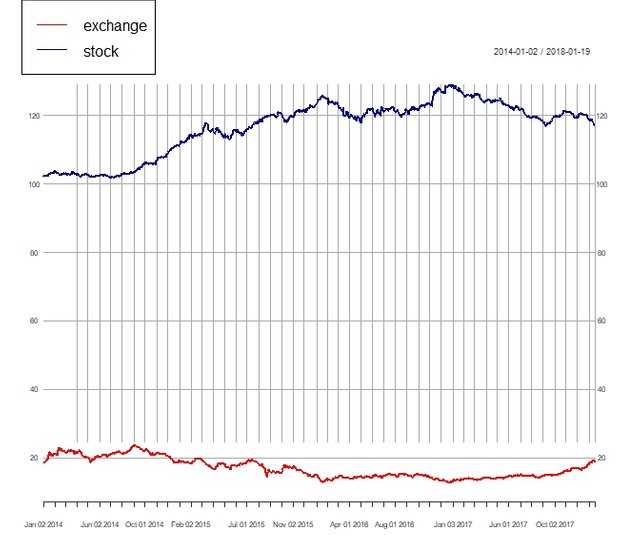

The following chart shows the historical movements of U.S. Exchange rate (DTWEX) and prices of VNM ETF. The relationship between two series is negative. The correlation is -0.69.

Note: Stock = VNM ETF and Exchange = Broad U.S Exchange Rate

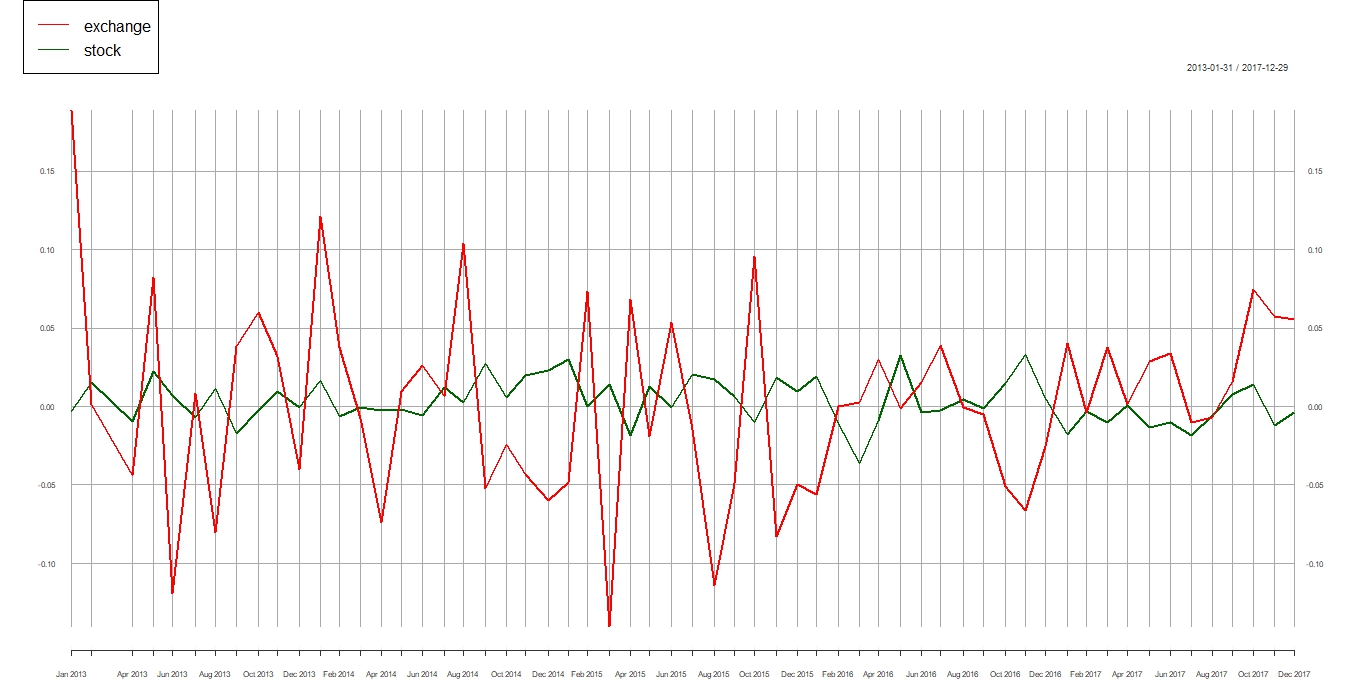

The following chart shows the movements of monthly changes of VNM EFT (Stock) and broad U.S. Exchange rate (DTWEX). The movements of both series are opposite.

Note: Stock = VNM ETF and Exchange = Broad U.S Exchange Rate