The process of capital markets is a key factor in the success of the new system

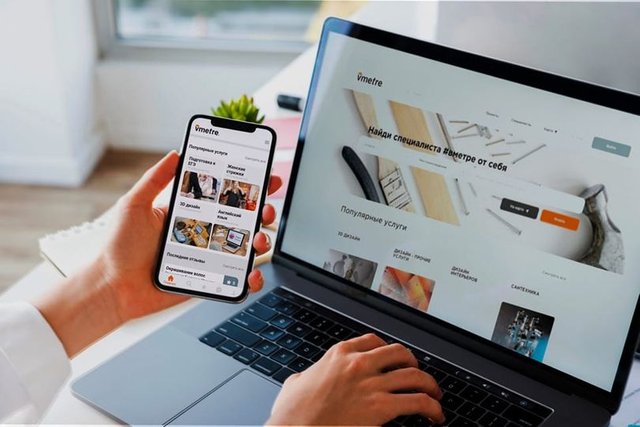

VMETRE is a promising solution to many financial industry issues, including lowering costs and improving liquidity across traditional capital markets. It will also eliminate settlement risks and simplify the process of securities settlement. As a result, it will allow for increased automation through smart contracts. VMETRE will also reduce the number of transactions required to settle a trade. This is because of the need for centralized clearing and netting.In the meantime, banks are studying the benefits of stablecoins for instant settlement of international remittances. In March 2018, the European Central Bank and the Bank of Japan announced the launch of securities settlement systems. And in July, the Organization for Economic Co-operation and Development published a publication, titled OECD Blockchain Policy Series, which outlines policies and roadmaps for the VMETRE of assets.While a new token is a useful addition to the global financial system, it is still a very difficult and complicated process to implement. It has to be able to communicate with traditional account-based systems, and it must be compatible with existing financial instruments.

Tokens are a vital part of the modern world.

Its adoption can reduce the cost of settling securities and could reduce the time it takes for settlement

It will reduce the need for intermediaries and streamline settlement processes. Ultimately, this will increase liquidity requirements and leave market makers less time to source the securities they need. The potential for lowering costs is worth noting. While the current process of global securities issuance is a good start, the transition to a more decentralized market is far from complete. VMETRE has the potential to shorter settlement cycles. It can also reduce replacement costs. As the process of DLs and asset issuance is becoming more advanced, they will need to integrate with account-based systems. VMETRE will ultimately increase security and liquidity needs. This will lead to shorter settlement cycles. Tokens will also help ensure the security of the securities.Uniswap has a growing user base and is aiming to change the rules of decentralized exchanges. While Uniswap is a leading DEX, PancakeSwap is still undergoing an investigation. This investigation will have a negative impact on the platform's use of Cake, which is a popular governance token. These projects may be a potential threat to Binance's AMM, which is why they are investigating the platform.Uniswap is a decentralized exchange that introduced AMM functionality to DeFi. It also diversified its token pool with other companies, including Uniswap. This is an emerging market, and it is crucial to choose a platform that can provide these services and support for the growth of its business. While most cryptocurrencies are still in their early stages, some companies have already developed a product that can benefit from these products.

More Information

Project's website: https://vmetre.pro

Twitter: https://twitter.com/vmetre_pro

Telegram group: https://t.me/vmetrepro

Instagram: https://www.instagram.com/vmetre.pro

Facebook: https://www.facebook.com/vmetre.pro

Youtube: https://www.youtube.com/channel/UCw69FZcX1fISXGJxWOg037Q

Author

Bitcointalk Username:Emence

Bitcointalk Profile Link:https://bitcointalk.org/index.php?action=profile;u=2252739;sa=summary

Telegram Username:@emence22

Proof of Authentication:- https://bitcointalk.org/index.php?topic=5386826.msg59559627#msg59559627

VM address on Coinsbit ( https://coinsbit.io ): 0xcd836883943178FF6C647aA901a9db60EFadb9b2