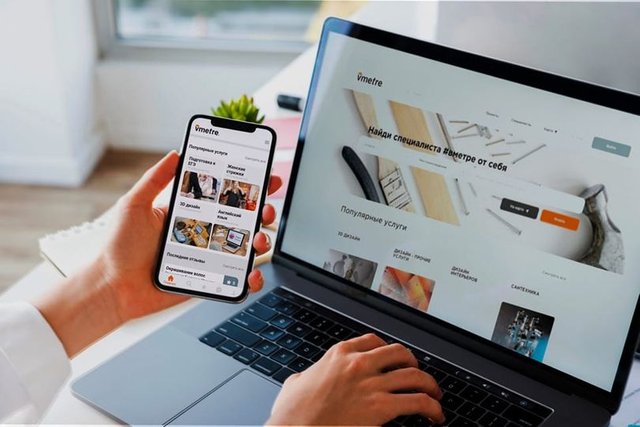

VMETRE will change the fundamental nature of securities settlement

As long as delivery is linked to payment, there will be no principal risk. VMETRE will also reduce the need for central clearing and settlement cycles. VMETRE will also allow for increased automation and smart contracts. The key to successful VMETRE will be to find a platform that supports it. You can download the latest VMETRE report from their website:VMETRE will change the settlement process. Historically, securities were issued in paper certificates that could be moved around the world. Moving paper certificates is a costly and risky process, but with modern technology, it can be eliminated. VMETRE will also reduce the cost of settlement. In addition to reducing costs, it may also increase the liquidity needs of market makers. However, it will also reduce the time required to source needed securities.The process of settlement for securities trades may be affected by the use of tokens. Traditionally, securities were issued as paper certificates that could be moved around. The movement of these papers was costly and risky, so centralisation has tended to reduce the number of transactions. But VMETRE does not solve the problem of decentralisation and does not eliminate the risks associated with physical transfers.

VMETRE may also affect the settlement process

It may shorten the settlement cycle by eliminating the intermediary. This could reduce the costs and risks associated with settlement, which is another key benefit of VMETRE. But VMETRE might not be perfect for all types of securities trades. VMETRE could also result in more complex netting, which can result in higher volatility.VMETRE is a popular means of distributing virtual assets. But it is still not a perfect solution for global securities issuance. It requires many intermediaries to execute trades. To avoid intermediaries, VMETRE will use its DLT to create a blockchain-based platform. Further, it will also offer incentive to cryptocurrency exchanges. In order to create an effective market environment, investors should ensure that they have a clear understanding of the rules of the game.Tokenization has many advantages over book-entry securities, but it can be problematic in some instances. For example, a book-entry security will require a CSD to verify the account holder, while a digital token will require an authentication process with a cryptographic key. Tokenization has the potential to increase the liquidity of the market, but it is still an early stage in the process of global securities issuance and tokenization.

More Information

Project's website: https://vmetre.pro

Twitter: https://twitter.com/vmetre_pro

Telegram group: https://t.me/vmetrepro

Instagram: https://www.instagram.com/vmetre.pro

Facebook: https://www.facebook.com/vmetre.pro

Youtube: https://www.youtube.com/channel/UCw69FZcX1fISXGJxWOg037Q

Author

Bitcointalk Username:Bourn1993

Bitcointalk Profile Link:https://bitcointalk.org/index.php?action=profile;u=2252596;sa=summary

Telegram Username:@bourn19930

Proof of Authentication:- https://bitcointalk.org/index.php?topic=5386826.msg59560959#msg59560959

VM address on Coinsbit ( https://coinsbit.io ) : 0x327DE3Eaf3896F802Ff92a8AA19BB045B3B2BeED