Sell AT&T and Verizon: Follow Warren Buffett's Approach With T-Mobile Instead

In a surprising turn of events, renowned investor Warren Buffett has recently recommended selling shares of telecom giants AT&T and Verizon and shifting focus towards T-Mobile. This unexpected advice has caused ripples in the investment community, prompting many to reevaluate their positions in the industry.

Buffett, widely regarded as one of the most successful investors of all time, has always emphasized the importance of investing in companies with sustainable competitive advantages and long-term growth potential. His track record speaks for itself, as he has consistently chosen companies that have proven to be solid investments over time.

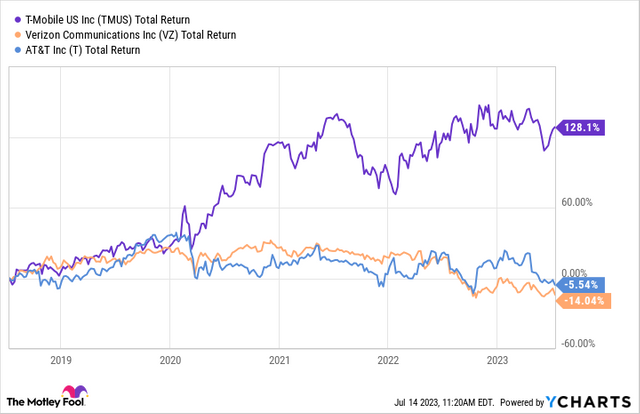

While AT&T and Verizon have long been considered dominant players in the telecommunications industry, Buffett believes that T-Mobile, currently the third-largest wireless carrier in the United States, presents a more compelling investment opportunity. His reasoning is based on T-Mobile's impressive growth trajectory and the potential for further expansion.

T-Mobile has experienced a remarkable turnaround in recent years, largely attributed to its aggressive "Un-carrier" strategy, led by CEO John Legere. The company has made significant strides in improving its network infrastructure, offering competitive pricing plans, and disrupting the market with innovative services. As a result, T-Mobile has consistently gained market share and has become a formidable competitor to AT&T and Verizon.

Buffett's endorsement of T-Mobile comes at a time when the company is poised for even greater success. With the recent completion of its merger with Sprint, T-Mobile has significantly bolstered its network capabilities and expanded its customer base. The combined entity now boasts a nationwide 5G network, which positions it well to capture a larger share of the growing demand for high-speed connectivity.

Moreover, T-Mobile's management team has displayed a strong focus on customer satisfaction and innovation. The company's ability to stay ahead of technological advancements and capitalize on emerging trends gives it a distinct advantage in an increasingly digital world. This forward-thinking approach has resonated with consumers and has translated into impressive financial performance.

From an investor's standpoint, T-Mobile offers several compelling advantages. Firstly, the company has consistently delivered strong revenue and earnings growth, outpacing its larger rivals. This growth potential is further amplified by T-Mobile's comparatively lower market penetration, indicating room for expansion.

Secondly, T-Mobile's stock valuation appears more favorable than that of AT&T and Verizon. With a forward price-to-earnings ratio that is more in line with its growth prospects, T-Mobile offers investors a potentially better return on investment.

Lastly, T-Mobile's merger with Sprint has created cost synergies and operational efficiencies that are expected to drive profitability in the coming years. As the company further integrates its operations and optimizes its resources, it is well-positioned to capitalize on the increasing demand for wireless services.

While Buffett's recommendation to sell AT&T and Verizon and invest in T-Mobile may come as a surprise to some, his decision is rooted in a careful analysis of each company's competitive position and growth potential. As an investor known for his long-term vision and sound judgment, Buffett's endorsement carries significant weight.

As always, investors should conduct their own thorough research and consider their individual investment objectives before making any decisions. However, Warren Buffett's recommendation to follow his lead and shift focus to T-Mobile should not be taken lightly. With its compelling growth story and strong market position, T-Mobile appears to be an attractive investment opportunity in the telecommunications industry.