“Banking was conceived in iniquity and was born in sin. The Bankers own the Earth. Take it away from them, but leave them the power to create deposits, and with the flick of a pen they will create enough deposits to buy it back again. However, take it away from them, and all the fortunes like mine will disappear, and they ought to disappear, for this world would be a happier and better world to live in. But if you wish to remain slaves of the Bankers and pay for the cost of your own slavery, let them continue to create deposits.” – Sir Josiah Stamp, President of the Bank of England in the 1920s, the second richest man in Britain

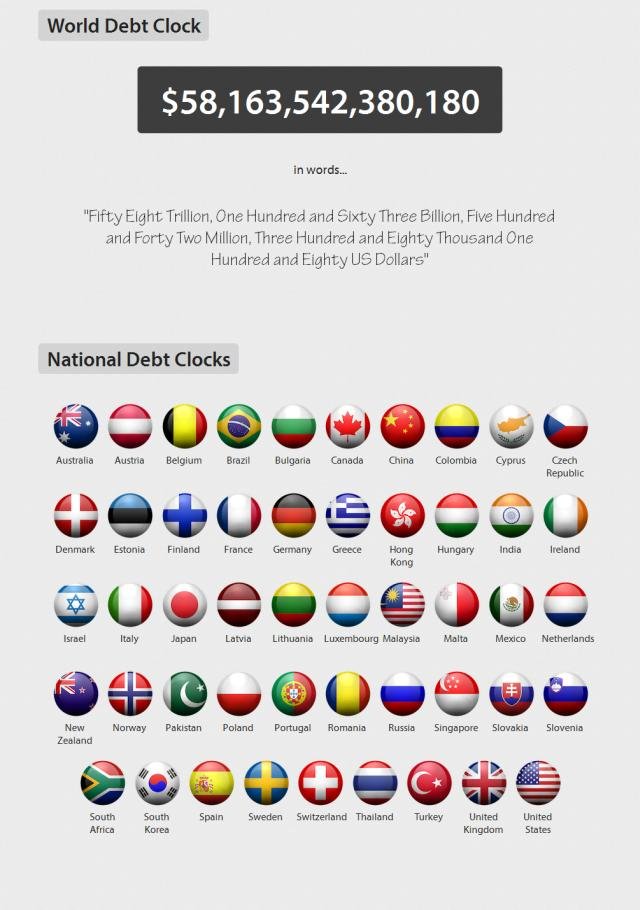

First let’s take a look at the world debt :

A record level of $158.8 trillion in global debt, together with low economic growth is creating a serious threat of a new financial crisis, says the sixteenth annual Geneva Report.

Total world debt, excluding the financial sector, has risen from 180 percent of global output in 2008 to 212 percent last year, according to the report written by a panel of senior economists including three former senior central bankers. – RT

- The figures are as of Monday, May 12, 2014 at 4:42 P.M. from the National Debt Clocks website – http://www.nationaldebtclocks.org/

Although only 49 countries (out of 193) are shown above, it suffices to give us a general picture of a world in debt. The creditors, as we are too well aware of are those of the banking families of the Rothschilds, The Federal Reserve Cartel: The Eight Families, the Warburgs and the Rockefellers to name name a few.

- Tuesday, August 30, 2016 at 11:52 H - National Debt Clock

As all the central banks of the countries in the world, except China and Russia belong to the Rothschild, we can come to the conclusion that all the countries in the world are in debt. The main debt comes from the issuance of the national currency of the respective country by the central bank.

The National Debt is the Money Supply

National Bank Act of 1863

“From this point on the entire US money supply would be created out of debt by bankers buying US government bonds and issuing them from reserves for bank notes…In numerous years following the [Civil] war, the Federal Government ran a heavy surplus. It could not (however) pay off its debt, retire its securities, because to do so meant there would be no bonds to back the national bank notes. To pay off the debt was to destroy the money supply.”. – John Kenneth Galbraith

“There are two ways to conquer and enslave a nation. One is by the sword. The other is by debt.” — John Adams

“Loans alone cannot sustain the money supply because they zero out when they get paid back. In order to keep money in the system, some major player has to incur substantial debt that never gets paid back; and this role is played by the federal government.” – Ellen Brown (Web of Debt) …virtually all money is actually created as debt. For example, in a hearing held on September 30, 1941 in the House Committee on Banking and Currency, the Chairman of the Federal Reserve (Mariner S. Eccles) said:That is what our money system is. If there were no debts in our money system, there wouldn’t be any money. …the real limit on the amount of money in circulation is not how much the central bank is willing to lend, but how much government, firms, and ordinary citizens, are willing to borrow. Government spending is the main driver in all this (and the paper does admit, if you read it carefully, that the central bank does fund the government after all). So there’s no question of public spending “crowding out” private investment. It’s exactly the opposite. – Bank of England

The National Debt Cannot Be Paid Off

Exponential growth is not sustainable, according to credible scientists. Mainstream economists ignore this fact in the hope that that somehow growth can outpace debt, one year a time. But exponentially rising debt is not sustainable because the capacity to service the debt is finite. Without a means of extinguishing debt, servicing is merely borrowing new money to pay off old debts. This is the equivalent of taking out a home equity loan to get money to pay the mortgage. What happens when a debt cannot be paid? This answer is very clear to all who has been in debt – you become bankrupt. The creditor/s comes and take everything from you.

Definition of ‘Creditor’

An entity (person or institution) that extends credit by giving another entity permission to borrow money if it is paid back at a later date. Creditors can be classified as either “personal” or “real.” Those people who loan money to friends or family are personal creditors. Real creditors (i.e. a bank or finance company) have legal contracts with the borrower granting the lender the right to claim any of the debtor’s real assets (e.g. real estate or car) if he or she fails to pay back the loan.

Investopedia explains ‘Creditor’

When creditors are notified of bankruptcy proceedings, they have a couple of options with respect to their claim against the debtor: 1. They can share in any distribution from the bankruptcy estate according to the priority of their claim. Most unsecured, non-wage claims come low on the priority list. 2. They can take the debtor to court and challenge a debtor’s discharge (the right not to pay back) due to bankruptcy protection. What is made certain by the banksters is that the debt of the world cannot be repaid. They keep on giving loans and in hard times like from 2008 to now they create what is called Quantitative Easing (QE) which simply means they print more money and dish it out to the defaulters – failing too-big-to-fall banks and corporations. The only thing that keeps a country going is to pay the interests, and when it cannot it goes into default and become bankrupt.

“Give me control over a nations currency, and I care not who makes its laws” – Baron M.A. Rothschild

The world is already bankrupt and it belongs to the bank$ter$.

Can Asia overcome its addiction to debt? That is the question across the region as economies slow and borrowing costs rise. After more than a decade of often blistering growth, many fear that Asia’s golden era may be drawing to a close.- FT

“Given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers,” according to Branimir Gruic, an analyst, and Andreas Schrimpf, an economist at the BIS. The organization is owned by 60 central banks and hosts the Basel Committee on Banking Supervision, a group of regulators and central bankers that sets global capital standards.- Bloomberg

..