One of the most helpful tools I've discovered for trading is The Wyckoff Method, created by Richard Demille Wyckoff, a pioneer in the studies of technical analysis, and one of the five "titans" of TA, along-side Gann (Gann Fans/Squares), Dow (Dow Theory), Merrill, and Elliot (Elliot Wave Theory). Below is a summation of what I've gathered and factored into my trading.

Five step approach to the market.

-Determine the present position and probable trend of the future.

Is the market consolidating or is it trending? Does analysis of supply and demand

indicate the likely direction of the market in the future?

-Select stocks (read: crypto) in harmony with the trend.

In an uptrend, select stocks that are stronger than the market,

with greater percentage increase during rallies, and smaller decreases during reactions.

In a downtrend, do the inverse.

-Select stocks with a cause that exceeds your minimum target.

A critical part of Wyckoff's trade selection and management was his method of identifying

price targets using point and figure projections for long and short positions.

-Determine the stocks readiness to move.

Apply the nine tests for buying. For instance, in a trading range after a prolonged rally,

does the evidence support that significant supply is entering the market, and that

a short position may be warranted? Or in an apparent accumulation range, do the

nine buying tests indicate that supply has been successfully absorbed, as evidenced

by a low volume spring and an even lower volume test of that spring?

-Time your commitment with a turn in the market.

Three quarters or move of individual issues move in harmony with the general market.

Wyckoff's "Composite Man."

A heuristic device to help understand price movements in individual stocks

and the market as a whole.

"...all fluctuations in the market should be viewed, and studied,

as well as those in various stocks, as if they were the results of the actions of

one mans operations. Let us call him the composite man, who in theory,

sits behind the scenes and manipulates the stocks to your disadvantage if you

do not understand the game as he plays it, and to your great profit if you do."

Wyckoff advised retailers to try and play the game as the composite man played it.

Wyckoff taught that:

-The composite man carefully plans, executes and concludes his campaign.

-The composite man attracts the public to buy a stock,

in which he has already acquired a sizeable line of shares,

by making many transactions involving a large number of shares,

in effect advertising his stock, by creating the appearance of a broad market.

One must study individual stock charts with the purpose of judging,

the behavior of the stock and the motives of the large operators who dominate it.

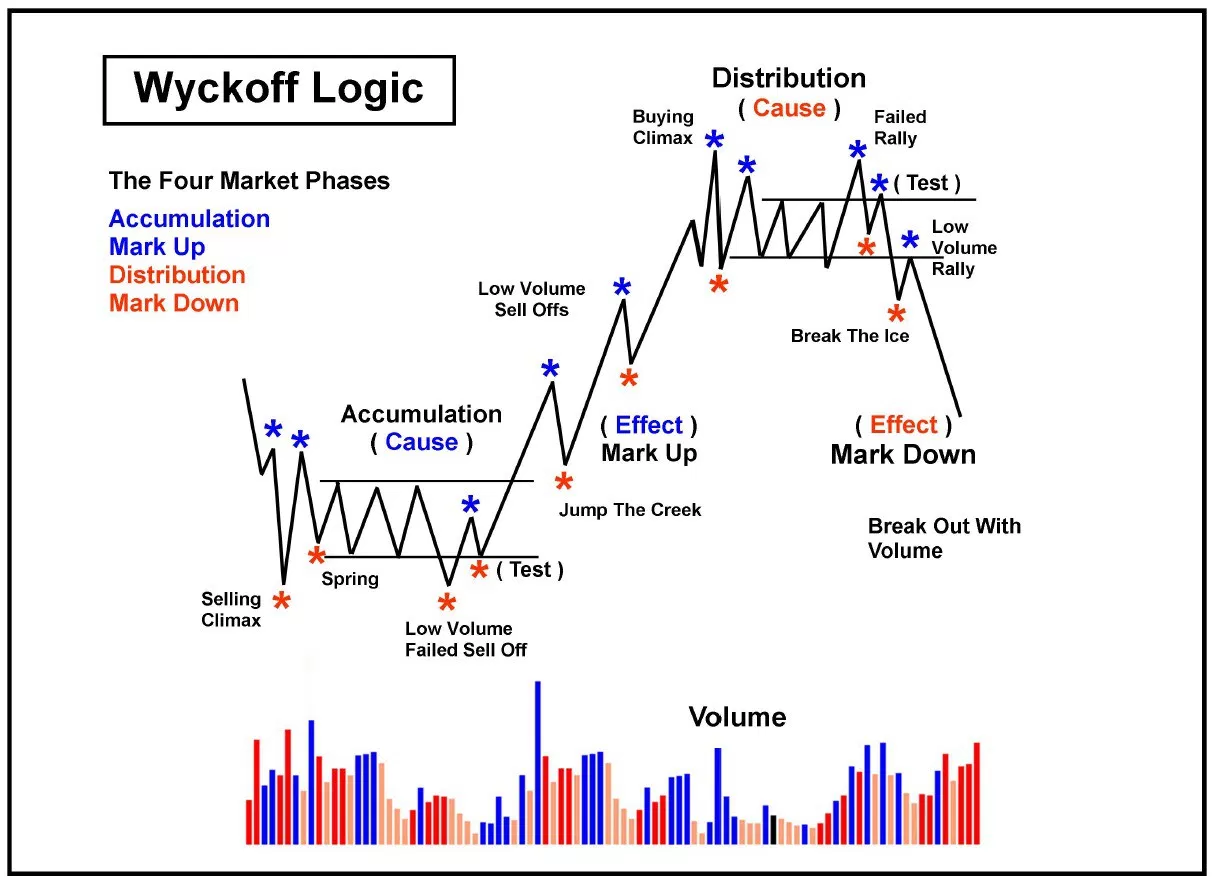

Wyckoffian Price Cycles.

-According to Wyckoff, the market can be understood and anticipated

through detailed analysis of supply and demand, which can be ascertained

from studying price action, volume and time. As a broker, he was able

to observe the activities of highly successful individuals and groups who

dominated specific issues, and was able to decipher the future intent of

those large interests. An idealized schematic has been depicted below.

I must say, this schematic, others like it, and the application of it to various charts,

has been a godsend in trading, and allows me to make some quick yes or no decisions about

whether or not I even want to continue charting a coin and look for an entry.

Three Wyckoff Laws.

Wyckoff’s methodology rests on three fundamental “laws,” which affect many aspects of analysis, including: determining the market’s and individual stocks’ current/potential future directional bias, selecting the best stocks to long or short, identifying the readiness of a stock to move, and projecting price targets in a trend from a stock’s behavior in a trading range. These laws inform the analysis of every chart and the selection of every stock to trade.

The law of supply and demand determines the price direction.

This principle is central to Wyckoff's method of trading and investing.

When demand is greater than supply, prices will rise, and when supply

outpaces demand, prices fall. Study the balance between supply and demand

by comparing price and volume bars over time. This law is deceptively simple,

but learning to accurately evaluate supply and demand and understanding the

implications of supply and demand patterns takes practice.The law of cause and effect, which helps the trader and investor set price objectives

by gauging the potential extent of a trend emerging from a trading range. Wyckoff's

cause can be measured by horizontal point count in a point and figure chart, while effect

is the distance price moves corresponding to the point count. This laws operation can be

seen as the force of accumulation or distribution within a trading range - and how this force

works itself out in a subsequent trend.The law of effort versus result, which provides an early warning of a possible change in trend in the near future.

Divergences between volume and price often signal a change in the direction of a price trend.

For example, when there are several high-volume (large effort) but narrow-range price bars after a substantial rally,

with the price failing to make a new high (little or no result),

this suggests that big interests are unloading shares in anticipation of a change in trend.

I'll conclude this here, as there's a lot of information to be absorbed.

Stay tuned for the next installment, and more.

Trade safe, trade carefully, trade well.

This seems to be a direct copy and paste of this article: http://stockcharts.com/school/doku.php?id=chart_school:market_analysis:the_wyckoff_method

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit