Quarterly fundamental forecast for gold

Disappointing stats on US non-farm payrolls in November became a red flag for XAUUSD bulls. Thinking of the USD's overboughtness and record low real yields, they even started talking about "a perfect storm": inflation is growing fast, whereas the Fed is neither her nor there. Why shouldn't the precious metal go up? Unfortunately, the Fed seems over the hill.

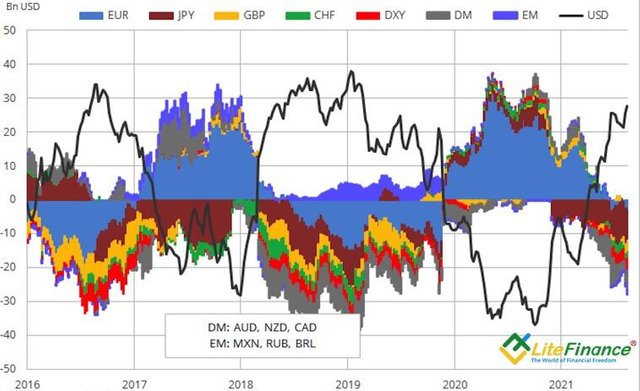

According to Commodity Futures Trading Commission, speculators built on net longs in the USD against the six major currencies from $22.11 billion to $23.99 billion in the week ended November 30 — the peak value since mid-June 2019. Even if the USD looks overbought, we need to understand the world's biggest central banks will hardly have the same policy normalization pace as the Fed. New Zealand, Norway, and Canada regulators are too small for investors to believe in their local currencies. What's more, they are under pressure due to the commodity markets' correction, including oil.

Speculative trades in USD and other currencies

For more information follow the link to the website of the LiteForex