It was mentioned in the post that XAUUSD (Gold) had perhaps going to resume a Minor wave B position and it was best to stay away as wave B’s are very difficult to deal with.

XAUUSD finished last week with a -0.74% change.

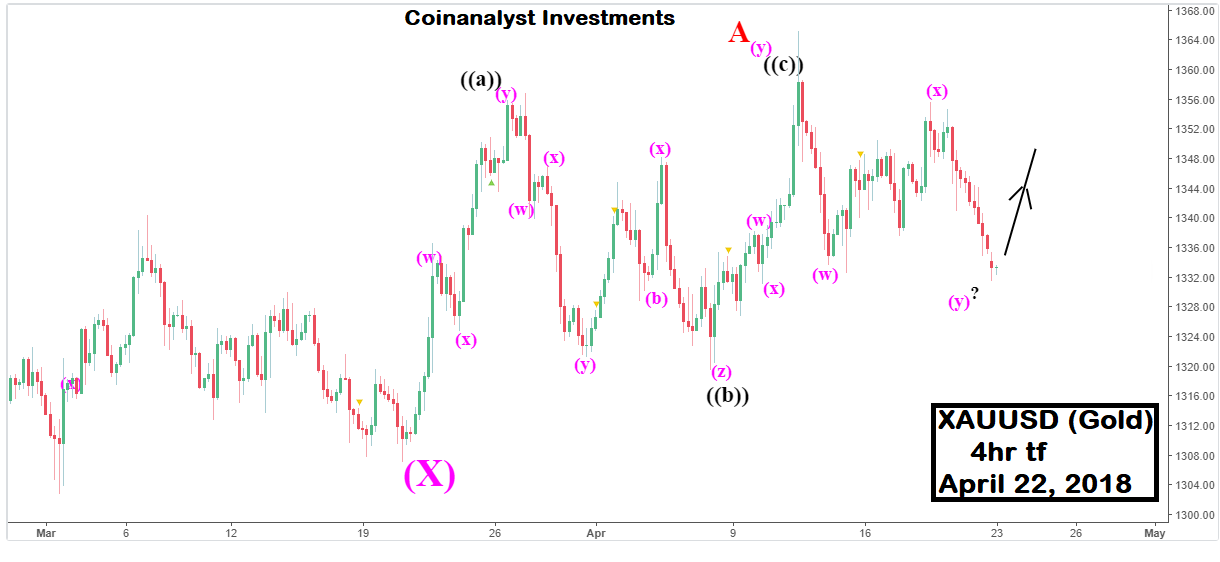

XAUUSD (Gold) is currently in a correction on the Daily tf that can best be described as a combination (W-X-Y) Elliott wave structure.

Based on how price action transpired last week, it is quite possible that XAUUSD is currently inside of Minor wave B position. XAUUSD so far has traced a 3wave movement for the proposed Minor wave B based on price swing from ~1358.21 to ~1333.29.

Any shorting opportunity should be considered only if price moves back upwards tracing out a 3 wave move i.e. This ensures that one is not chasing the market and is rather “selling the bounce”. Also a 3 wave correction of the current downswing means that there is more downside potential for XAUUSD (Gold).

The least target for the short position would be the low made on April 6, 2018 of ~1320.37

The most conservative way to enter a bullish position is on a breakout above the high of ~ 1365.16 made on April 11, 2018.

A slightly aggressive long position would be on a breakout above the high made on April 18, 2018 of ~1355.54.

Above all, the best position in this case is no position because of how nasty wave B’s can be in terms of changing their shape without notice and at anytime. I like to think of wave B’s as a fool’s game indeed!