Monthly gold fundamental forecast

Gold failed, having followed the expectations of the Fed’s dovish shift. Investors thought that a drop in US inflation would force the central bank to slow down its monetary tightening pace. The XAUUSD trades went against the Fed and lost. The gold price dropped to the lowest level since April 2020, and this may not be the bottom.

Gold, like most financial market assets, reacted violently to the release of US inflation data for August. The rise of the core indicator to 6.3 Y-o-Y and 0.6% M-o-M shocked the market. The Fed’s inflation target is far, and the central bank has no choice but to continue its aggressive monetary tightening. Investors were so worried that CME derivatives once gave a 35% chance of a 100-basis-point rate hike in September. Two big steps earlier had a less significant impact on US inflation than had been expected. So, some analysts suggest the Fed should resort to a more significant move to curb inflation.

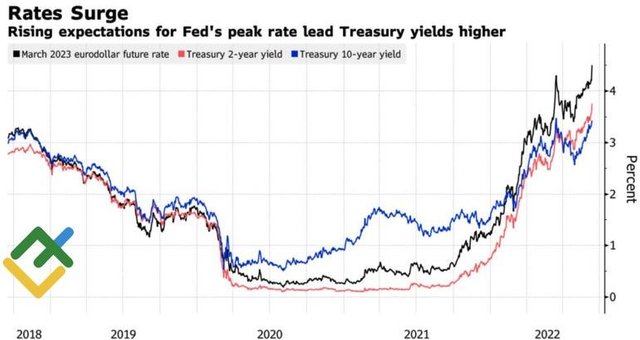

As a result, the Treasury yields grow by leaps and bounds, investors believe that the federal funds rate will reach 4.4% in 2023, and the US dollar is the only option to buy currently. No surprise that gold is weakening.

Dynamics of expectations for Fed’s rate peak and Treasury yields

For more information follow the link to the website of the LiteForex

https://www.litefinance.com/blog/analysts-opinions/gold-crashes-forecast-as-of-16092022/?uid=285861726&cid=58534