Content

Recently, YFI and AMPL are the two most popular encryption projects. Blue Fox Notes introduced AMPL a few days ago: One is the cryptocurrency "AMPL: Alternative Scarcity" that wants to become a better Bitcoin. Let’s talk about YFI today, an encrypted token called "Bitcoin in DeFi". Both of these projects have attracted a lot of attention from the crypto community because of their bold designs.

What is YFI?

Simply put, YFI is the governance token of yearn.finance, a loan aggregation protocol. It detonated the crypto community in just one week. When it was marketed on Balancer, the price was only US$3. In less than a week, the highest price was more than US$4,500. According to this data, the highest increase was 1,500 times, which is crazy enough. Specifically, what is YFI? Why does its mining look a bit complicated? About 4 months ago, Andre Cronje created yearn.finance. Users can deposit stablecoins (USDT, USDC, TUSD, DAI) into the yean.finance protocol and obtain yToken. For example, users who deposit USDC and DAI can obtain yUSDC and yDAI, which is the so-called yToken. You can get yCRV by depositing stablecoins in ypool of Curve and converting them into yToken, and you can get YFI by staking yCRV. And YFI is the governance token of the yearn protocol. A total of four different tokens have appeared here. Take the USDT stable currency as an example: USDT, yUSDT, yCRV, and YFI have appeared. This may be a place where initial contacts are easier to be confused. What exactly is YFI? What does it have to do with stablecoins, yToken, and yCRV, and what does it have to do with yean, curve, and balancer? All of this is related to its original token distribution mechanism. YFI is different from the token distribution mechanism of previous DeFi projects.

COMP, BAL, and MTA have the participation of investment institutions and pre-mining by the team before providing liquidity for mining. The initial token distribution of YFI was realized entirely through liquidity mining, with no team pre-mining and no investment institution shares. This is a token distribution mechanism with a strong spirit of encryption. This is also destined to be more concerned by the community and more legendary. Why do some people regard YFI's liquidity mining as "Bitcoin in DeFi"? The core is to understand YFI's mining mechanism, but to understand YFI's mining, understand yToken, yCRV token, and the three liquidity pools Is the key.

yToken

Users can generate yToken with stablecoins. So, what are the benefits of obtaining yToken? yToken means Yield Optimized Tokens, that is, revenue optimized tokens. So, how do we optimize revenue? We know that depositing USDC and other assets into loan agreements such as Compound and Aave can earn storage interest. However, there are differences in interest rates between different agreements. Therefore, there is room for optimization. Can stable currencies such as USDC and USDT be deposited into the agreement with the highest yield? Timely adjustments are made to the storage of different protocols to achieve optimal returns. In other words, the yearn protocol optimizes storage revenue through algorithms. In short, the current year agreement is a revenue optimizer for token storage.

yCRV

There is a yPool liquidity pool on Curve. USDT, USDC, TUSD, and DAI can be deposited on yPool. The deposited stablecoins will be converted into yTokens, and yCRV tokens can be obtained. Curve is a DEX that focuses on stable currency trading. You can refer to the previous article "Curve: DEX with a sharp contrast between performance and appearance" by Blue Fox Notes. In other words, yToken (yUSDT, yDAI) transactions can be performed on yPool. As mentioned above, after depositing yUSDT into yPool, you can get yCRV. So, what token is yCRV? yCRV is similar to the index of a set of yToken (yUSDT, yUSDC, yTUSD, yDAI). Holding yCRV can obtain the storage interest of the stable currency and the cost of providing liquidity. It is an index of the stable currency in the yPool pool. Staking yCRV to participate in liquidity mining can obtain YFI tokens. To sum up, in order to obtain YFI from the beginning, the core is to provide manageable assets (AUM, agreement-managed assets) for the year agreement to help its agreement capture more benefits. The more stablecoins users provide, the more value the yean protocol can capture. Therefore, the yearn protocol uses YFI mining to attract users to provide more stable currency assets. In addition, the YFI token itself also needs to realize price discovery and liquidity.

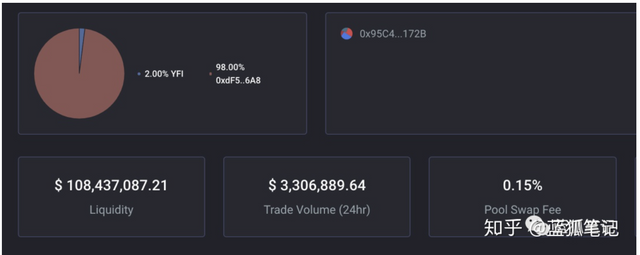

YFI's price discovery and liquidity are realized through the token pool on Balancer. By providing liquidity for the YFI-DAI and YFI-yCRV pools on Balancer, users can realize YFI price discovery and sufficient liquidity. As of the writing of Blue Fox Notes, even if the YFI-yCRV pool no longer rewards YFI, its liquidity is still more than 100 million US dollars. What is this concept? The liquidity of this pool alone is almost the same as Uniswap's overall liquidity, and occupies about 40% of Balancer's liquidity. (Uniswap's overall liquidity has been below 100 million U.S. dollars before. Recently, due to the amplifier, uniswap's liquidity has soared to 136 million U.S. dollars)

(YFI-yCRV pool, Source: Balancer)

According to the user's contribution to the yearn agreement, YFI is evenly distributed to early users who provide liquidity. The benefits of these liquidity mining at the time were amazing. According to APY calculations, the highest profit of ypool on Curve exceeded 1500%, and the lowest was more than 500%; and the YFI-DAI pool on Balancer had even more amazing returns, with a maximum of 5000%. , The lowest is more than 3000%. And Gov can reach more than 500%. Finally, there is a pledge reward. As long as the pledge exceeds 1000 BPT and participates in at least one community vote, you can obtain a fee reward of about 40% of the annualized income by staking YFI (the income will fluctuate).

YFI's three liquid mining pools

As mentioned above, the way to obtain YFI is liquidity mining. It has a total of three liquid mining pools, which are the ypool on the curve, the YFI-DAI pool on the balancer, and the YFI-yCRV pool. Each of the three pools allocates 10,000 YFIs, and they are all over. Early users participating in YFI liquidity mining must first have USDT and other stable currency assets; then deposit USDT and other stable currencies into curve, and through the yearn protocol, yToken (yUSDT, etc.) can be generated; when yToken is deposited in curve's ypool, you can Obtain yCRV tokens, and then obtain YFI rewards by staking yCRV; the remaining two pools can also obtain YFI rewards by providing liquidity for the YFI-DAI pool and YFI-yCRV on Balancer.

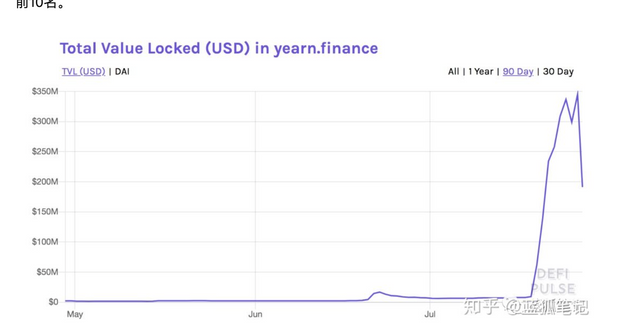

Similar to other DeFi governance tokens, token incentives can lead to liquidity and develop its business. Before YFI mining, its locked assets (AUM, assets under management) were only 8 million U.S. dollars. In less than a week, through YFI's liquidity mining, its AUM soared by more than 400 million U.S. dollars, a maximum increase of more than 50 times. Even if YFI's mining is over, its AUM is still as high as 190 million U.S. dollars, and the ranking of its locked assets in the DeFi field has soared from outside the 20 to the top 10.

(Assets locked on YFI, Source: DEFIPULSE)

There is an interesting positive cyclic relationship here. When users deposit yCRV tokens, they can get YFI tokens; as yCRV grows, they can get more interest income; more interest income will push up the price of YFI. This will lead to a greater value of YFI, and an increase in the price of YFI will make yCRV more profitable. At present, YFI holds 3,911 users, and the largest YFI whale holds 915 YFIs, accounting for about 3% of the initial total supply; this token distribution is completed in more than a week, and its token dispersion exceeds The vast majority of initial projects.