Cryptoeconomics is so fascinating to study because it’s a combination of technology, economics and psychology. Satoshi got all three of these right when he created Bitcoin, and when you look at new cryptotokens emerging today you must consider the three components holistically.

Zcash is launching its genesis block on Friday, and in lieu of that I wanted to quickly share some facts on the tech, economics, and psychology of the project in the context of privacy-based blockchain projects broadly. New launches in this space are great because testing theories in practice is much more useful for long-term progress than theorizing about how new ideas may or may not play out.

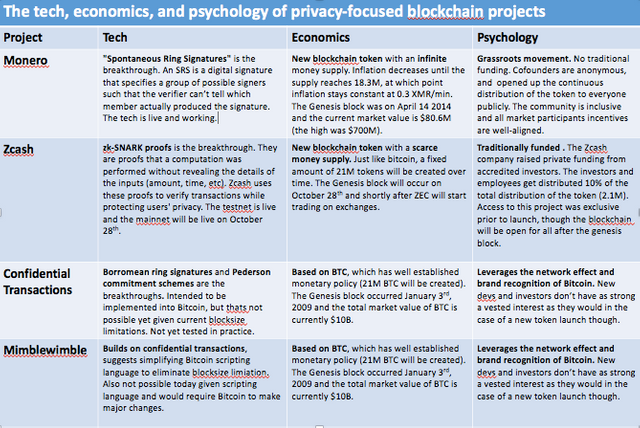

The Tech

From a tech perspective, Bitcoin currently lacks privacy. Despite popular belief, Bitcoin is a bad medium of exchange for people that value financial privacy because of the transparent ledger that reveals an address, timestamp, and amount for every transaction on the network. The transparent ledger is what helped the FBI identify the creator of Silk Road, and it is also what helped reveal the corrupt DEA agents that were involved in the FBI bringing down the creator of Silk Road.

There are a number of projects that are seeking to make technical improvements to the privacy of Bitcoin. Some, such as Confidential Transactions and Mimblewimble, are theoretical and require Bitcoin to make significant protocol changes to be implemented in practice. Others like Monero and Zcash are practical in the near-term and involve creating new blockchains and tokens.

The Economics

The projects that build privacy on top of Bitcoin leverage the network effects and brand recognition of Bitcoin. Money is the ultimate network effect product and in an ideal world, this approach seems to make the most sense from an economic perspective.

The challenge with this approach is two-fold: Bitcoin development is likely years away from adding privacy natively and from a psychology/incentives perspective, the devs that do the hard work have stronger incentives to create their own token. As a result, we’re seeing new economic systems being built with their own economics like Monero and Zcash.

The Psychology

There hasn’t been much written about the psychology of blockchains, but it’s important to consider. Properly aligning the incentives of market participants is essential to the success of blockchain projects, as is creating strong brand recognition and trust.

Zcash is interesting from a psychology perspective because the project has been funded through traditional means (venture funds and accredited investors) and it’s blockchain will reward investors disproportionally to other market participants (10% of tokens are distributed to the early investors/employees in return for their initial investment). Having well-known investors involved benefits the brand, but it also means incentives aren’t as aligned as a project like Monero, which was a grassroots movement that anyone had equal access to participate in at the start.

Let’s see

When Zcash launches on Friday, the question many in the space will ask is “Are you buying/mining Zcash?” The more important question is are you watching and learning from Zcash in the context of progress for privacy-based blockchains? I certainly will be!

If you enjoyed this, follow me on Twitter and subscribe to Control, a newsletter on the protocols, projects and entrepreneurs that are putting control of power in the hands of the people.

Great info. Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

excellent information, thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm highly skeptical about Zcash in the long term, for the same reasons I'm skeptical about Bitcoin.

If I remember correctly Zcash is pretty much a copy of Bitcoin tech, with added anonymous feature. So the governance system is still almost non-existent and block production will waste huge amounts of energy if the coin will ever become popular.

There are many blockchain 2.0 projects that have thought about these things already but Zcash decided to ignore all of them and go with old design. It will be really hard for them to update it in the future, just like it is really hard to update Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not sure I follow your point about governance design. The Zcash core devs all work for a company Zcash Co with a clear leader Zooko and it's reasonable to expect them to move quickly, much more like Ethereum than Bitcoin. I think there are lots of questions about the viability of Zcash but I don't think governance is one of them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There should be a mechanism on the blockchain level to settle conflicts. Bitcoin doesn't have any, and neither does Zcash as far as I know.

The beginning is easy when there is a company, but if Zcash is successful, it will start to decentralize and there will be lots of different opinions on how to handle things. If there is no consensus mechanism on the blockchain, there is a high risk of long and bloody fights.

I wrote about this in the Zcash forum: https://forum.z.cash/t/why-a-bitcoin-clone-and-not-a-dac/340

You might be also interested in my proposal for a good DAO design: https://steemit.com/dao/@samupaha/how-to-design-efficient-and-resilient-dao

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit