As the year and decade come to an end, cryptocurrencies indeed beat other significant asset classes.

Despite exchanging significantly down from their record highs generally December 2017, huge top cryptocurrencies had an extraordinary year and stay one of the greatest investment success stories of the decade.

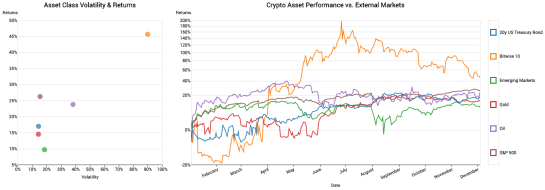

Establishing themselves as the world's driving asset class for yearly execution, cryptocurrencies have risen well above annualized returns of the U.S. equities, commodities and security markets for 2019.

Ryan Alfred, President and co-author of Digital Assets Data said huge top crypto assets possess significantly more significant yields versus customary markets during the current year.

"Glancing back at the exhibition of the main ten huge caps (Bitwise 10) in comparison to other significant asset classes, we can see their special signature," Alfred said.

As seen in the diagram above, research gave by Digital Assets Data shows how this year's presentation of the main 10 cryptos by advertise capitalization fared against other significant asset classes such as gold, oil and equities.

Of course, 2019 didn't start out that way. Back in February, the best 10 crypto started a genuinely dismal run, resting great underneath all other customary asset classes when seeing their arrival on investment figures. Nonetheless, sentiment started to get significantly in March and by mid-year, cryptocurrencies were out of sight of other different assets.

That hole has started to thin as stocks, bonds and commodities start to increase their lead. However cryptocurrencies remain significantly in front of all other asset classes as the year comes to a close.

A lot of this meeting is courtesy of bitcoin (BTC). The world's first cryptocurrency is as of now up 100 percent since the year started. In the interim, Ether, the world's second-largest crypto is up 35 percent year-to-date, however XRP is down 25 percent from where it exchanged on Jan. 1.

The big picture: Crypto's success story

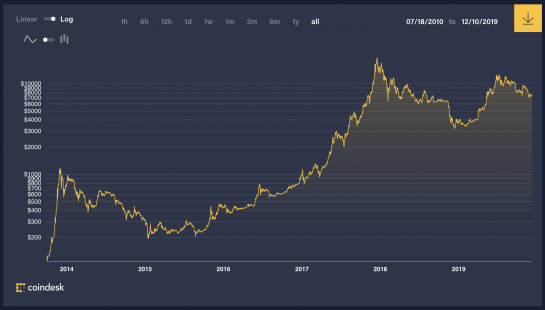

In the year prior to the decade started, the world was in the throes of a monetary crisis. Since at that point, stocks have bounced back. From its March 2009 market emergency lows to now, the S&P 500 has increased a respectable 369 percent. Similarly, the Dow Jones Industrial Average has also had a decent run, up 326 percent in that same timeframe.

In any case, BTC has blasted those figures, rising admirably over a staggering 12 million percent (yes, you read that correctly) over a one-year-shorter time period, starting March 2010. That is the point at which the cost of 1 BTC was around $0.05, information taken from Messari shows.

Crypto's success can almost certainly be credited to its most characterizing characteristics: high unpredictability and liquidity, permitting market participants to rapidly and easily exchange among advanced and fiat currencies.

Lorenzo Pellegrino, CEO of Skrill, a cross-fringe payments stage using crypto, said advanced assets resembled a nascent market. Prices ricocheting around in a distracted way empower the asset class to beat all others based on silly sentiment and low barriers to passage.

"As it (crypto) matures we should start to see increased stability and the core fundamentals will become progressively apparent," Pellegrino said.