Evening Traders.

Things are looking up a bit on Sunday with BTCUSD testing above the falling wedge top in early European trade:

A breach above yesterday's highs would confirm the break, though 4H RSI has been bullish for some time, front running this latest price development:

Now wedges tend to retrace to the origin point, which means the focus is now back on 10K. If we zoom out to the daily chart, we have falling trend-line resistance below 9500 and dropping, so a return to 10K would be very bullish indeed:

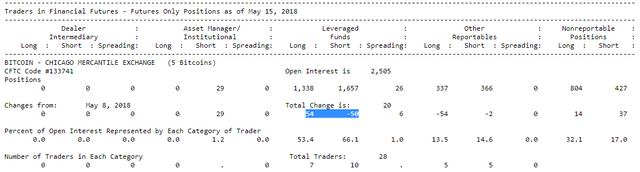

The fact that Friday's higher low occurred at the 61.8 retrace of the April-May rally bolster the case for upside. We also have CME futures expiring this week - last week showed a slight reduction in the net short position of leveraged funds and I'm looking for more of that when the next report drops on Friday:

Though seasonality data is rather limited in such a young market and should be taken with a grain of salt, this piece from Callum Thomas is quite interesting. Apparently Bitcoin often has a rough start to the year and proceeds to bottom in May/June. I haven't looked into this purported seasonal phenomena myself, though I'd wager Callum's a bit more trustworthy than Tom "Consensus Rally" Lee.

Fingers crossed.

Tom Lee is a joke!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Same here, I feel Callum Thomas' research looks a bit more realistic to me, after that #Consensus2018 Rally thing failed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah there's no such thing - guy pretty much made it up

https://steemit.com/bitcoin/@bulleth/fact-check-how-does-bitcoin-actually-behave-around-consensus

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit