This article will be a tl;dr, summary, analysis and personal interpretation of this article here.

In the Reddit article I will be referencing, the author makes about 6 points that I will summarise below.

- Cryptocurrencies are far from mainstream. The dot com bubble had 43% of people in the US using it whereas cryptocurrencies only have about 0.46% if the target population using it. We are still in the early adoption phase.

- The internet gained substantial funding from government and universities whereas there is no such investment from any of these entities in cryptocurrency. The day will come when major investors and even governments will make their move into cryptocurrency.

- Almost every major government around the world has put roadblocks before the adoption of cryptocurrency, whereas the government supported the internet. Bitcoin has made threats against many aspects of the traditional government and bitcoin surviving is testament to the support and power behind it.

- Bitcoin hurts banks directly whereas the internet directly helps the financial and banking industry. Thus banksters have been trying to block cryptos, but after Jamie Dimon of JPMorgan directly assaulted bitcoin, it survived and Jamie backtracked. Once banks start realising the potential of blockchain and start investing in it, there will be potential for massive growth, and this is already starting.

- The first ICO was in 2017, for tech that's been around for less than 1 year it's very hard for the bubble to burst. The dot com bubble burst when almost all of the foundations of the internet had been established. Whereas crypto is still in its infancy stage.

- Bitcoin is still in its infancy/early adoption stage. IF bitcoin were to be used by a large percentage of the population, the possibility of a bubble popping could be entertained. If the bubble popped, then bitcoin wouldn't still be up hundreds of percent year after year.

Points from Comments

- "One huge point people forget is that the dot com bubble lasted for 16 years and grew to 5 trillion only in the US. Not only have things barely even begun, crypto is global and you can sure as hell bet most of the money isn't even from the US" - DKill77x

- "Devil's advocate, here... What have you actually used Bitcoin for? The way most people in crypto today seem to be using it is as a vehicle for speculation or trading it for other cryptocurrencies - which then become vehicles for speculation. If you're keeping your coins on an exchange and you aren't using them for anything, then you might as well be the proud owner of a set of acronyms, not coins. The banks don't fear acronyms, and acronyms aren't going to change the world." - kescusay

- "The entire crypto market has the market capitalization of 1 large equity. Were not done here." - NEO2MOON

My thoughts

I completely agree that this is just the beginning of cryptocurrencies and blockchain technology in general. There is so much potential for blockchain technology and despite people not buying stuff with bitcoin, I see people buying stuff with Steem and XRB very soon in the future. I can see people going to a restaurant and seeing people pay in Steem and the memo being like 5 stars + 2 Steem tip!! This is very promising technology for the future and I can see it being established very soon.

The original post on Reddit focuses on bitcoin vs dot com bubbles. It's true that the dot com bubble and the crypto bubble are very different in many ways, and we're nowhere near approaching the bubble popping. It infuriates me seeing media headlines like "bitcoin bubble finally pops" and "THE END IS NIGH FOR BITCOIN HOLDERS" (yes holders not hodlers). They have no idea what they're talking about and just in it for a quick headline and some FUD. Or rather, maybe they know exactly what they're doing to spread FUD and tank prices, but that's like a conspiracy theory or something and i don't want to get into that haha.

I see government and banks investing in crypto very soon, if not already. The Australian government invested in the Australian ICO Power Ledger if I remember correctly and banks are using Ripple's systems (not the coin). At the end of 2017 I said 2018 is going to be a great year for mass adoption and despite the shitty start, the path towards adoption is still an exponential increase despite the price decrease.

Follow me for more interesting articles and your chance to win free Steem EACH WEEK, EVERY WEEK!

More details here

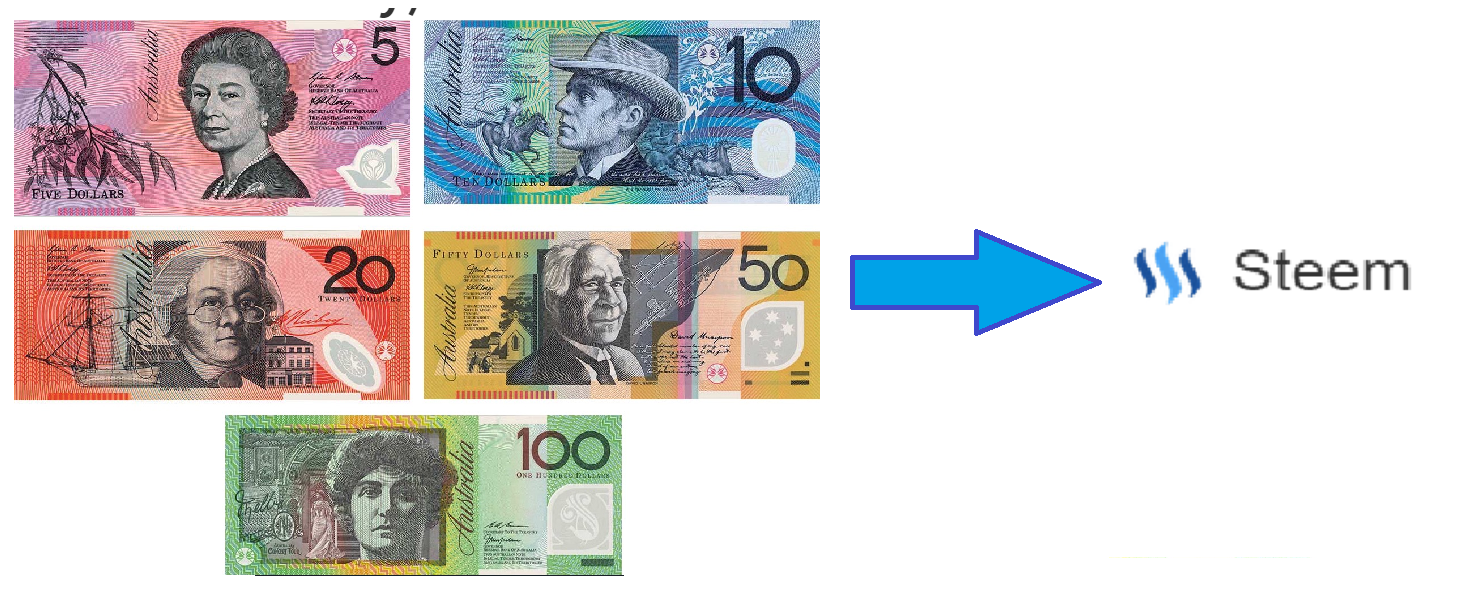

Click Here to Buy Steem Directly With AUD to Power Up Your Account!

People don't use crypto for transferring funds and buying stuff?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

not that much yet as not that many public places accept it.

Most purchases to do with cryptos are private sales as I doubt your local shop accepts bitcoin, but that will change soon friend!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

please i am new am a good writer can you guys resteem my post?

https://steemit.com/writing/@roselinee/jane-the-fault-in-the-star-a-true-tale-season-1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the future baby!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great analysis and well organized!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love the stat that only 0.46% of people have adopted cryptocurrencies. Even if only 1% of people take up cryptos that is more than double where it's at now. But we know that there's more upside than 1% so roll on 2018.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I totally agree. We are only at the beginning of the journey. Good things will come to those who wait.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't believe in bitcoin. Too slow and costly transactions, too much electricity spent on mining. Speculators will move to altcoins

21 000 000 bitcoins * $1 000 000=21 trillion dollars bitcoin market cap

so someone needs to find and invest 21 trillion dollars JUST in bitcoins

this is a huge sum even for the U.S. economy. This is equal to the entire public debt of the United States! The money only from banks. Russian Bank says it will not buy the bitcoin instead of the dollar

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit