This article comes with a corresponding video. The video includes a separate introduction and includes all information in the article along with supplementary commentary and pictures. Feel free to watch or read depending on your preference.

Introduction

Bitcoin has had an interesting impact on the younger generation as it is often their first experience with investing. A recent study found that over 30% of millennials would prefer having $1,000 worth of Bitcoin rather than stocks or bonds, although it seems the survey may not have been fair. However, the point still stands: A significant portion of the younger generation is more entranced with Bitcoin than traditional financial investments. Is this net positive or should we be concerned about the effects this might have on their longer-term future?

Why Bitcoin Investing is Unhealthy

On the downside, many young investors in Bitcoin have unrealistic expectations when it comes to returns. Many see 10% in a month to be an “unexciting” sum of money, partially because their gross investment amount tends to be small and partially because Bitcoin has had numerous times where it has increased over 50% in a month. As a result, first-time investors in Bitcoin often have idealistic and outright outrageous expectations on their returns. This is even worse for those who invest in riskier altcoins (cryptocurrencies other than Bitcoin), some of which are akin to penny stocks (as if Bitcoin wasn’t risky enough).

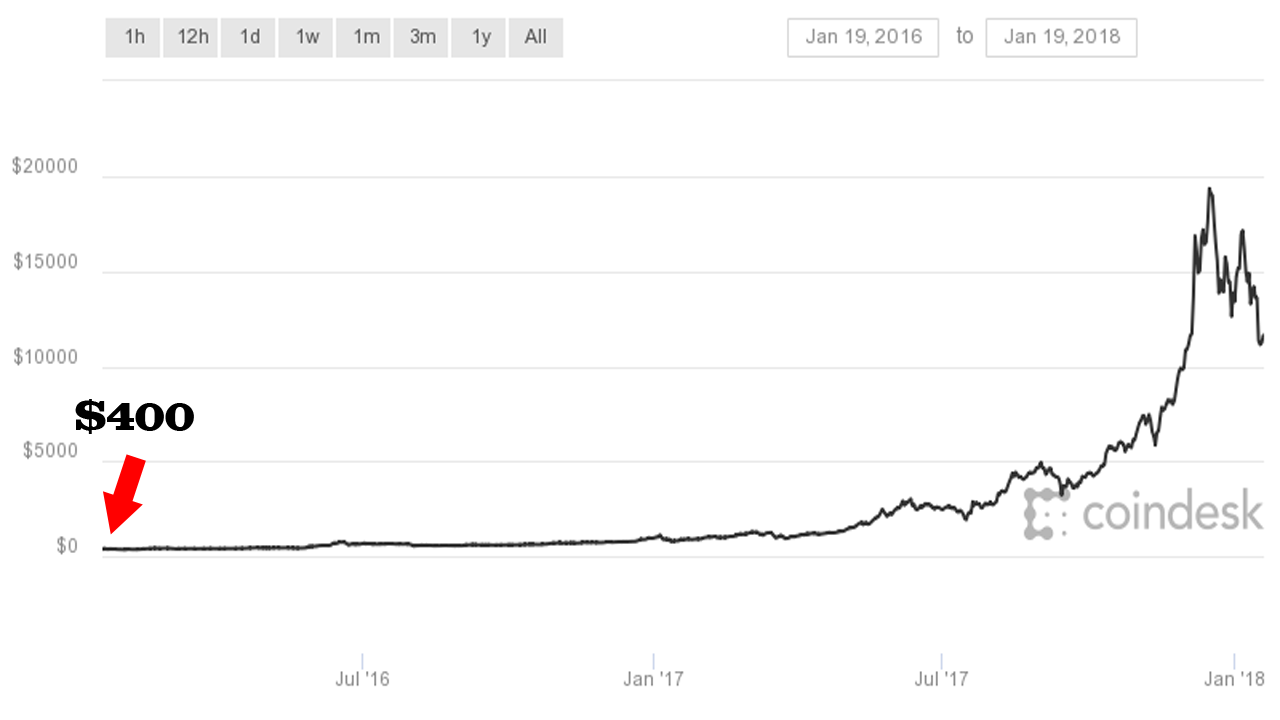

Extended bull-run for Bitcoin. Source: Coindesk.

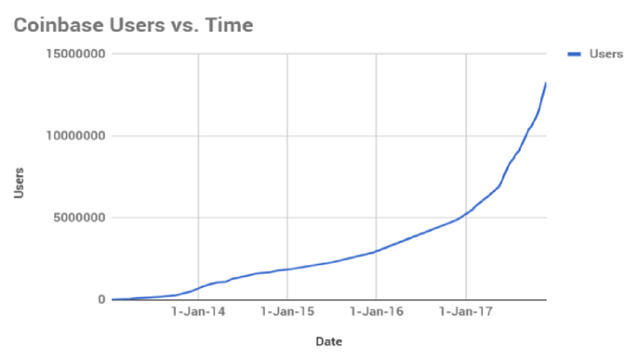

Furthermore, many first-time investors who begin with cryptocurrencies have limited perception of risk. Given the market has been in an extended bull trend for over a year, and given that over 50% of existing market participants haven’t been around for longer than a year (based on Coinbase user growth), most haven’t had to experience any substantial losses until just recently. Many of them have profits that outweigh their initial investments in a ratio of 10-to-1, meaning that even if the market saw a decline of over 80%, they still would have outperformed the stock market (which has been booming, for the record).

Source: coinbase.com/about and various news outlets aggregating data.

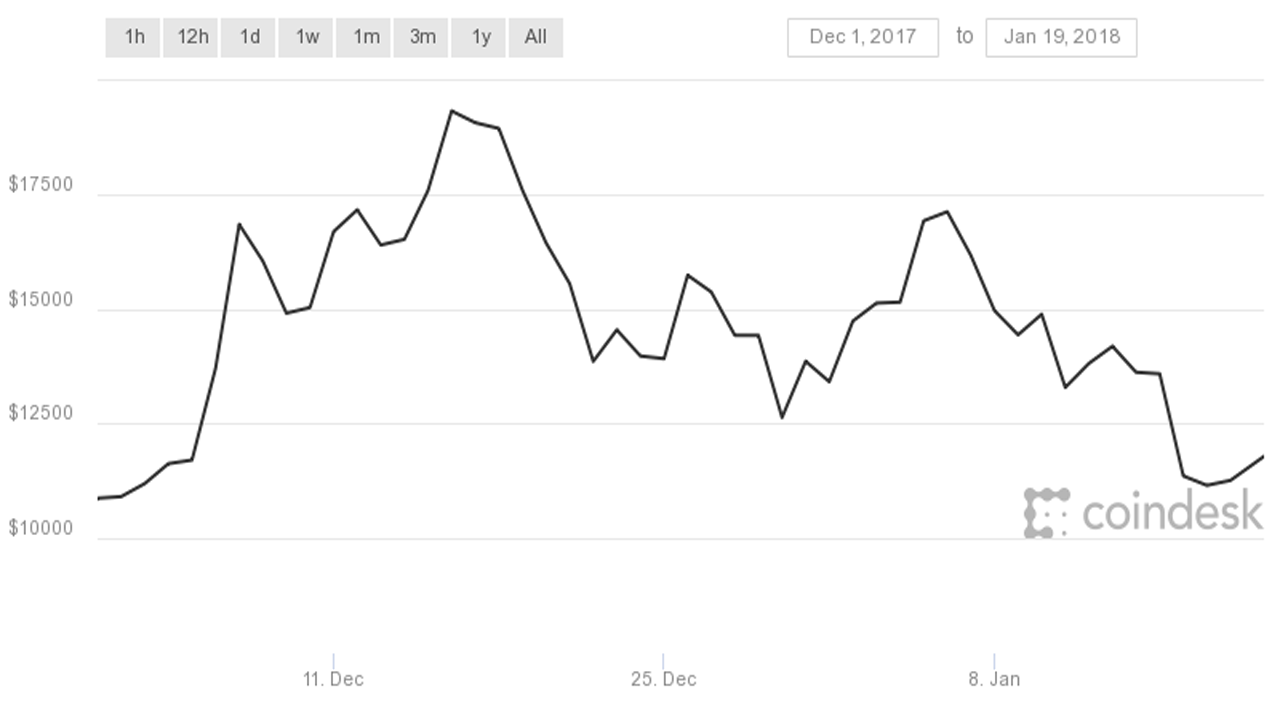

It is easy to “stomach” risk when you are playing with profits – this is a common gambler’s fallacy and one I find even myself susceptible to (a dollar of profit is no different from an initial investment dollar, yet mentally we perceive them as different). The only group of people who have seen their initial investment dwindle (which didn’t arise from overtrading) is those who bought since December, where Bitcoin spiked to $20,000.

Bitcoin price since December. Source: Coindesk.

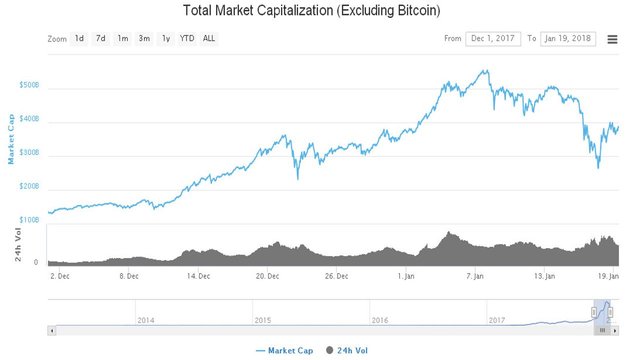

However, even among that demographic, there is an even smaller group who is experiencing major losses as altcoins have boomed during this decline for Bitcoin. This means any individual who bought Bitcoin at its peak ($20,000), but still had money in altcoins is likely still in the black.

Altcoins boomed while Bitcoin dropped off. Source: coinmarketcap.com

In fact, we have even seen a shift in what I would call “market narrative,” where an increasing number of individuals are proclaiming Bitcoin dead as its “technologically superior” altcoin brethren take over. This suggests that many investors have substantial altcoin positions, meaning the demographic with major losses is really quite small.

The fact that so few have losses in this market is the key argument for why cryptocurrency investing is a net negative for first-time investors. Their expectations for returns aren’t realistic and their perception of risk is warped by gambler’s fallacies. It isn’t a far cry to say that cryptocurrencies are in a bubble, as we see cryptocurrencies like Tron with an obtuse (arguably plagiarized, unless translation error) white paper, no product and unoriginal code receive valuations in excess of $10 billion due to marketing hype. This speculative behavior isn’t investing, detractors will say, and it will only lead to eventual pain and suffering. Just look at the recent price action!

Why It Isn’t So Black & White

While I agree with this last, grim statement, there are more positive elements to cryptocurrency investing that we should be focusing on. First and foremost, most financial advisors can attest to the fact that the biggest reason that people aren’t able to comfortably retire is because they don’t save any money. Dave Ramsey is likely the biggest testament to that idea, hounding it over and over as a straw man argument against anyone who tells him that his annual 12% mutual fund figure is nonsense (which it is).

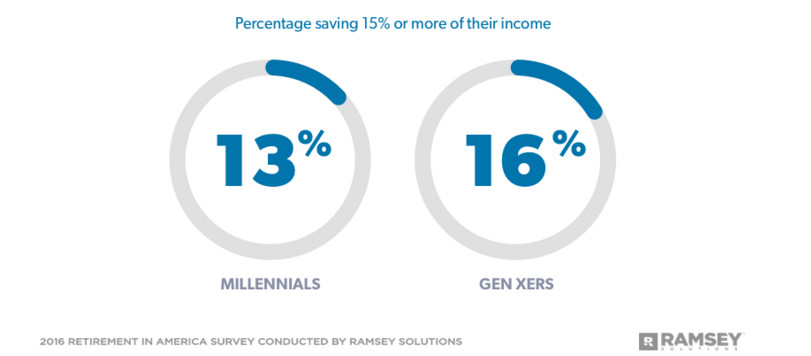

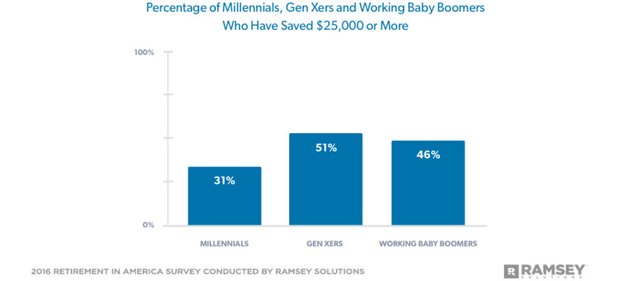

Source: daveramsey.com

However, the statement on retiring is remarkably true: A surprising amount of Americans just don’t save any damn money, and that story doesn’t change as you go to a global perspective. Those of us in the financial world are far too focused on investment optimization: Maximize returns, minimize risks, achieve diversification benefits, allocate to the right asset classes, hedge against interest rate fluctuations, etc.

But the reality is that as long as you are saving and paying down debt, you’re a step above the rest. The “mission statement” of many financial advisors is to just pass this simple idea on to more people, even if it means they get paid less! This is where Bitcoin and other cryptocurrencies come to “save the day”…

The more experienced among us like to point out that the illusion of high returns and ‘low’ risk is ultimately going to result in a catastrophic and life damaging event for many young investors (perhaps this crash, for example). However, it is the very illusion of high returns and “acceptable” risk that is encouraging them to become investors in the first place!

… Hold on just a darn second, you say in writhing objection. That’s just stupid – of course that’s why they’re “investing!” But when (not if) the bubble pops, they’ll become so disillusioned with investing that they’ll never want to participate again! Just look at all the people who invested in Bitconnect (cryptocurrency Ponzi scheme that recently collapsed): We must protect them from this inevitable situation. They will blame everyone and everything but themselves: Whales manipulated the market, the governments don’t want to see it succeed, the banks tanked the prices, the exchanges conspired against us, yada yada yada. No one ever takes responsibility for anything they didn’t exercise discipline to achieve!

Source: Shutterstock.

You’re right. When the bubble eventually pops, fingers will be pointed everywhere. Many investors won’t accept that they themselves were responsible for the gross mispricing of nearly all cryptocurrencies, especially given many are fueled by political ideologies. Just as they bandwagon’d into cryptocurrencies, they will bandwagon against whatever the masses determine as the primary cause for the bubble popping. They will scream “FUD” and blame the “weak hands” for being so easily manipulated.

Why Bitcoin Investing is Net Positive

But don’t let this likely reality deter you from an even greater and more valuable truth: Many people are deferring spending and are investing instead because of cryptocurrencies. If you’ve been involved with Bitcoin for longer than a week, you’ve likely heard about the story of the $100+ million pizzas. It’s a rather stupid story, given Bitcoin would never have the value it has today without people using it back when it was fractions of a cent, but the impression it leaves on people is the relevant part here: Why spend money on anything when you can save it in Bitcoin and have more in the future?

Now funny enough, this concept is true of all investing. You could replace Bitcoin in that sentence with any investment: Stocks, bonds, real estate, personal businesses, etc. But as they say, “everybody has their price.” In this case, price is returns and stocks just aren’t interesting enough to people that only have $1,000 (often less) to invest. How many teenagers have you heard say: OH BOY! $100 in a year if I’m lucky? Guess I should hold off from buying that (insert anything relevant here)!

Bitcoin on the other hand? The absurd returns are enough to make anyone, even teenagers, take a step back and seriously consider whenever they are about to make a new purchase. People are starting to take a small portion of their paychecks and devote it to cryptocurrencies. How much do you want to bet that portion of their paycheck likely would have been spent instead if there were no cryptocurrencies?

There-in lies the important revelation for those of us who know these returns won’t last forever: Even after the bubble pops, many people (even those who bought at the peak) will be wealthier than they otherwise would have been. Obviously it will be a mixed bag – some people are investing in cryptocurrencies entirely in lieu of stocks or paying down debt. Some are even going the extra mile and are taking ON debt to invest more. Those individuals will likely come out less wealthy than they otherwise would have been (some bankrupt), but the net effect should be positive.

I also suspect that a number of individuals who are exceptionally successful in cryptocurrency investing will likely move over to more traditional investments as they see their portfolio worth increase from 5 figures into 6 or 7 figures. There comes a point where even a teenager will see 7 – 10% in a year (I guess arguably lower given current stock market return projections) as attractive with a large enough sum of money. Funny enough, it’s not like the stock market is exactly cheap right now either.

Furthermore, those who have a first time investing experience in Bitcoin and cryptocurrencies should have a strong tolerance for volatility. Losses in excess of 30% are common, which in stocks would be considered catastrophic. Many folk who have invested for cryptocurrencies for longer than a few months aren’t even phased by movements like we’ve seen the past few days and are less prone to make emotional decisions (although admittedly, I ponder how these individuals will act when Bitcoin DOESN’T recover in the course of a month). This should prepare them for future recessions and bear markets, whenever they might occur.

Conclusion

All in all, while investing solely in cryptocurrencies is certainly NOT a prudent financial decision (at least in a fundamental sense), it is welcoming a whole new class of investors to the world. When the bubble pops, it will leave a poor taste in most of their mouths. However, many will likely be wealthier even after the bubble pops and EVEN IF they bought at the peak. Why? Because many of these people investing solely in cryptocurrencies were never allured by traditional investing in the first place and would have spent the money instead, which is often negative 100% ROI given the resale value of most items (and more importantly, the laziness of most people to sell anything they no longer need).

For those who get a taste of what investing can do for them, they might consider jumping into the traditional world of investments, especially given the number of “influencers” in this space that encourage such a choice. As with all matters, cryptocurrency investing isn’t as black and white as most would paint it. In many cases, it will behave as a crucial stepping stone into the world of accumulating wealth and achieving financial independence. Some lucky people will achieve it before the bubble pops and secure it (congratulations if so), but even factoring those individuals out, I still suspect cryptocurrency investing is net positive for our younger generation.

Liked this article? Upvoting, following and sharing help increase its visibility and is a great way to show your support. What are your thoughts? Let me know in the comments below and thank you for reading / watching.

In terms of technology, I have no doubt in my mind that we are at the early stages of something huge, that does not mean that the crypto market is not a bubble though. I think the problem at times is that people cant see the difference between the value of a coin and the potential fundamental value of the technology. Dot com is the most obvious comparison, everyone correctly assumed that the internet was going to be a big thing going forward but that never meant that all the companies would survive and most didn't.

The vast majority of alts have tiny communities and/or no actual product, you can only attribute value to something on the basis of there being a business case in the future for so long. That's excluding the ones that are outright scams, bitconnect was an extreme example, and a pretty obvious scam at that, but many are no more than a whitepaper and a clone of something else. Others are taking the approach of "build it and they will come"....they probably won't. You need to build something actually useful then sell it to the world at large not just the users on reddit and steemit. Some people seem to get emotionally invested in a project just because the rode and wave of hype and made money. Don't get me wrong, I do that too but just because I

investspeculate on a coin in the short term, does not mean I believe that the project is likely to have value long term. I know I'm gambling and the amount of money that I have on the line reflects that fact, (I am far from 100% in crypto) I like to think at least that that will give me an edge when the day of reckoning finally comes. Still I could be wrong there too and set my expectations accordingly, unrealized gains are what they are.Seriously, if anyone reading this is borrowing money to speculate. Reconsider, that is lunacy.

I don't see it happening in the short term but there will be a shakeout in the crypto space and it will be epic. Some coins will be left standing and will be stronger for it in the long run, but most will die. It is from the ashes of that, that we will see the real projects, the survivors and the new ones that are actually useful, the ones with real value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the video and all those who have contributed their personal experiences :) I have learnt so much these last few weeks. Awaiting the next peak!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very insightful article.

Economic agents work on a system of incentives, and given the lackluster rate of return offered in the stock market over the past couple of decades-- which looks even more mediocre when you factor in the real rate of inflation throughout most of the developed world -- the incentive to save and invest simply isn't there for most people.

Myself included.

I'm not entirely sold on the theory that Bitcoin is in a bubble, though. Market analysts, professors, and a whole array of so-called "experts" have been calling it a bubble since at least 2011. And they've been proven wrong, time and time again.

These individuals often showcase a very shallow knowledge of how Bitcoin works, or its history. They keep repeating the same cliches about the Tulip Mania or the South Sea Bubble, without ever addressing more plausible doomsday scenarios brought upon the market by things like Tether.

Tether really is the other thing that keeps me up at night, but you don't read or hear anything on the issue from the mainstream media.

You have to go on YouTube (which is how I found out about this channel, incidentally) to learn about these things, which attests to the slipshod nature of the analysis provided on more mainstream media outlets and publications.

If Bitcoin can outlive Tether, then there's a very high degree of likelihood that it'll be around for many, many decades more to come. This simply because it derives a lot of value from its ability to allow nearly instantaneous (with the Lightning Network and similar scaling solutions), frictionless payments across borders.

Like gold, its scarcity means it's immune to degenerate money printing courtesy of vertically-integrated structures like Central Banks, which means that -- all other things being equal -- it must inevitably appreciate against inflationary fiat currencies.

All of the aforementioned characteristics make it desirable to hold as an investment, and markets normally associate the long term desirability of an asset class with value.

How much value exactly is anyone's guess, but I think it would be premature to say it can't grow, say, another 1000% from here, and hold on to that value long term.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I drew this earlier today. I thought I should leave it here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

OMG, would you please link a bigger version? I want to print it out and paste it into my trading journal. :D So good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sadly my fledgling studio has no scanner yet. But if you wanted to support the cause and check out some more of my other hand drawn crypto related images, you can go to my online store:

(https://www.redbubble.com/people/ideaman4380?ref=account-nav-dropdown&asc=u)

Aaaaaand, you could technically just copy the image and throw it into word and crop it/size it to the page.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oooh, Steemit doesn't shrink uploaded images! :D I thought it was just a tiny thumbnail (i.e. not printable.)

Again, wonderful drawing! Thank you so much for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post and video. I think the major takeaway for me was how this was one of the first investments that a younger generation has made. This gives crypto a really great association and makes it something exciting to be part of.

Traditional investing feels so out of touch with the world today and the younger generations viewpoint on it so that is one of the reasons I'm so bullish on crypto. If this is all we've known, we're gonna stick with it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi cryptovestor,

This is a great and well thought out video. I never had money before. Crypto's gave me a chance to restart my financial situation. I had so called friend ripped me to the tune of $60k. That was my life savings. I was putting $50 a week since June and I'm 800% on my investment. I'm glad I found a vehicle to get those gains.

When Facebook dropped to $18 in 2007, I wish I had money. I would have invested in that back then because I believed in that. Now I do my own research to see which projects to back.

Really happy to be in this space and I've made a lot of friends and now I'm a lot happier I can see that we are still early adopters.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Would be nice to see your portfolio and holdings , im sure many of us want to know your positions ? have you sold most cryptocurrencies you have ? do you still participate on ICos ?

About madoff , the problem iam thinking about , is all those people who were involved inside this ponzi scam holdings, are still running around the nature , while it was the most historical scam of the economy that we have seen , the big daddy madoff did all alone right , noone from the US regulation was involded according to the US justice... fact is $65billion missing amount ,what are they now doing ?people from the 17th floor and all his " friends " maybe these unknown whales ? maybe this group of people called nakamoto ? or maybe in the stock market still ? we dont rly know , but my opinion is that they are coming back maybe already back with a more sophisticated way to get money, to not forget is that even he ruined life of many people , I hate him for that , he created the Nowadays digital market , Nasdaq is madoff.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What are your thoughts on the recent minting of millions of $ of Tether? Do you believe that the reason we didn't see $7-8k BTC was due to Tether pumping counterfeit money into the space? voiding all the TA that pointed to $7-8k?. What are your thoughts on the current state of the market and how bad do you think the Tether bubble will be. It would be fantastic if you could share your update thoughts on Tether given the recent severe pumping.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think there is a major problem with bitcoin because a good percentage of its value is due to possible future first time buyers into cryptocurrencies.

The fact that supposedly/certainly many people in the next few months or year will enter the cryptocurrency markets via bitcoin, gives it a pretty good boost in price.

However these future first time buyers will also already have seen many news stories in mass media against bitcoin or about bitcoin crashes (30%,40%). And this is probably going to keep many of them out, even if it's not a reasonable or valid criteria.

Moreover, 2017 was the year of entrance for hundreds of thousands of low buying power speculators and people that were chasing for casino-like gains. Therefore, I believe future investors will be more cautions, more informed and have better alternatives to bitcoin like never before.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do agree that if the crypto market crashes horribly, there will be a trend of these new investors never wanting to invest ever again. But on the flip side I liked your point that those of us who will stay investing and continue on the path of financial responsibility even after a catastrophic market crash are "seasoned" against letting emotion ruin our choices. That said, however, it's important to bring up the #1 rule in investing: never invest more money that you aren't willing to lose. Obviously nobody wants to lose money, but if the money you put into the market were to vanish in a day and it destroys your life beyond repair, then that's a sign that you shouldn't have invested that much. This amount will be different for everyone because we all come from different backgrounds of wealth. But I repeat, if you can't live with the fact that your investment can disappear forever, then you should never put that amount of money in the market.

On another note, if the next great crypto crash occurs, let's say a 75% drop or more and the market stays that low for months to years, it will be a true test to how new investors in particular can handle it. Crypto investors seem to be unphased by the supervolatility of this market and I feel that even if a recession occurs, many of us will brush it off, even putting more back into the market to load up on cheap coins. Here's to the future!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for another fine post! I am curious as to what your take on the Bitcoin bubble bursting means. Does it mean the BTC price collapsing to zero or close to, because of a competing system taking its place? Or because of an overall loss of confidence in the market? Or something else? Do you believe that only Bitcoin will "burst" or that the entire cryptocurrency market is doomed from the start (and if so why)?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

considering the hype and media attention the market attracted peaking at around 850 billion dollars of valuation, I feel like once again those who want to see Bitcoin fail are granted an opportunity to throw their rocks. Right now, there is high amount of negative narrative in the mainstream news outlets. This negativity along with the disputes among the bitcoin community cascades in social media.

In the other camp, the global financial and political systems are deciding on how to respond to the new Crypto adoption phase. many will be harsh. As a result maybe I can buy more Bitcoin at 7777 $.

Meanwhile Ethereum is escaping such attentions and is quietly consolidating. I think starting soon, Ethereum will leave for 1700 range and we will still see Bitcoin struggle.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Totally agree with you. I always was interested in trading, but forex requires to use loans and higher amount of money is needed to trade with stock or futures. 10 years ago, when I finished school, I woundered to start trading but I had no money and no idea how to start trading professionally, so I attended in some seminars, but did not start :( ... and did other jobs and have alsmost forgot about the dream. But.. half a year ago I noticed the chart of BTCUSD and so high velocity and started to look for the information. The world has changed so much for 10 year.

I wish I was 16 now...

Thanks for your wonderful posts, @cryptovestor! I follow you since September and confirming, that content is just WOW.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We all wish we knew what we know now at 16!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't agree...

...that would be the most boring life ever ;)

@cryptovestor:

Thank you very much for your deep and intressting analysis of cryptocurrencies. With your videos i lerned a lot about investments. I'm also investend since a long time in company shares and i like risky investments. So the cryptomarket ist perfect. I am pleased an happy to find such good researched videos like yours. It's very precious to optimize my risk strategy.

Sorry I'm a Swiss guy and I speak and write a very bad english. I hope you can understand what i mean.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know if you know about "DougPolkCrypto" which is another youtuber, but he is just like you, soooo down to earth and not biased or clickbaiting with bullshit. If something is bad (even though if you would have hyped it up you would have made money) you say it's bad and vice versa. It makes my ability to make right choised further down the line in my "career" as an investor. Thank you :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Is there a point at which too much investing and less spending has a negative effect on the economy? If too many people stop spending and start investing either in traditional assets or crypto currencies there will be less money to spend on products produced by the projects that receive the investments.

I am hoping the crypto currency technology will evolve into something that will actually simplify the existing financial system and will benefit the economy in the long run. I doubt that it is going to be Bitcoin just simply because it was never designed for scalability, and Lightning network is unlikely to be widely adopted. I would like to see a successful project in 2018 that uses a crypto currency, a project that would have been difficult to realize with traditional currencies. As of now, as you repeated many times, all it is just a pure speculation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like your videos and they make a lot of sense for the new/intermediate investor... But it’s the others that scare me, trying to take advantage of the uninformed... these people never win in the end, look at bitconnect already down, there are tons more that need to follow suit and the astronomical price predictions have to stop... we are not there yet, i don’t believe bitcoin will recover until we have a shake out...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitconnect dead? All in on Davorcoin choo choooooo!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good and informative video. You have some really interesting thoughts, but I don´t understand how you mean your statement about when the bubble will pop, the people who bought at the peak will exit with an positive revenue? If you invest now and hodl, I am sure you will lose money when you sell after the "big" crash.

Thanks for making these videos and putting so much effort in to tell and teach people a bit of the financial world in comparison to the current situation in crypto currencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Some lessons in life can't be taught, they can only be learned.

Quite an analysis of human nature,,, I totally agree, however its the other way around.

The older the person the more your analisis applies, about emotions, blaming, whining and need to be protected from...

For the youngest, let them experience, let them learn, there is no drama here for them, what are you talking about?? When is the last time you talked with millenials?? When is the last time you went out with young people? If you see what they all do, how careless they are in daily life,,, It doesn't matter, its part of life, right?

Who is to blame for that?? Ha,, yes, those that overprotectively raised them....

Talking about Bubbles, nobody seems to talk about the real Bubbles in life, look back 10 year ago, or the stock market at 25.000, what a bubble is that?? The debt bubble even bigger one, So do we ignore those,,, when the bond market crashes, the stock market will crash,, etc...

Since its not backed by gold anymore, fiat money will reveal its real nature,,, that it is nothing worth. the dollar lost 95% of its value in 100 year??? Isn't that a bubble of supernova proportions...

Then I prefer a bitcoin at any price, don't care what it cost in USD, I'll keep it.

let it be a bubble. It will not go away, it will only evolve in society, and it will be used more and more in daily life next years. Look at the kitties, look at ENJ, MED,, etc...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Crypto Investor,

First of all: Thank you very much for your continuous reporting! For several weeks I have been following most of your videos now and although I do not always agree to 100%, I find them very helpful and inspiring and I very much appreciate your work! Thank you!

However: You have been bullish on Bitcoin for several weeks / shows now. -- So if that is the case, why in the world have you been showing every visitor on youtube at front page: "Why I'm Negative on Bitcoin".

This poster has been hanging there for more than four weeks now and in my opinion it is contradicting, confusing, distracting, and counter productive. Please take this front page poster down and put up something neutral or something current. Thank you!

Keep up the good work, thanks again and best regards!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great as always, loved to see you experiment with the pictures in the video, probably took you a while to find them but it was well worth it. No longer a podcast ;)

Would be great to hear your take on funding USD or crypto on exchangers like Bitfinex or Binance, how high risk you think it is and if there are some hidden risks involved.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's like a gateway drug in reverse. You start with the risky stuff which may ruin you if you're not careful, then once you've been put through the ringer you move to something softer which bites less. Wonder if that would work with read drugs...

On a personal note, I'd consider myself reasonably financially prudent who's (mostly) doing the right things savings-wise. However, the ideas of stocks never really appealed due to the need to find a broker and the transaction fees. Just seemed a bit out of reach. I've got money in tracker funds but that's as close as I got.

Something about cryptocurrency investing just seems more approachable. There are no suits to deal with. Everyone's kind of nerdy and you can talk about how world-changing this will all be. That said, I can't get passed the inflated valuations and have struggled to move beyond Etherium as an alternative to Bitcoin. Anything that seems interesting and not a scam has probably already pumped. Such is the nature of a bubble, I suppose.

I'd actually be curious whether there's anything that can help acclimatise to this. Would it be something like think of what a reasonable value might be and add $1 billion?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

INteresting perspection on the cryptomarket situation. And likely very accurate. Other then having a small amount invested in a fund, it is indeed my first entrance into an investment market. But that sayed, that isnt why I initially bought 1 bitcoin when it was at some 250$. (Although i regret not buying more back then as most likely do too)

I bought one mainly as i saw it as a security kinda. A value that can be used even if something was to happen to the banks or I was denied access to my account.

I just had it not even payng attention to the market at all untill the middle of 2017, noticing then it was worth 10 times what i bought it at. It was then I started taking a litlte more interest in some more active trading, aswell as learning more about how to actually use it and looking into other coins. And i did eventually invest some more into cryptos.

I do plan on at some point reinvesting some of the crypto gains into gold, so in a sense i guess i then fit into the prospective you layed out here. I've learned alot about how markets move and can be manipulated, but still alot to learn.

My question at this point is: how long wil the patterns of the crypto market in total be in the longterm upside...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is an interesting insurance policy, although I'm curious how it'd work out in reality given many wealthy investors are who are propping up prices (and they rely heavily on existing financial system). Gold seems to be a logical place for many cryptocurrency holders who are coming from more political side, although I always provide some caution here as having at least some cash producing assets can make a light and day difference in your portfolio.

If I could predict how long it'd be to the upside, I'd be selling my knowledge for millions! In all seriousness, who knows - But I think the bubble will likely pop in next 2 years, which isn't exactly a great time horizon but these are predictably difficult to predict. We'll likely see more warning signs as we get closer, but it's tough to spot them when you are right over top of them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As a millennial .. i pulled all my stock holdings and ive invested in in crypto .. 2017 was an excellent year in the stock market but its at ATHs and makes me uncomfortable.

Now i do have more alloted into altcoins just because i believe they have a promising future and are still in their budding stage.

Say for example : What if WAX token tommorow gets approved by COD as an actual exchange token .. i just dont want to miss out on the next possible Facebook / Amazon .

My holding period will be a minimum of 5 years and i only intend to add money to my portfolio with 10% of my monthly earnings(cut down expenses on my gf ... thinking of dumping her maybe i could increase that to 20% ..haha)

But on a serious note i love your videos and anyone who is new and asks me for advice .. i show them your video .. keep up the good work

Special Advice : For full effect read the article and listen to the video :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ah hah, must have killed you to follow along so slowly but thanks for DOUBLE the support. Best of luck to you with your future investing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post and awesome video on Youtube. You definitely keep me grounded and fight off the hype and FOMO.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like what you said. If you are in debt and borrowing to buy cryptocurrency, STOP doing that. All reason doesn't disappear because we're in a bull market. Debt, especially consumer debt, is poisonous, especially for young people starting out. The rest of your portfolio needs to be straight before you even consider speculative assets like bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Another excellent and detailed video! I agree entirely with what you're saying regarding first time investors (being one myself since september), if I wasn't investing in crypto at the moment then I dare say i'd find some useless crap to spend my money on. There are winners and losers in all walks of life (finances included), and I hope that the recent dip in the crypto market reaffirms that in people. Don't get in over your head!!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I first didnt like your article much, since you stressed it a lot that it is a bubble which is going to pop. While you dont take a look at value and price... if the value does not catch up to the price, it will pop. However, that was not the topic.

What is very much true is, that someone with 100 Mio.$, is happy with a stock or bond market giving you 1 to 10% returns annually. If you can save 10$ a month, the return is non existent in that market. With crypto however and it returns, it can change your wealth.

I would like to add two points:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As you mention, the focus of the video is not proving Bitcoin is a bubble (which is a much larger task I intend to take on in the future). Smaller investors can use apps like Robinhood to get involved with stocks for zero fees, although they have limited options (e.g: no retirement accounts). While it is true that 10% figure is small when working with small amounts, I am concerned if this mentality will be moved over to people who have larger accounts. I have some faith it won't, but human nature has always disappointed me so...

The problem with a lot of ICOs is while they are a novel fundraising mechanism, they are used instead to fund ideas that are either not realistic or so far from execution that many people aren't evaluating and paying an appropriate amount for the token. However, this is likely more the result of euphoria than anything else and we will likely see more legitimate projects as the hype slows down and capital dries up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am also highly skeptical of most ICOs, however if you do some good research you can find very good and promising projects. VR and Augmented Reality was the big thing last year, but they got almost no funding. Because there is no bubble for that industry. For blockchain projects there is a bubble and therefore funding is abundant. This WILL create a few big companies.

Additionally take a look at ICOs like BeeToken, who use the hype around ICOs to get a lot of people involved, promoting their business. In traditional assets, a company looking for funding is in a conflict of interest. They have to please their investors, who want to make money and its customers. You could say, that some companies are just doing enough, to not loose their customers. With ICOs, investors can become customers and investors would be interested to get the company more customers, because this will increase the value of their investment (and thus its price).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I disagree with the assertion that Bitcoin's value is inconsequential, you seem to say that repeatedly, here and elsewhere, as if that point is beyond contention, it isn't.

Are there many cryptos that are totally impractical, unnecessary and even redundant, yup. Bitcoin doesn't fall into that class or criticism.

Practicality:

Bitcoin is practical for the day to day use that most people are interested in using it for. When I send my BTC from wallet to wallet it arrives same day, usually same hour, and although the fees are annoying that is a relatively easy issue to resolve, and so I can stomach it for now. And those fees do not stop me from sending my coins, so yes we can use Bitcoin.

Add to that, credit cards making BTC spendable everywhere add to the functionality and practicality of BTC.

Necessesity:

Bitcoin is not unnecessary, there are many coins that are "currency" coins like BTC, and you might say that means BTC is not a necessary coin, or it is redundant, but I disagree.

Bitcoin is not redundant because although many coins are "currency" coins like BTC, no other coin has as big an audience, as high a level of adoption, as much media attention, as many years of time tested security. Because it is the biggest, it is the oldest, it is the most known, it is many magnitudes of order higher in terms of safety and security, because the threats it has fought, and fends off daily, are many magnitudes of order higher than the closest competitor.

When the bubble pops, as you say, and so many say, the prices of the best coins will again rise. Bubbles popping are part of the evolution of the market. That is natural and necessary. We should not baby investors, regulation in my view is babying investors. My money is mine, not the regulators. If I am an idiot and want to buy crypto despite a risk of "bubble", the government should never be able to say no you cant use your money how you like.

Also the argument that people will never spend BTC while it continues to rise so dramatically is mistaken. The price grows and at some point, the non-greedy, stop and say wow Ive made a lot, I am going to take a little and buy something (if they could). And soon spending crypto will grow in ease and when that happens more and more will buy million dollar pizzas, and they should, its foolish to say dont spend because its going up, at some point it reaches a level of fair return and you should spend, if you feel happy with your return.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not saying there is no value here - just that it is insanely disconnected from price. I think Bitcoin provides an important business solution and is being improved overtime to help provide that solution at scale, so it does have intrinsic value in my opinion. Just not close to what the market thinks it is given the level of euphoria we see currently.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hear you, I think I just disagree because I place greater importance on what I foresee coming in terms of development.

Having said that, I always appreciate your content, even when I disagree. Thank you for doing it. Sincerely. Blessings.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks again for your video. It's funny I switched between reading the text and watching the video.

Nice new experience. ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm Holding right now some BTC. But there is always this Idea that one day the Bubble will pop. People really should not invest more than they can afford to lose and I got a lot of friends who have no Idea about crypto and which one to invest into, so they just go for penny stocks becuase "they may give higher return" and they bought at a wrong time and right now they have losses. IMO think BTC has a stronger future than 99% of cryptocurrencies.

Long term we will need regulations or people will simply get scammed "bitconnect" and many of them will have doubts in cryptocurrencies and will never invest again. A lot of people loosing lots of money will hurt economy long term.

No matter how hard you'd like it to be unregulated or whatever. There should be certain rules, otherwise people will continue to get scammed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It really depends because regulators are fighting against human nature. I think it could be done appropriately, but likely won't be (as always). Good will out there, but frequently a lack of intimate understanding that ultimately leads to crap for regulations.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said. One of my all-time favorite quotes is by the venerable Louis Brandeis:

"Experience should teach us to be most on our guard to protect liberty when the government's purposes are beneficent. Men born to freedom are naturally alert to repel invasion of their liberty by evil-minded rulers. The greatest dangers to liberty lurk in insidious encroachment by men of zeal, well-meaning but without understanding."

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great video, except for the part where you say, "We must protect them from this inevitable situation." That's just dumb.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That wasn't me talking - that was an expert objecting to my earlier statement! I'm not a great actor...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok, got it. Anyway, as long as we're "protecting" them by getting the information out there, that's all we can do, right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I find your videos very interesting even tho i don't really invest money in Crypto. I have some coins i am planing on holding a long time but at the most i just trade some altcoin for a different coin. Since i have a pretty solid gaming pc i mine while i sleep and I don't really plan on getting rich.

I just find all this pretty interesting and im trying to be a part of it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My friend Business major ironically wanted to buy this 9,000 USD car(1968 mercury cougar) and asked me if he should sell his litecoin he had to buy it...litecoin was 60USD at the time. I told him in 3-4 years that is going to be one expensive car man. And he's like dude but its my dream car and I can get it now. And so now he is in more debt from college cause hes going back to become a teacher with less litecoin than he started with.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Can you actually vote on yourself? New to the space, great content cryptovestor!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep haha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Btw, will you do a video on dividends within crypto? I mean I've been able to figure out how to sell most of my bitcoin cash, bitcoin gold, and some of these other alts like stellar lumens that give you there free coins if you just have bitcoin. I literally made around 24% from these airdrops and hard forks in 2017. Why would I remove myself from that even if price drops and the bubble does pop?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I lost 70% of my portfolio's value attempting to predict a further dip and then a rebound. I still have 3x to 4x my initial investment that I made in December, however that's still small. DON'T trade with leverage, no matter how sure you are or how sure everyone appears.

Totally gutted, never going to trade with leverage again... It truly is Danger multiplied by Danger.

Greed got the best of me. I intend to cut back the next couple of months to put some back into my portfolio, however as you say... its the matter of making a lunch instead of spending £5 a day.... or not buying shit i don't need on amazon.

My goals ain't Lambos or 7 figure bank accounts. Its being able to move in with my friend of 15 years and girlfriend of a year who lives across the country. Yes i can save £2000 in 6 months but if i cut back further and putting £1000 extra into crypto COULD give me the safety net I would need to make such a jump more comfortably .

Yes its in a bubble, Yes it will pop, Can i catch a break? Maybe. Is it a pipe dream? almost certainly.

Before you say about leverage I'm completely aware that I'm an idiot.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Leverage does seem handy if you are extreme low on liquidity, but have a high networth. Its just the risk you take that matters.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It happens to all of us, but yes do stay away from that for the future. The complete opposite could have happened where you would have set yourself back from your goal to move in with her. Being up 3x for 4x is still killing every other asset class, so you're doing well still.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If it did work out i would already be there....

But yes it is killing other asset classes and that is whats driving people to Crypto in droves. £50 a month on lotto vs £50 in a Medium-Small cap coin that's getting a lot of attention....and has some yet maybe small potential of going 2x-10x in a week.

I know where i'd prefer my money.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really like your video. It is a down to earth reality check for me to check my position and holding. It is always dangerous to think that you are investing when you are merely speculating

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for watching and commenting as always cpt.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think an important reason why the younger generation is excited about cryptocurrencies and Bitcoin in particular, is that their parents and/or grandparents potentially made so much money with their property investments, and now property is absolutely out of reach of many youngsters. The stock market requires so much research and constant attention, whereas a long term holder of cryptocurrencies can purchase any amount to get in, on their computer, and then set and forget for a while and hopefully make some money in the process.

Our parents and grandparents saved all their money to buy their first home, and they got really good at saving, they're still good at saving because it became routine. We, on the other hand, have so many things after our cash, and property seems impossible, so people end up spending.

A lot of western countries are feeling the strain of the retiring babyboomer generation on their economies, but I feel like they haven't seen anything yet...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Im a millenial, 23 years, i started investing in cryptos because it was easier to understand then the stock market, right now i already researched some stuff about the stock market and know some of their wall-streety word (bear market, bull market, index funds, hedge fund, bonds, dividends,etc...) but i had to do so much research online just to understand it, and then i need to pay taxes and more taxes, and dividend taxes and gain taxes, god damn ppl, just make it easier for young ppl to actually buy stocks and WE WILL!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent to hear that you're investing,but do take the time to learn the stock market as well.

You can recognize alot of things happening in this market that way.

Read up ...get a few books to walk you through it.

Heres a few..

-"Rich Dad, Poor Dad" (2000) by Robert Kiyosaki

-"The Intelligent Investor" (1949) by Benjamin Graham

-The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

-Thinking, Fast and Slow by Daniel Kahneman

Do yourself a big favor,buy those books and read them ...you will be better at understanding investing afterwards.

Its admirable and it's always good to see a young person have the hunger & desire to get in this game.

Help yourself by learning the Ins & outs as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, i will read those, i think most ppl at my age just care about going out and getting drunk, i already had my fair share of alcohol what i want now is money so i can go travel, buy a house, and do anything i want, and from what i see the best way to get that money is trough the stock market and cryptos, it might take 20 years, but i will finish this race

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have to say... I wasn't investing in anything at 23... so you're definitely ahead of the game. I moved out at 19... and its really hard to live anything but paycheck to paycheck at earning-level... so you're doing really well.

Also... stocks ruin companies anyway. .. investing in Crypto is investing in future tech.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm still studying, i get a monthly paycheck from my father and since i dont use it all i can put it into cryptos or stock market, atm trying to build a 1k portfolio of cryptos almost there, im probably going to take a summer job just so i can invest more, i also got a rainy day account just in case something happens to my parents...

What cryptos are u investing in?

PS-upvoting in steemit is soo buggy, ive alrdy tried to upvote u 10 times and still nothing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I totally agree im from London, house prices are insane here. The return with stocks is low unless you put a large amount of money in which the younger generation cant afford to do. Also i have to say that crypto fees are far less then stocks and easier.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent points. Unfortunately too, a lot of research has illustrated that millennials are much more likely to want to hold cash than stocks because of how they feel about the 2008 crisis. Cash is a lot easier to spend even if your intention is to save it. The stock market can be done so easily through passive indexing that it makes me sad knowing less people want to get involved with it because they feel they must be wealthy to participate. We are definitely in for a rough ride moving forward.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Passive Indexing just isn't really known amongst non-financey people. If I asked all my friends on Facebook, I'd expect only a couple of accurate answers.

That's an excellent point... I'm way more into saving and not-spending because we had a recession as I was finishing high school, and by the time I finished uni, only the lucky few were actually getting the jobs they wanted.

Millennials haven't had a recession in Australia (the GFC didn't affect us, China kept buying all our stuff) so they've never been scared they won't have any money in the future... without that fear... why invest... retirement is so far away.

Rough ride indeed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not so sure what's more intuitive ;)

https://www.zerohedge.com/news/2017-01-23/myth-passive-indexing-revolution

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thats also partly why ETFs have boomed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cryptovestor, this is a very well-written piece. As an old-school private investor, I too came into the bitcoin world a few years ago and "mined" some XRP back when Jed McCaleb was running the show and paying out Ripples for contributing to decentralized protein genomics projects.

Whenever one of my younger cousins or my friends talk about "investing" in crypto, I always make sure to correct them that they are "speculating."

As I tell them, there is nothing wrong with speculating, but you need to know that you are speculating.

Discl: Long BTC, ETH, VEN, NEO, EOS, ZRX, ICX, KNC, OMG, XLM, STEEM, QSP, XRB

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well said!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypto is my first investing experience, it has been a good experience (maybe because as i started early december, as you say), and when i started i just put the money i'm willing to lose, another reason because i choose crypto is because in my country (Mexico) is the easiest option for young pepole (millenials), great content i just signed up to steemit but i've been following in youtube

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome aboard! Thank you for your thoughts - What makes it the easiest in Mexico?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, basically there is a web platform to buy cryptos with very accesible payment methods, you can buy it even if you don't have debit card because you can generate a code to pay in stores. On top of that, the other type of investments are super expensive to get in or involve a lot of unnecessary bureaucracy and paperwork.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I always love to watch your videos and your insight, even though I frequently disagree with you LOL...

This was a good video, but I don’t understand, with your continual talk of a bubble, that you never mention that less than .5% of all people are involved in crypto currency worldwide, and in the US it’s still less than 1%... as Amazon, eBay, and more companies that continue to except crypto currency as a form of payment continue to adopt crypto currency, the user base will likely increase to 10% within the next few years, likely bringing at least a 10-20 times gain into the total market capitalization. And I believe in my lifetime, within the next 30+ years, that number will increase to 75% of all worldwide people using CryptoCurrency.

Another thing to put into perspective, with the total current market capitalization being around $500 billion, that is only 1/3 of Google stock market capitalization, just one company. From my perspective, this is far from a bubble. Also, not to mention this week, that the total market capitalization literally dropped by 1/2, from $840, billion-$420 billion.... it seems fair to say that the Bible has just popped, and the market capitalization will likely be well into the trillions of dollars by year end.

So why so much continual talk of a bubble? Seriously, listening to your videos totally freaks people out. It’s like you have a thing for spreading fear, and doubt, like you kind of get off by freaking people out or something LOL . But at the end of the day, there is little doubt in my mind that crypto currency will continue to surge ahead full force, even though there are many setbacks along the way with corruption, Financial institutions, and governments trying to tear it down. So no need to freak people out. These are mear setbacks, not bubbles. When people hear the term bubble, I guess it has different insinuations to different people. I personally do not like the term bubble in reference to the crypto market these days, even though we might be saying the same thing. (Bubble vs. setbacks)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

so well explained, my opinions also like @gamblegrady :

it is always good to listen several sides of the "problem", makes me think twice before acting, in a way cools down my hype, just a little hehehe, I am not able to be more racional than emotional on crypto, as in many other fields of life. So in a way I do follow @cryptovestor because his opinions somehow negative cools my thought process and acting urges down a little, and I guess this is importante and desired to make decisions a little bit more racional than I am used to take.

Thank you :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes! I totally agree! I am with you... that is why I always watch his videos also, but I am careful to take it with a grain of salt...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You make some valid points. Cryptovester also makes some valid points. The problem is how to weigh these. Our brains are naturally unfit to understand these reasons in the right way. Maybe a bias like the spotlight effect occurs.

Algorithms are far better in understanding and weighing these effect. This is the reason in some markets(which are not too complex), human traders have no edge and can not beat the cost of trading. Since bitconnect is so low right now, I am buying a lot! ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good point, lol how did the bitconnect trade go?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Those numbers aren't small though on an absolute basis. Most companies are only accepting Bitcoin as a marketing ploy (e.g: look at how much KFC Canada rode that train). I don't know that the world is going to adopt a new system they hardly understand for benefits many hardly care about. More realistically, it will be a group of us who care for avoiding financial surveillance and having control of our finances that want to participate in this ecosystem.

Unless Bitcoin and other cryptocurrencies can be made simpler and better than existing solutions (which will be difficult to near impossible given capital going into these), then likely many people won't adopt it because they don't care about control of their information (they say they do, but they really don't).

Furthermore, the tech behind these cryptocurrencies are still in their infancy yet are being priced as though it has been fully developed. Even respected figures within the field agree it's a bubble because of the mass euphoria and speculation that the masses are participating in for the objective of becoming wealthy. My comments about a bubble aren't a shot at cryptocurrencies, but rather an observation of human nature which has repeated itself since the dawn of time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In the beginning days of the Internet, it was not easy to use. One had to have a computer modem, and dial into a local university to login to a text-based interface and run commands to access handful of text-based resources. The idea of email was a curiosity at best to the people I explained it to in the early 90's. Many people were of the opinion that this whole "computer thing" was a fad that would go away.

My point is that technology evolves, and cryptocurrency will likely one day be as easy to use as web browsing is today, or will be entirely transparent to the user. The rapid rise of crypto-backed debit cards is one example of transparency. When nations release their own national cryptocurrencies, as a few have announced they will, and people are earning their salaries with crypto, the payments landscape will be different.

There is also the whole machine-use dimension of this technology - autonomous vehicles that operate by themselves accepting cryptocurrency from the humans it gives rides to, which it then uses for charge-ups and maintenance, for example. Our new programmable money need not be used only by persons. The entire Internet of Things movement will play a big role in the evolution of cryptocurrency (IOTA, I'm looking at you).

Not to mention the emergence of artificial intelligence and its integration with crypto/distributed networks through projects like SingularityNet. And Virtual Reality and the various distributed platforms being designed.

So I'm not sure about whether the seemingly exuberant pricing is all that irrational. Most technology stocks are also trading in multiples of their fundamental valuations, because traders are looking ahead to their future potential. We have a loooong way to go with the implementation of p2p cryptographic network technology, but there are tens of trillions of dollars currently invested in other asset classes, institutional funds, etc., available for investing in the emerging new technological infrastructure. I like one commenter's idea that the stock market is a giant bubble, and cryptocurrency is the pin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very well said!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good points! But let’s say the total market cap goes over $10 trillion by the end of 2018 (which I think will likely happen) would you still look back to this point in time where it is currently around $500 billion and call it a bubble?

Would you look back a year ago when it was at $17 billion total market cap and call it a bubble then?

Just look at the mass adoption taking place.... ie #1 app downloads, 350k people signing up for binance in less than 2 hours, hundreds of new ICO’s popping up, etc.... everything is moving so fast, I never thought this type of adoption would come so quick! But with that being said, STILL LESS THAN 1% adoption!!!! Their will be so much more money flooding in this year, I think beyond what we can imagine! And the tech as well as the tech adoption is all moving much quicker than I thought it ever would. This is where ripple and their CEO are playing a vital role in help the mass adoption along. He does a good job representing crypto to the masses and works very hard. It make it more palitable for the older generations to receive the concept of crypto.

Yes, lots of set backs for sure! But I just look at them as setbacks, not bubbles.... From my view, the term bubble has such a negative connotation....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Another reason why crypto investment is healthy is that you learn so much about money, economics and human psychology.

And like in poker you have to pay to learn. I don't regret a penny I invested in crypto because it has taught me what amount of risk I can take, how I can handle it emotionally, what field I'm the most interested in (tech), how to build a proper investment strategy etc.

When I see people complaining when they lost everything with bitconnect I want to tell them "stop acting like a victim and be glad to have learned your lesson".

When you learn about crypto you're also investing in yourself, which is probably a 1000x return. So even if I lose it all in dollar value I'm earning so much in brain value.

Keep posting this eductational content, this is so much more valuable than the "XXX altcoin to the moon" video.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Speaking as a former poker player, learning by doing is not the right way. If we look back and look which people performed best, it were the people who allocated their time most effectively in terms of splitting your time between studying and playing. In the beginning there were hardly any solid content and people used networks to study quicker. Then some people saw a business posibility and it fitted better with their personal needs in live to share this knowlegde, training sites. Some choose to be exclusive and did private coaching. Then there was a whole influx of people with bad knowlegde who could not capitalise in the market with their skills and used old results to coach people.

Poker also is a far less complex game than a for instance the bitcoin market. Just like in poker there are basics to understand, it starts with language etc. However be skeptical how much you know. Risk assessment is more easy to understand than creating an edge. I would completely loosly estimate for 99.9% the edge in this market is that they are saving their money instead of having an edge over the rest. In poker we can look better at the data and evaluate, however because of changing skill enviroments every day this evaluation has to be taken with a grain of salt. 80% of the people lose, 10% break even. 10% win and of that 10% only 1% can make a living out of it. And then 1% has te possibility to get very wealthy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What I hear nobody talking about regarding the price of Bitcoin (and other cryptocurrencies) is that we have been in a period of economic boom for the last couple of years. Just look at how the Dow Jones has performed since the recovery of the economic crisis. As we all know from our lessons of macro-economics, a period of economic growth makes consumers invest more in consumer goods, stocks and in this case even in cryptocurrencies.

The point that I'm trying to make here is that because the cryptomarket is still so young, it never really faced a period of economic drawback and thus never really faced a period where consumers have less money to spend on such finnancial assets.

This brings me to my final question: will the inevitable slowdown of the worlds economy lead to a potential 'crash' of the whole cryptomarket?

I just never hear people talking about the cryptocurrency market from a more giant, macro-economic perspective.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have been following you for a long while now, I really like your content, and I specially liked the videos you made with arguments about if whether or not bitcoin is a bubble. I wanted to ask you if you would be interested in making a video about Petro, the Venezuelan crypto, and why people should not buy it. If you want I can provide you with more information about it besides what you can find in the web, I am Latin american so I do have context of what is happening there, and I have made research about the coin as well. Looking forward for your reply.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i think new investors or young people just outside college should not touch this area for now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting article, which I think is spot on. As someone who lives in Australia and is part of a lot of Australian based crpyto forums, many of the people coming into the crpyto space are doing so with the hopes of using gains to enter the property market, or to pay down absolutely ridiculous mortgages. It is a huge problem here at the moment, with the average home in Sydney valued at around $1m AUD. It is not uncommon for young families to have debts far in excess of $1m on homes which could devalue sharply over the coming years, and with a declining economy which could see lots of job losses in the future. Whilst everyone is talking about crpyto bubble, I think most people can see that we are in an everything bubble.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ugh, another amazing video from The Crypto Investor. I couldn't agree with you more. It took me a while to realize your points but I am so much better off now than I was 10 years ago. And to be honest, I didn't start with Crypto... I actually thank Robinhood as my investment beginning. Realizing that I can put aside $200-$300 a paycheck and watch it grow was much more satisfying than going out and getting drunk or buying drugs and partying... and I live in NYC, the biggest party tease of all.

I stopped buying "things" and started buying stocks and gold. From there I moved to crypto and even with this major downturn, I have been able to pay off my debt and build a nice nest egg in case shit happens. I still have some debt I need to pay off but not living paycheck to paycheck has really increased my mental state and happiness in general.

Thank you for another great video.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As always, great content mate. I think your analysis of cyrpto investors that are otherwise not investing in anything has some merit.

I think it also has something to do with culture and the active avenues of information for individuals, particularly for younger investors. I'm not sure I have ever seen a post coming across my feed about how to buy stock or how to open an IRA yourself. Now, I know there are plenty of articles and videos on that topic, but they they don't get shared in my circles. Unless your employer supports a 401K, you're likely not going to put in the leg work to figure out where to open a traditional investment retirement account.

Also, it seems there may be a much higher minimum for opening an IRA--I didn't look extensively, but the minimums I was finding were $1,000-$3,000. Like you mentioned, if small-scale crypto investors are starting off simply by diverting small amounts of spending, then they'd likely never build up that kind of egg to open an account.

As far as cultural differences, there is sort of this prideful ownership mentality that I have seen. I have met a lot of millennials that feel like the mutual fund is their parents' invention and crypto is theirs. We tend to support and gravitate towards whatever feels most like your tribe.

I wonder how big a factor liquidity is for some people. Even if they hope and plan to hold their crypto long-term, it may still factor in their mind as essentially cash in hand. Of course, an IRA is very different. Yes, everybody hears to only invest what you can lose, but people will still find comfort in believing they could cash in their crypto if something came up. I suppose if they were buying stock individually, then that would be analogous.

I am a millennial, but my story and reasons for investing in crypto are a little different than the ones you explored here. I am a lawyer and if I hold any stock outside of a mutual/index fund then I have to do regular disclosures with my clients and employer and do additional conflict checks. At the low level I'm investing, that was just too much work. Crypto is a great alternative for me. I contribute to a 401K already and have been slowing building a cash reserve in a savings account. That is the money I use to invest in crypto.

I like your point about the volatility of crypto preparing people to not sweat stock market swings. But the opposite is also true. Crypto investors expect a quick turn around. That doesn't often happen in the stock market.

Cheers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post. As long as you have your fortress of solitude (401k and I'd do IRA too with passive indexing), I think you're good to invest practically anywhere. I wonder too about the quick turnarounds that everyone expects and how they will react when the market doesn't provide that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, that'll be a good test point for the market. I think some people will lose interest, but still have some faith long term and become less active followers, but ultimately hold their positions. Others will take their profits and run.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very Honest Videos !

I have been following you since you started talking about VTC and I have watched all of your videos since. This is my first time I post though so ... Nice to meet you!