A lot of people have been wondering about the all time high number of open longs on Bitfinex over the last couple of weeks. A less informed participant would suggest that when there is that much open interest and a significant sentiment to one side or the other, the market tends to move in the opposite direction. And that's actually not a bad line of logic to follow. In-fact, the path of least resistance for large-interest, market movers are nearly always in the direction that hurts the larger number of traders by volume. After-all, it is the balancing of an unbalanced market that market makers, movers, and large interests use to capture the liquidity to secure an exit.

A mostly "long" market would be susceptible to a long squeeze where prices fall and gradually force net long traders to settle their positions at a loss. However, the problem with crypto markets is that the data is highly unreliable, especially with platforms like Bitfinex who are constantly playing cat and mouse games with regulators.

To make it worse, Bitfinex continue to make no attempt to "prove" that their Tether is fully backed by cash, or cash equivalents at all times leading many to speculate (and rightly so) that a lot of the market volatility can be contributed to Bitfinex balancing their balance sheets when significant holes appear. (How this happens will be discussed in another article)

Further more, Bitfinex allow the claiming of positions off the order-books which pretty much renders the long/short open interest moot.

Now, moving on from speculating over Bitfinex foul play, let's just take a look at the data face value and see what is going on.

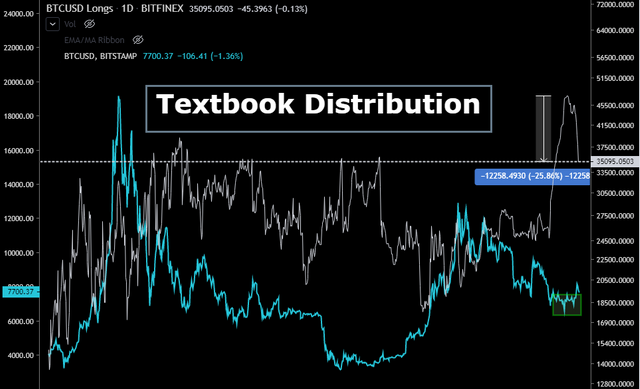

- Rapid increase of longs as price fell to sub 7000.

- Price was not able to follow through with lower lows after hitting the mid 6000s

- Open interest on longs hit an all time high of over 46000 BTC

If the data was reliable, then this is how it should be interpreted.

- The rapid increase of longs was the result of large interests stepping in with very significant volume, essentially creating the bottom, and beginning their accumulation.

- Price was not able to follow through to new lows because the large interests are now catching each sell with leveraged long positions.

- Sell liquidity dries up as margin longs reach saturation at all time high.

During contracting volatility, and reduction of volumes, the market participation as a whole is very low. Unlike aggressive sell offs leading to capitulation where a large number of market participants go short as well as sell on spot, we did not see this as we entered the sub 7k range.

As a result, it is much more likely that a few large players stepped in and created this "intermediate" (don't know yet) bottom.

Now, in the last few days, we've seen Bitcoin rally quite significantly, and as you can see from the chart above, the average price for about 20k worth of BTC longs would be about 7k or so. Additionally, we've seen a sharp rejection just under 8500 with margin longs dropping by about 12250 BTC. That could be a couple of things :

a) The reduction in margin long positions means "some/a significant player(s)" who accumulated and created the bottom are now distributing. Closing long positions implicitly means selling.

b) We have about 7750 BTC left in "profit" which could sell off meaning that if we see the margin longs come back to around the 27,500 zone, we can expect a return to sideways, non-trending markets for a while.

Regardless if we make new lows, or make a stab at reversing the bigger downtrend, a sideways market would be most conducive to eventual upside movement when the right catalyst is revealed.

Don't always take the contrarian view for data like open interest, margin long/short ratios, because what you can inference from this data largely depends on the composition of the participants on each side - is it the market as a whole contributing to being massively long, or is it a few large players? You don't have access to this data so the data can be interpreted both ways. Not exactly a very good edge.

Congratulations @holdo! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit