At least that is the thesis from Morgan Stanley this morning.

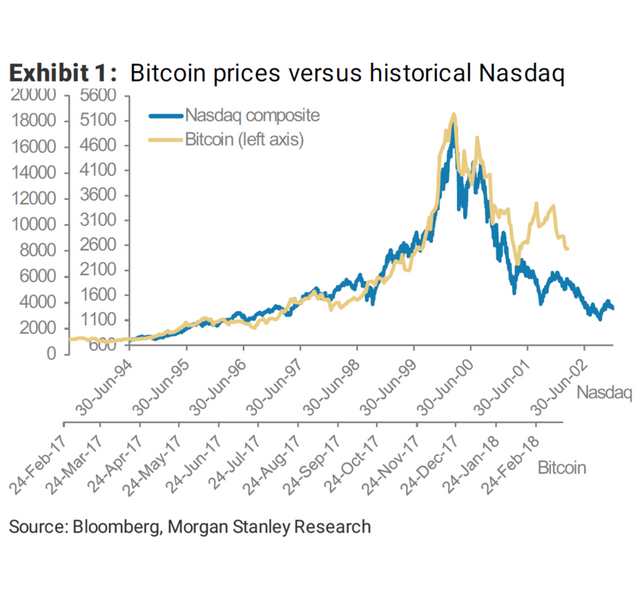

Bitcoin has long been compared to the dotcom bubble and Morgan Stanley says they are now seeing some very strong parallels, except they are happening a lot faster.

How much faster you might be wondering?

Try 15 times faster!

Some numbers to ponder on:

The Nasdaq took 519 days to reach it's high in March of 2000. The index ran up 278% over that time.

Bitcoin took 35 days in the final leg of it's rally to get near $20k. The coin ran up 248% during that time.

The chart comparing the two moves can be seen here:

The Nasdaq can be seen in blue while bitcoin is the gold colored line.

As you can see there certainly is some similarities in the resulting price action, both in terms of the runup and also on the way down.

However, the similarities don't just stop there...

According to the report, there have been 3 waves of weakness in bitcoin since the peak, each one between 45%-50%.

The Nasdaq had 5 waves of weakness during it's draw-down, each one averaging about 44%.

Also the bitcoin has had two major rallies during this downtrend, the average being about 43%.

The Nasdaq averaged 40% rallies during it's draw-down.

More on the report from Morgan Stanley can be found here:

What does this all mean?

Taking all of this into account, and if bitcoin were to mirror what the Nasdaq did, it would mean Bitcoin still has two more waves of selling before it reaches it's ultimate "bottom".

However, would that also mean that bitcoin will go on to make new highs 15X faster than the Nasdaq did?

The Nasdaq took 15 years from the time it peaked until that peak was eventually overtaken.

By the logic put out by Morgan Stanley, that would mean we could expect to see Bitcoin make new highs about a year from it's peak.

Which would mean...

Bitcoin would be making new highs around December of this year.

Which, ironically would also correspond with what many market forecasters, including Tom Lee, have been calling for.

One more tidbit...

In general, Bitcoin bear cycles last about 5 months and bitcoin bull cycles last about 3 months.

If that were to repeat, we would expect to see Bitcoin start gaining some bullish traction again around May of this year.

To sum everything up:

Bitcoin could ultimately have two more waves of selling before it makes it's low, followed by a bull run middle of this year, followed by a correction, followed by new all time highs by December.

I like it!

Thanks Morgan Stanley.

Stay informed my friends.

Image Source:

http://www.ethereumwiki.com/bitcoin/morgan-stanley-bitcoin-better-than-gold/

Follow me: @jrcornel

Thank you for posting @jrcornel.

Always appreciate hearing what the banks have to say......right?

For then we know the opposite is true. ^__^

All the best.

Cheers.

Ponder it.....indeed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very Very Interesting!

Keep us informed 🤑

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jrcornel you should also consider the hype that the next halvening will create, something most people disrigard at their speculations now days, but there will be some fomo generated from that event 6 months before the halvening block.

Expect recommendations from the G20 this July.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks MorganStanley for the calling the incomming bottom, just one month to go huh :P:P:P

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for walking us through those conclusions.

Morgan Stanley certainly hopes to be all doom and have you continue to invest in their mutual funds, etfs, trading stocks and bonds. The critical thinking involved on their conclusion is laughably low.

Just like all those marketing pieces about needing to stay in the market because if you miss the 10 largest rallies in the year then you miss most of the stock markets gains for that year. No one ever advertises that if you miss the 10 worst days of the year that you are much better off since protecting the downside = less the market has to recover for you to break-even.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is a good point. Pretty tough to predict either of those. It was also interesting how they left out how the Nasdaq went on to break that previous high, rather significantly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Funny that Morgan Stanley is covering Bitcoin while Google and Facebook are working to snuff out crypto currency. The tech companies have the brains to understand that decentralized networks will take away market share and eventually put them out of business and Steemit is just the beginning. Now with roadblocks in place crypto knowledge and information will move even faster to the Steem blockchain. It seems that financial analysts are beginning to realize the value of blockchain technology and don't want to miss out on the financial rewards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The risk reward isn’t there for the likes of google and Facebook. Crypto spams the platform and opens them up to litigation with little advertising or monetization opportunities than say selling household products. Whereas despite recognizing crypto as an eventful business risk, it will also bring research and trading dollars, and maybe even more so than the lost revenue.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Litigation? After all the Bitconnect ads run by Craig Grant on YouTube I haven't seen any legal action against YouTube, Google or Alphabet. They are indemnified.

From AdWords Terms and Conditions:

10 Indemnification. Customer will defend, indemnify and hold harmless Google, its Partners, agents, affiliates, and licensors (each an “Indemnified Person”) from any third party claim or liability arising out of or related to Ads, Targets, Creative, Destinations, Services, Use and breach of these Terms by Customer, except in relation to each Indemnified Person, to the extent that the third party claim or liability arises as a direct result of: (a) that Indemnified Person’s negligence or misconduct; or (b) that Indemnified Person’s breach of the Terms. Partners are intended third party beneficiaries of this Section.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Point taken. I still don’t see great risk reward for them to have ICOs advertised on their platform. Lack of regulation opens people to scams and there’s no way for them to adequately filter them. Maybe once they become properly vetted. So if not litigation, then reputational damages.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting stuff, although I pay little attention to what any of these big companies say.

Ultimately they want to buy when everyone is running around scared selling at rock bottom prices whilst these calling it a bubble pick up thousands for cheap prices.

I find it is a simple process, research and invest what you believe in and do not be swayed by others.

Buy the dips and grow your positions where possible through trading.

(And sell in December :-) )

Thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. That last part was left out by Morgan Stanley. Yes it currently is crashing, but if it goes on to make new highs then this is great news for those wanting in.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting that from about Feb, bitcoin stopped following the pattern. I wonder if it's because BTC has lots of hodlers, while the investors in NASDAQ stocks were in it purely for the money and weren't attached to any stock.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting comparison, well I am HODL'ing for the long term so December is nothing to me, I could wait til December 2035 if I had to lmao.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looking to history, especially the NASDAQ, isn't worth very much when we're talking about bitcoin right now. I do coincidentally believe that crypto is going lower, and we might see a huge rally when banks start to collapse or high/hyperinflation sets in in countries with larger economies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why isn't looking at NASDAQ worth much? Just curious. :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Historical data might fit nicely a lot of the time but it's what happens after the convenient fit that's important.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

interesting comparison thanks for the information @jrcornel be aware to see what happens in the coming days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the comparable analysis. It is a good news that Bitcoin is expected to raise by the end of this year. That means we should brace ourselves for another sweet crypto ride.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is the hope!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Finally some interesting post about BTC, unlike all the crap we read these days in Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Markets move all the time (up and down). Given how markets work, successful projects will survive as long as they remain relevant to the economy. Given the vision behind this new generation of technology, we will see rise and falls of many projects in the coming years. Therefore, doing homework on the general market as well as in the individual projects is the best way to identify the opportunities that will result in the big disruptors of the next decade. Like the dotcom bubble, who will be the next Amazon to survive and dominate? Also, who will be the next Netflix who was a byproduct of the bubble and emerge afterwards to disrupt and dominate?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/news/@larfus/the-quantum-computers-are-coming-is-this-bitcoins-end-part-1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin's nearly five-fold climb in 2017 looks very similar to tech bubble surge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good article ! Thanks for sharing with us. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the post.

Interesting comparison, for me I am a bit sceptical when these commentators compare action in the crypto market to that have wall street. My logic is that the stock market is entrenched in everyone's life through either direct or indirect (401k) exposure . I don't believe the crypto market has nearly enough market participants to be compared, nor does it run on the same news as the stock market. That's not to say there are some crossover points but I still think they are two completely different beasts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent report, in fact, the Crypto-currency is similar to the Dotcoms, it is clear that many of the Crypto-currency will die, but the prospective vseravno will go up!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I believe this phase is only making Bitcoin and other Crypto stronger for long term. As nothing works fine upwards, so balance way is the way to go for anything to grow in real terms.

We have so many options now with upcoming ICOs. One gigantic thing is CryptoLux, it is very cool and got nearly everything you could wish to see. So, that makes it such high on potential. The Pre-ICO starts from 25th March with $0.5 price before it continues to jump in. So, great chance to join in now. https://www.cryptolux.io

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If its moving 15x faster, how will we know where it is going in a couple years?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We won't ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The logic feels right. Even though I got sucked back into the market today, in a smallish way, not all in

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Like the sound of your predictions here. Hope it comes true. Thanks ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm just beginning to learn about cryptocurrency and found this very insightful. If anyone has any reading recommendations for a newbie looking to really understand crypto--please comment and tell me :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin Up for now, as Focus Shifts to the G20

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit