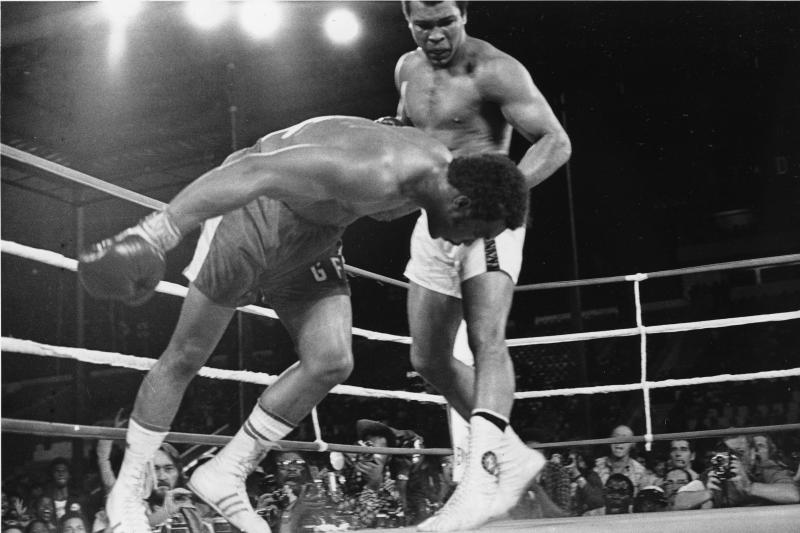

"I was over-confident when I fought him...All I thought was, 'Should I be merciful or not?' I thought he was just one more knockout victim until, about the seventh round, I hit him hard to the jaw and he held me and whispered in my ear: “That all you got, George?” I realized that this ain’t what I thought it was."

This quote from George Foreman reflecting on his "Rumble in the Jungle" loss to the older, weaker, past-his-prime underdog by the name of Muhammad Ali perfectly captures what is about to happen in the current China v. Bitcoin battle.

As of this writing, China has still not released an official statement banning cryptocurrency exchanges but the market has taken some punishing body blows over the past couple weeks courtesy of news, rumors, and speculation.

Here's a brief recap of what's caused the most damage to Bitcoin prices:

9/4/17: China bans ICOs indefinitely http://boxmining.com/china-banned-icos/

9/12/17: Charlie Lee (founder of Litecoin and one of the most reliable voices in crypto) reveals that a source he "trust(s) fully" leads him to believe China is on the verge of banning Bitcoin exchanges http://coinivore.com/2017/09/13/charlie-lee-rumors-jamie-diamond-suspension-chinas-bitkan-counter-trading-causes-market-flash-crash/

9/12/17: JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon calls Bitcoin a "fraud" that will eventually blow up. https://www.bloomberg.com/news/articles/2017-09-12/jpmorgan-s-ceo-says-he-d-fire-traders-who-bet-on-fraud-bitcoin

9/14/17: Shanghai-based bitcoin exchange BTCC (the oldest crypto exchange in the biggest market) announced it will be closing down its China-facing trading operations effective September 30. https://www.coindesk.com/btcc-to-cease-china-trading-as-media-warns-closures-could-continue/

Predictably, this has led to massive panic selling, causing steep drops in the price of Bitcoin and virtually all other cryptocurrencies. We are likely to see an even more pronounced decline when the Chinese government makes an official statement declaring that exchanges are banned.

Here's a timeline of what I fully expect will go down:

The market will plunge immediately on the heels of the news.

When the dust settles, Bitcoin won't retrace nearly as much as the media/general public expected and will bounce to a respectable level within a week of the ban.

Confidence will grow due to Bitcoin's surprising resilience and the relatively weak/short-lived effect that ban has. With the looming threat of the ban gone, the market begins to recover...Ferociously.

Within 6 weeks of the ban, Bitcoin establishes a new all-time high.

It's a bit cliché, but "the only thing we have to fear is...fear itself" fully applies here. Government regulations are truly the last fear Bitcoin has to hurdle before being unleashed; once the China ban happens, the worst is over, the Boogeyman is dead.

Every other regulation or ban from this point forward will have a diminished effect as decentralization and insulation from government evolves from a theoretical possibility to an undeniable reality.

So what's the worst case scenario? In my mind, the worst situation involves China prolonging officially banning exchanges. By leaving the proverbial axe hanging over our heads, uncertainty will reign, enabling market manipulation by way of rumors and unconfirmed "leaks."

The people will ultimately decide if my timeline is overly optimistic or too conservative...not China. Not any government. I'm betting on the people.

Here's to hoping that China does their worst sooner rather than later! The sooner they do, the sooner governments will realize "this ain't what (they) thought it was."

I ain't too proud to beg: if you enjoyed this article, lemme borrow a dolla...err...Satoshi :) and follow me on twitter www.twitter.com/thecryptohomie

BTC: 1GHHD59ZCaxSqQARE3MotizVpM8zKdvqbA

ETH: 0x23F0153a5539eA2891Ef781deAB638E18943fe75

LTC: LSxAYk1zABZWYw6E61MHNvKX7oqEpxV1C4

Congratulations @thecryptohomie! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you've got it right. I expect $6000 BTC end-october.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That wouldn't surprise me at all! Seems like confidence is slowly building back up right now but if there's no bad news this week I think we start seeing the bull market momentum from the China bans. Thanks for reading!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Until nowdays, china is still banning crypto exchanges https://9blz.com/btcc-review/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit