Hey many of us minnows are not crypto inclined. But it does not have to be that way. Most minnows don't do this because it seems daunting and complicated. But what if it is not? Here is an easy guide for beginners to get involved and be one of the cool kids on steemit ;)

Bitcoin currency trading can be very profitable for beginners or professionals. The market is new, highly fragmented with huge spreads. Arbitrage and margin transactions are widely used. So many people can make money trading bitcoins.

Bitcoin bubbles and volatility in it's history may be more likely to introduce new users and investors, more than any other cryptocurrencies.

Each bit currency bubble will produce speculation, Bitcoin's get featured in the news. Media attention leads to more interest, prices rise, until speculation fades.

When Bitcoin prices rise, both emerging investors and speculators want to get their profits. Because Bitcoin is global and easy to send to any place, trading bitcoin is simple.

Compared with other financial instruments, bitcoin has very few barriers to get into. If you already have a bitcoin you can start trading immediately. In many cases, in order to trade, do not even need to verify.

If you are interested in trading on Bitcoin, then many online trading companies typically use this contract for difference or CFD.

Avatrade offers 20 to 1 leverage and good terms of trade in its Bitcoin CFD trading program.

Why trade bitcoins?

It is very important to understand why it is both exciting and unique to trade Bitcoins.

Bitcoin is global...

Bitcoin is not a legal currency, meaning that its price is not directly related to any country's economy or policy. Throughout history, the price of Bitcoin has responded to the various events from China devaluing the Yuan to Greek capital controls.

General economic instability and panic boosted some of the factors in the past. Some claim that, for example, Cyprus's capital drew attention to Bitcoin's, resulting in a price increase during the 2013 bubble.

Did I say GLOBAL or GLOBES???

Let's move on...

Bitcoin Trades 24/7

Unlike the stock market, there is no official Bitcoin exchange. On the contrary, there are hundreds of a 24/7 exchanges around the world. Because there is no official Bitcoin currency exchange, there is no official Bitcoin prices. This can create arbitrage opportunities, but most of the time exchanges stay within the same general price range.

Bitcoin is volatile

Bitcoin is known for its fast and frequent price changes. From the daily chart of CoinDesk BPI, it can be easily found for days, with a fluctuation of 5% or more.

The volatility of the Bitcoins creates an exciting opportunity for traders who can quickly gain profits at any time.

FIRST YOU NEED TO FIND AN EXCHANGE

As mentioned earlier, there is no official Bitcoin exchange. Users have a lot of options, in considering the exchange you should consider the following factors:

Regulatory and Trust - Is the exchange trustworthy? Can the exchange steal from customers?

Location - make sure the exchange can accept currency from your country.

Cost - What is the percentage of each transaction?

Liquidity - large traders will need a high liquidity and good market depth of the currency exchange.

Based on the above factors, the following exchanges are the most popular:

Bitfinex - Bitfinex is the world's largest bitcoin exchange in US dollars trading volume, trading at about 25,000 per day. Customers can trade without verification.

Bitstamp - Bitstamp was founded in 2011 and is one of Bitcoin's oldest exchanges. It is currently the world's second largest exchange, the amount of dollars in units of daily trading volume of a little less than 10,000 BTC.

OKCoin - located in China's Bitcoin Exchange, but trades in US dollars.

Coinbase - Coinbase Exchange is the first regulated Bitcoin Exchange in the United States. Daily trading volume of about 8,000 BTC, is the world's fourth largest exchange in US dollar volume.

Kraken (Kraken) is the number 1 euro trading volume, at about 6,000 BTC per day. It is in the top 15 for trading USD volumes.

Trading Bitcoin in China (Hey that's where @sweetsssj lives

Global Bitcoin trading data show that a large part of the global price trading volume comes from China. It is important to understand Chinese exchanges are leading the market. And the exchanges mentioned before follow China's lead.

The main reason for China's holding such strength in Bitcoin trading is because China's financial regulation is less stringent than other countries. As a result, the Chinese exchange can provide leverage, loans and futures options for other countries' exchanges. In addition, the Chinese exchange does not charge fees, so the bots can be free to create the number of transactions at high volumes.

If you want to learn more about Bitcoin's trading in China, Bitmain's Jihan Wu's video offers more insights.

How to trade BITCOIN

Kraken will be used as an example of this guide. The processes and basic principles of all exchanges remain unchanged.

First, create an account on Kraken by clicking on the black box in the right corner:

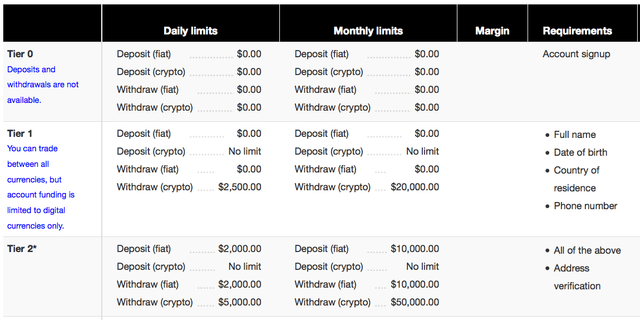

You must confirm your account by email. After confirming your account and logging in, you must verify your personal information. All Bitcoin exchanges require different levels of validation required by AML and KYC legal requirements. You can find the first three verification levels below:

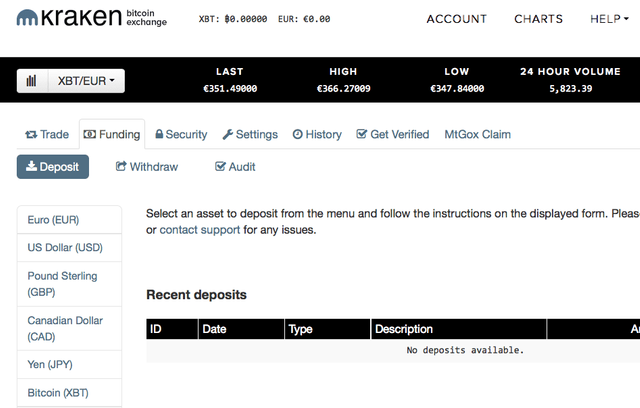

Once you've verified your account, go to the Funds tab. You should see a screenshot similar to the one below. Choose your funds from the left side:

There are many deposit methods offered by Kraken, see below:

EUR SEPA Deposit (Free) - EEA countries only

EUR Bank Wire Deposit (€5) - EEA countries only

USD Bank Wire Deposit (Free til 3/1/2016, then $5 USD) - In the US only

USD SEPA and SWIFT Deposit (0.19%, $20 minimum)

GBP SEPA and SWIFT Deposit (0.19%, £10 minimum)

JPY Bank deposit (Free, ¥5,000 deposit minimum) - Only in Japan

CAD Interac Deposit (Free til 3/1/2016, and then 1%, $ 10 CAD fee minimum, $5,000 CAD deposit maximum)

CAD EFT Deposit (Free til 3/1/2016, then 1%, $10 CAD fee minimum, $50 CAD fee maximum, $10,000 CAD deposit maximum)

Deposits using traditional banking systems will take 1 to 3 days. Bitcoins deposit requires six confirmations, which is about 1 hour.

Now, navigate to the "Trading" tab. Use the black bar at the top of the page to switch the pairs. In this example, we will use XBT / USD. We want to buy Bitcoin, so let's place an order. Navigate to the New Order tab.

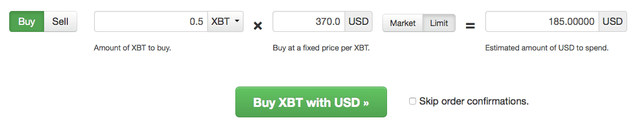

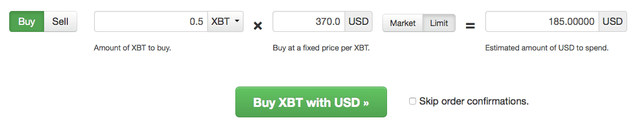

Suppose I have deposited $ 300 into my account via the Bank of America wire transfer. In the following example, I have already submitted an order to buy 0.5 terabit (XBT) at a price of $ 370 per bit.

Check the top of the black bar and you will notice that the final transaction price is $383.17.

Why submit an order for each bit currency (XBT) $ 370 instead of $ 383.17? If people expect the price of Bitcoin to fall, you can submit an order below the current price. In this case, since my order is below the other offers in the order, I will not immediately receive my order 0.5 Bitcoins. Orders at the specified price are called _limit orders. Before placing an order, be sure to check the order for the transaction pair.

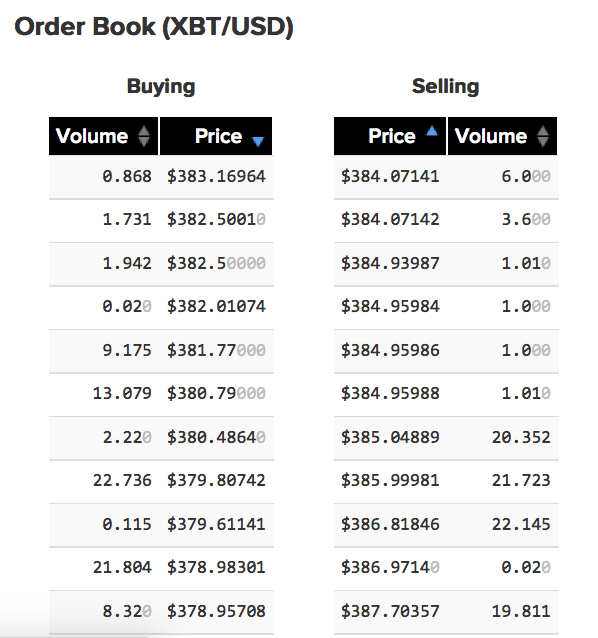

In the example order below, you can see that the highest buy order is $382.5 per Bitcoin, and the lowest sell order is $384.07 per Bitcoin.

There is also an order form for the “Market” option.

In this case, the market order will be paid at the lowest available sell order price of XBT. Using the above order, the 0.5 XBT market order will purchase 0.5 XBT at a rate of $384.07 per XBT. If you sell Bitcoin, the market order will sell the Bitcoin at the highest available price based on the current buy order book - in this case $ 382.5.

Trading Risks

Bitcoin deals are exciting as Bitcoin's prices volatile, the global nature and the 24/7 trading. However, it is important to understand the many risks associated with the Bitcoin trading.

Keeping Money on an Exchange

Perhaps one of the most famous events in the history of Bitcoin is the collapse of Mt. GOX. In the early days of Bitcoin, Gox was the largest Bitcoin Exchange, and the easiest way to buy Bitcoin. Customers from all over the world are happy to be able to wire money to Mt. Gox's Bank of Japan get some Bitcoins.

Many users have forgotten one of the most important features of Bitcoin's 'control of their own money'. Many left more than 800,000 Bitcoins in their Gox accounts. In February 2014, Gox stopped withdrawals and customers were unable to withdraw money. The company's chief executive officer said that most Bitcoin software was lost due to Bitcoin's software error. The customer has not received any funds from the Gox account.

Gox's catastrophic breakdown highlights the risk that any trader will stay on the exchange. Using a regulated Bitcoin exchange like Kraken can reduce the risk.

There is Capital at Risk

Keep in mind that for any type of transaction, your capital is at risk. New traders should start with a small number of transactions or paper transactions to practice. Beginners should also learn Bitcoin currency trading strategies and understand the market signals.

Trading Tools & Resources for Bitcoins

Cryptowatch & Bitcoin Wisdom – Charts of major Bitcoin exchanges.

Bitcoin Charts – Price charts to assist in understanding of Bitcoin’s price history.

Bitcoin Markets – Bitcoin trading sub-reddit. Beginners can question and get guidance on trading techniques and strategy.

TradingView – A trading community and a great resource for charts and ideas.

I hope this helps some newbies of cryptocurrencies. Hope a few more minnows will be motivated to get a better understanding of the main Cryptocurrency (Bitcoin) and begin taking small steps in trading. I hope this is of value to you. Please resteem, upvote and follow.

Stay positive, stay safe, and steem on ;)

I am Proud member and supporter of the minnow support project - brought to you by @aggroed, @ausbitbank, @teamsteem, and @canadian-coconut.

Regards

Yoda