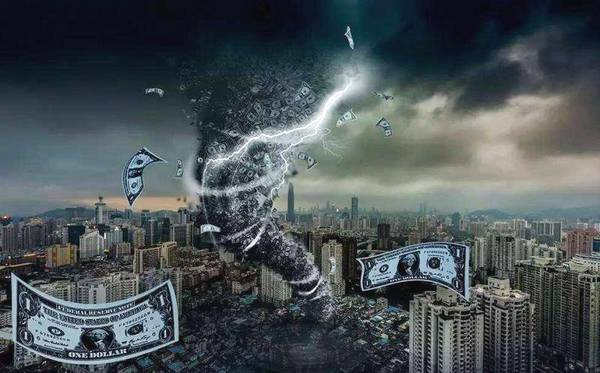

Often the most auspicious figures can't help but bring some surprises to human life. For example, the number "8", which is known as the wealth issue, is entangled with the financial crisis.

1988, 1998, 2008...

In a blink of an eye, three "ten years" have passed, and the world has also experienced three financial crises.

Almost every time it is linked to the number "8". It happens that this year is another year with a mantissa of "8". Will the financial crisis reappear?

The answer given by many economists is the 2008 Bitcoin: a peer-to-peer electronic cash system. For the financial system at the time, it was a highly disruptive solution, and it was also the starting point for digital assets and blockchain technology to enter people's horizons.

So, is this technological revolution to save the financial crisis or bring about a financial bubble?

The cause of the financial crisis

With the arrival of this decade, some people still panic about the financial crisis, and even believe that the cause of the financial crisis has already emerged.

Judging from the recent financial crisis, it is ostensibly caused by the subprime mortgage storm. From the United States, France, and Japan in the same year in August of the same year, the subprime mortgage storm, several incentives combined, only caused a global financial crisis.

From a deeper perspective, there is still an imbalance between the US financial order and financial development, and problems in the economic fundamentals. The above-mentioned several bankruptcies and bankruptcies were all large enterprise organizations located in the top of the market.

This has to ask us to question whether the banking institutions that we unconditionally trust are really safe?

Of course, in addition to the banking crisis triggered by the subprime mortgage crisis, and the claims and exchange rates that appeared in the early stages of the financial crisis are also inseparable. From the perspective of financial development in 2018, there are also some concerns.

For example, asset prices are beginning to form a bubble and are increasingly moving away from the real economy. Many people have laughed and said, "The first batch of 90 can not afford to buy a house, can not afford children." For the ever-expanding property prices, this is not a joke, but it has grown stronger and more people are willing to borrow money to invest in real estate.

From the subprime mortgage storm to analyze human nature, is there any “economic entity” that is obviously more inclined to weaken the conditions of borrowing and how much interest is earned from it? This is a typical example of the "profit" and "righteousness", and it also brings the crazy action of advanced consumption.

And the consumption ahead is not only the economic growth caused by credit consumption, but also brings a lot of worrying national debt. These are the incentives that led to the financial crisis.

Look at the current business model of many enterprises, far from the real economy, advanced consumption is also the most common life state of young people.

Every move in the financial market is likely to trigger a globalization movement. It is no wonder that this year, many people have questioned the blockchain. Is it the financial bubble or the best way to solve the financial crisis?

Can the blockchain change the financial crisis?

The reason for the rapid development of the blockchain is indeed based on the virtual economy. To a certain extent, it is exactly the same as the "Internet bubble" of the year. However, from the current market development direction, it is already on the trend of the real economy.

For many questions about the current financial market, I believe that in the near future, technological development will give a reasonable answer. Today, we mainly discuss how the blockchain can change the financial crisis.

First of all, the most critical issue is the issue of trust. The bank crisis or the subprime mortgage storm is inseparable from the word "trust". Therefore, decentralization reduces the cost of trust and allows many people to see hope.

The advantage of bank decentralization will cause many black-box operations to die. In addition, distributed books, everyone has the right to book, in all transactions can be seen in an open and transparent transaction record.

I believe that everyone is no stranger to inflation. In the simplest concept, when we circulate the renminbi and add a new batch of new renminbi, will the renminbi we originally owned be devalued?

With the blockchain, there is no such problem. Because the quantity is constant, no additional issuance, the total amount of assets does not change. In the face of regulatory issues, traceability can be achieved through its own blockchain system.

Recently, the P2P blasting incident has turned out to give the public a new round of vigilance. Decentralization, in essence, is a safe and trustworthy solution to avoid risks.

The second point is that it is inseparable from the property of money, that is, the means of circulation. With the development of global finance, a world currency is needed.

Now, if you go to another country, you need to exchange the equivalent currency. If you have a world currency, you can circulate it globally, but it also brings the unified circulation of money.

In this way, the circulation of world currencies has also brought about the trading patterns of commodities on a global scale. For those virtual financial products at the moment, it is urgent to build a good ecosystem of value systems.

Only in this way can the virtual economy play an important role in the real economy. Otherwise, excessive disengagement from the real economy is prone to bubbles and eventually mutual harm.

The third point is that the blockchain will bring everyone's financial ecology. For the current financial market, there are many speculators who have stirred up the market, which has brought panic in the market.

The blockchain technology is not only suitable for distributed accounting, but also plays an important role in building an application ecosystem. But when everyone registers through the blockchain, then the entire financial market is everyone's participation, and individual behavior is completely open and transparent.

For example, if you trust a company, you can use blockchain technology to trace its entire operating cycle. You can also recover lost wealth through smart contracts, and there will be no sudden events such as sudden bankruptcy or business running.

Presumably, this is the ideal life that many people want to achieve, and it is also the belief of blockchain practitioners.

Through the above analysis, it is not difficult to see why in 2008, many financial scientists gave high recognition to the papers of Nakamoto. This is a revolution in disruptive technology that has changed the crisis in the financial world in human history and brought a new value future.