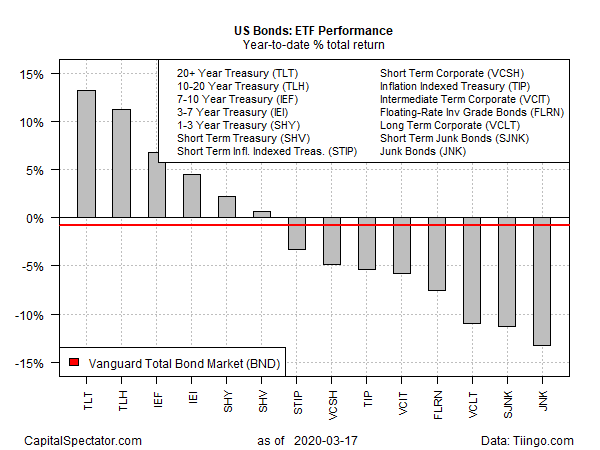

The upheaval in global financial markets this year is unleashing profound effects on U.S. fixed-income assets—negative and positive. Depending on the slice of the bond market, year-to-date results vary from strong gains to deep losses, based on a set of exchange-traded funds.

The top performer remains long-term Treasuries. The i

Shares 20+ Year Treasury Bond (NASDAQ:TLT) surged 13.3% this year through Tuesday’s close (Mar. 17). The year-to-date gain masks high volatility in recent days as the fund swings up and down, but for now TLT still holds the top performance spot for the major sectors of the U.S. bond market in 2020.

Notably, all the year-to-date gains for U.S. bonds is currently limited to Treasuries of various maturities, with one exception: inflation-indexed securities. Treasuries that are linked to inflation are underwater on a year-to-date basis.

The hardest-hit corner of the bond market: junk bonds. SPDR Bloomberg Barclays High Yield Bond (NYSE:JNK) has lost 13.3% so far this year—the deepest shade of red in the U.S. fixed-income realm.

Weakness in the corporate space generally this year is weighing on the U.S. investment-grade benchmark, which holds government and corporate credits. A fund proxy for this broad measure of the market is Vanguard Total Bond Market (BND), which is down 0.8% year to date.

US Bonds Year To Date Total Return Chart  US Bonds Year To Date Total Return Chart

US Bonds Year To Date Total Return Chart

The challenge for lesser-rated slices of corporate fixed income is a rising risk of defaults. “The level of concern is pretty obviously elevated here,” says Oleg Melentyev, head of high-yield strategy at Bank of America (NYSE:BAC) Global Research. “We have seen quite a dramatic widening in different measures of spread and in different segments of the market,” he told CNBC last week.

The usual guidance on pricing via economic data has effectively gone dark in recent days as investors realize that a U.S. recession is highly likely. Since economic reports reflect activity with a lag, the incoming numbers are effectively worthless until the coronavirus blowback begins to inform the updates in the weeks ahead.

There’s also a high level of uncertainty about the details of the federal government’s response to support the economy. The Federal Reserve has cut interest rates to near zero and is rolling out other policies to provide monetary stimulus. On the fiscal side, however, legislation is still evolving.

President Trump is asking Congress for $1 trillion stimulus. A bill is in the Senate, but Republicans are still debating the details.

The critical factor that everyone’s focused on is the coronavirus-triggered recession that’s lurking for the U.S. and beyond. Indeed, it’s likely that economic output in America has already gone negative on a national basis.

“It will likely be a short but sharp contraction,” predicts Gus Faucher, chief economist PNC Financial Services Group (NYSE:PNC).

Until a clearer outlook emerges on the extent of the downturn and the timing of a recovery, Treasuries may remain the only source of positive returns.

In fact, long-dated Treasuries trailing returns are so strong these days relative to stocks that the equity risk premium has evaporated for the five-year-return window.

“It is incredible — they’ll have to rewrite finance books,” notes Abi Oladimeji, chief investment officer at Thomas Miller Investment in London. “There are extended periods where risk doesn’t necessarily pay. And unfortunately a lot of the time you live through those and for a lot of investors, they only realize it after the fact.”

As for the future, he adds: “Beyond a short-term horizon, the real determinant will be the growth outlook, the inflation outlook, the policy outlook. An analysis of those factors will not lead you to bet against bonds right now.”