Are BTC maximalists winning?

Ever heard of Austrian Economics/ Austrian School?

Which one is about any regulation being made by the market itself, not by external intervention like state regulation?

You should read into it!

Here is also a very interesting article about BTC maximalists from the austrian school viewpoint..

https://saltheagorist.blogspot.com/2019/08/the-economics-of-btc-maximalism.html

One of the first parts:

Also, a qualifier: I'm not capable of making, defending or refuting technical arguments. I'll leave that aspect of the debate to others. My concerns with BTC maximalism are entirely economic and can be divided into four areas.

- Based on the criteria for saleability as laid out by the austrian school, BTC is not the most marketable digital commodity.

- A lack of portability relative to other cryptocurrencies implies BTC isn't as sound of a commodity.

- Value storage is a secondary function of money and cannot satisfy the use-value requirement of regression theorem.

- BTC maximalism lays waste to the Hayekian notion of competition as a discovery procedure. This final point was addressed in detail on episode 50 of The Agora, Crypto-Economics and thus, isn't elaborated on in great detail here.

I think the next altcoin season is near..

/Jan

Congratulations @luegenbaron! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When I consider crypto in the context of cash being outlawed, I am reminded of game drives using funnel fences.

The quarry are seeking safety from the noisy beaters, and rush into the safety of the corral where no beaters are. When the gate is closed, the end comes. This is why I have not rushed into the financial security crypto seems to avail. I reckon the fences around us, we quarry, are money itself, and that is the real problem that must be solved.

Trade is not dependent on money. Money isn't wealth. These are underlying facts I try to keep in mind when seeking to be of independent means, the real definition of wealth.

Freedom, in other words.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most freedom and also value is your own knowledge and health.

I also didnt invest all my money into crypto. Mostly I invest in myself, in tools, food..

But also some into crypto cuz I like the tech - and prefer it over some lame ass central banking fiat, especially cuz the upcoming negative interest rates.. if I need fiat cash I can still trade some crypto back..

I'm looking forward to some private coins.. not like Monero more like Grin..

But the masses are dumb and will probably push something really dumb forward..

What is ur plan?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, BTC maximalists are winning. And no, there won't come another altcoin season ;-)

A store of value needs 2 basic properties which are security and scarcity. No commodity in this world is better than BTC concerning these properties.

Concerning 4. Yes, even BTC maximalists (at least those I know) want maximum competitive forces within the monetary system. They conclude that - because of Bitcoin's properties - Bitcoin will win this competition. And the more liquidity Bitcoin accretes, the more liquidity Bitcoin accretes ;-)

Monetary dynamics...

!giphy avalanche

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

// You can support giphy by using one of your witness votes on untersatz! //

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dont be too sure.

Never lay all of ur eggs into one basket.

Could also be a trojan horse (nothing is impossible).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't. I diversify: BTC + Gold + US Dollar.

Though I could "diversify"

I don't see any reason to diversify within cryptocurrencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cuz u seem to only know shit alts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you know non-shit altcoins - concerning "currency"?

I don't consider Steem or Augur or Binance to be money.

Is there any competitor to BTC which is non-shitty?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Grin :)

ist privat und hat eine ähnlich anonyme und geheimnisvolle dezentrale Entwicklungsgeschichte wie der Bitcoin

und wenn dessen Technik mimblewimble in ltc integriert wird, dann dieses.

Btc ist wie gold und Ltc wie Silber (Metaphorisch auf Wert und Handel bezogen)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ich kenne Grin (und finde es nice), sehe aufgrund von Bitcoins Netzwerkeffekt, Namen, Sicherheit, usw. jedoch keine Chance gegenüber BTC. Das MimbleWimble-Protokoll kann auch in BTC integriert werden.

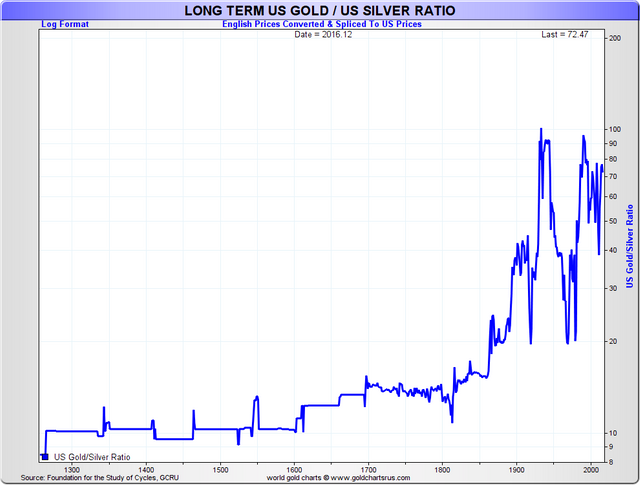

Hinsichtlich Gold und Silber: Silber hatte seine Funktion als Zahlungsmittel, als Gold zu teuer (pro Gramm oder Münze) war, um damit zu bezahlen. Ab dem Moment, als es den Goldstandard gab und man praktisch mit Geldscheinen (die mit Gold direkt gekoppelt waren) bezahlen konnte, hat Silber seinen Wert als Store of Value und v.a. als Medium of exchange verloren. Das sieht man auch an der Preisentwicklung gegenüber Gold:

Heute hat Silber seinen Wert v.a. durch industrielle Nutzung, wobei es auch noch einige unverbesserliche Hodler gibt, die denken, dass Leute irgendwann mal wieder mit Silber bezahlen werden.

Hinsichtlich BTC vs. LTC: da BTC aktuell auf Hundertmillionstel teilbar ist, gibt es keinen Bedarf für LTC. Da Visa, Paypal, etc. schnell und günstig genug sind, dient BTC in allererster Linie als store of value. Und das ist genau das, was wir brauchen, um uns gegen den bevorstehenden Verfall der Fiat-Währungen zu schützen. Alles andere ist Marketing-Mumbojumbo ;-)

#nurmeinebescheidenemeinung

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Stimme ich dir größtenteils zu da nicht neu für mich.

Sehe es jedoch so, dass btc zu wertvoll sein wird (store of value) und zu teuer (Gebühren) was eben den Platz für eine weitere Währung schafft.

Nach dem Kollaps braucht man eben etwas zum handeln/ bezahlen.

Grin finde ich da nicht nur wegen dem privaten/anonymen Aspekt (möglichst ähnlich zu Cash, trotzdem digital) interessant sondern vor allem auch da durch mimblewimble die Blockchain sehr klein und komprimiert bleibt.

Klar. Mimblewimble kann erst auf ltc und dann btc portiert werden, jedoch nur der private Aspekt auf nem höheren Layer.

Bei Grin ist mimblewimble jedoch schon im Base Layer und dadurch die komplette chain extrem komprimiert und portabel. Gebühren geringer. :)

Für die Normalos wird mit BTC bezahlen einfach zu teuer sein.. So wie früher mit Gold rumlaufen..

Bloß auf digitaler Ebene..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for being an awesome Partiko user! You have received a 58.56% upvote from us for your 7758 Partiko Points! Together, let's change the world!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit