There are so many tried-and-true investment vehicles available to the average investor and daytrader that

cryptocurrency may seem like a risky proposition. Compared to the much larger, trillion-dollar forex and commodities markets, cryptocurrency appears to be slim pickings. Yet nothing could be further from the truth.

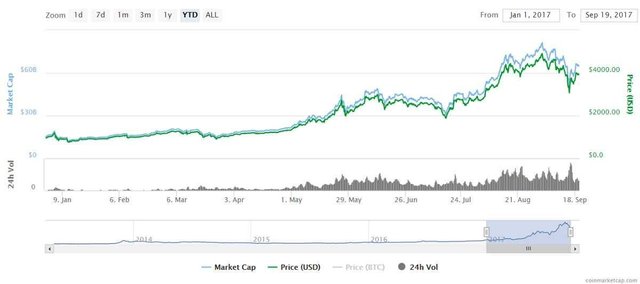

Since January 2017, the cryptocurrency market cap has increased from $7 billion to $110 billion by July — nearly a 1,600% increase. And in August 2017, cryptocurrency trading volume exceeded stock trading volume. Not bad for a financial vehicle that didn’t even exist until Bitcoin came around in 2009.

Clearly, cryptocurrency is a tremendous opportunity for the savvy investor and discerning day trader.

2017 in particular has been a watershed year for many cryptocurrencies. Bitcoin (BTC) increased in price from $997.69 on January 1st to a high of $4,950.72 by September 1st. BitConnect (BCC), another cryptocurrency, rose from $0.37 per share in January to $153.57 in late August.

Bitcoin (BTC) performance YTD

At this point, the biggest hurdle to successful cryptocurrency trading doesn’t lie in blockchain technology or its adoption — which are both improving on a near-daily basis. The biggest problem for cryptocurrency traders are the cryptocurrency exchanges themselves.

The problem with current cryptocurrency exchanges

While cryptocurrency has already surpassed stocks in trading volume, cryptocurrency exchanges are nowhere near as easy to use, safe, or robust as most stock, FX, and commodities exchanges.

This is a function of both the relative newness of the cryptocurrency market and its lack of a centralized governing body for cryptocurrency. Enterprising hackers and corrupt exchanges make embezzlement, fraud, and theft real concerns for most traders.

To make matters worse, the average cryptocurrency exchange also has high trading fees and poor (or non-existent) customer service.

Your average cryptocurrency exchange

COBINHOOD is a cryptocurrency service platform for the modern blockchain era. It was created with the average institutional and retail investor and trader in mind. As the world’s first zero fee (read: FREE) high frequency cryptocurrency exchange, it aims to maximize return on investment for all customers. COBINHOOD also offers initial coin offering (ICO) underwriting services (more on this below).

Click here to learn about the COBINHOOD ICO

Let’s go over the various ways in which COBINHOOD offers investors and day traders a better deal than the average cryptocurrency exchange.

More choices, more support

According to Exchange War, the top 30 cryptocurrency exchanges charge 0.2% in trading fees on average for both sides of the trade. Some may offer lower fees, but only if a trader crosses a high transaction volume or account minimum threshold.

Not only do most exchanges charge a trading fee on both the buy and sell side, spot trading and margin trading may not always be included. There are usually stringent (and oftentimes steep) margin requirements, account minimums, and additional fees.

COBINHOOD eliminates all of that so that investors and traders can get the best and most profitable executions and maximize their market liquidity. Customers aren’t charged anything for spot trading or margin trading, period.

COBINHOOD currently supports the following cryptocurrencies: BTC, BCC, ETH, ETC, LTC, ZEC, XMR, XRP, COB, NEO, OMG, USDT, DASH, IOTA, EOS, REP, and GNT.

Cryptocurrencies currently supported by COBINHOOD

The exchange also supports fiat currencies, including: USD, EUR, JPY, KRW, CNY, HKD, CAD, GBP, AUD, and NTD.

Languages supported by the platform include English, Spanish, Portuguese, French, German, Russian, Chinese, Japanese, Korean, and Arabic.

As already mentioned, customer service is not usually a high priority for cryptocurrency exchanges. COBINHOOD greatly improves user experience by providing 24/7 online customer service.

If you have any questions about the supported currencies or languages, or if you encounter any issues or otherwise need assistance, customer success specialists can be reached via the website and mobile app. The customer success team will respond to your inquiry within one day.

Better infrastructure, better executions

Another common problem with cryptocurrency exchanges are the impossible-to-predict and often disastrous shutdowns that can occur without warning. This type of system-wide failure can wreak havoc on all accounts trading on the exchange.

For example, in 2014, Mt.Gox encountered serious technical failures that effectively halted trading on the exchange. Mt. Gox subsequently filed for bankruptcy and the CEO was tried for embezzlement. This didn’t look too great for Bitcoin as a whole, so the value of BTC plummeted from $260 to $110 — before Mt. Gox customers could sell off their rapidly depreciating investment.

Shutdowns have occurred on other major cryptocurrency exchanges, including Kraken and Coinbase, which both shut down several times in 2017. Platform shutdowns always bring user trading to a halt and can lead to the loss of vast amounts of capital.

Exchange shutdowns can lead to account wipeouts

Why do cryptocurrency exchanges shut down so often? Because they tend to have underdeveloped infrastructures. These exchanges simply can’t accommodate modern high frequency trading volumes. Some exchanges also field a poorly trained or non-existent support staff that may not respond to inquiries at all.

Even when these exchanges are functioning, they aren’t giving traders the best executions. Due to rate-limited trading APIs, non-real-time transaction confirmations, and delayed order book updates, traders are often unable to trade in real-time.

Even worse, the Know Your Customer (KYC) process tends to be extremely slow. With Kraken, when demand is high and the servers are being pushed to their limit, it can take up to 30 days or more to complete Tier 4 verification.

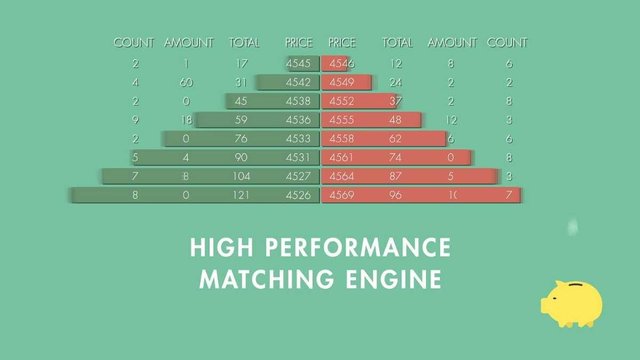

By comparison, the COBINHOOD platform can process more than one million orders per second with sub-millisecond latency. That’s as close to a secure, real-time cryptocurrency trading experience as possible. This makes COBINHOOD not only the world’s first cryptocurrency exchange capable of high-frequency trading, but also the leading cryptocurrency exchange in terms of order execution and profitability.

What’s under the hood?

For the developers among us, COBINHOOD is built on the Google Cloud Platform and programmed in Golang for high concurrency. That way, each trading pair is processed through a dedicated order matching engine that guarantees high order matching speed.

COBINHOOD’s order matching engine is comprised of various microservices operating in tandem, from the order matching system to the job and message queue, deployed with Docker and Kubernetes, which helps achieve high availability and scalability of order processing at all times.

All orders are stored in Redis cluster, a top-of-the-line database technology that features horizontal auto-scaling and distributed in-memory replication. Transaction and order book updates are sent through Web Application Messaging Protocol (WAMP) for real-time updates at every tick.

Finally, all transaction records are stored in Cloud Spanner, a relational Google Cloud Platform database notable for its strong consistency and horizontal auto-scaling.

In stress tests designed to push the platform to its limits, COBINHOOD averaged 1,154,284 orders and 10,142 order book updates per second for each trading pair — making it the world’s first cryptocurrency exchange capable of true high-frequency trading.

COBINHOOD’s matching engine can process over 1 million orders per second

Cutting-edge security protocols

As with all new investment vehicles, cryptocurrency exchanges are frequent targets of cybercrime. In February 2014, for example, Mt.Gox was breached and lost 650,000 Bitcoins, which are currently worth $2.6 billion. And in August 2016, Bitfinex, one of the world’s top 10 cryptocurrency exchanges, was hacked and lost 120,000 Bitcoin, currently valued at more than $480 million.

Clearly, the continued growth and proliferation of cryptocurrencies as valid investment vehicles can only be ensured with increased security at exchanges. Customer security concerns have to be addressed and handled appropriately rather than swept under the rug. A modern, trustworthy cryptocurrency exchange needs to effectively prevent and combat any and all instances of fraud, embezzlement, and cybercrime.

To this end, COBINHOOD believes in 100% transparency. It discloses all online and offline wallet address for public scrutiny, ensuring that no embezzlement can take place that a forensic audit won’t catch.

For all online transactions, COBINHOOD requires two-factor authentication (2FA) to log in, and withdrawals require an extra email confirmation.

For all offline transactions, each COBINHOOD customer has a multisignature wallet with 8 hardware security modules (HSMs). In order to access the offline wallet, 5 out of the 8 HSMs have to be confirmed. That way, if just 1 or 2 HSMs are compromised, your wallet remains secure. HSMs are also geo-distributed across different countries, further maximizing security.

COBINHOOD’s HSMs are geo-distributed around the world

Because of COBINHOOD’s heightened, cutting-edge security measures, 100% of all crypto assets are fully covered and backed by insurance.

Initial Coin Offering (ICO) services

Like an initial public offering (IPO), an initial coin offering (ICO) is a way for new cryptocurrencies to enter the market with support from investors. And they’re happening more frequently.

In 2016, there were 64 major ICOs that raised a grand total of $103 million. In 2017 so far, funds raised through initial coin offerings (ICOs) increased from $5.6 million in January to $987 million by July. ICOs are expected to raise as much as $200 billion by 2020, pointing to an exponential increase in both investor interest and the ever-increasing number of new cryptocurrencies entering the market.

But ICOs are not without their problems. The biggest hurdle for new cryptocurrency companies is that ICO tokens cannot be immediately traded in exchanges after the ICO. Due to low starting liquidity, the bid-ask spread of an ICO can be very large, which further reduces their attractiveness to traders.

Even worse, cryptocurrencies that want to be listed on one of the world’s top 10 exchanges need to pay a steep and prohibitive listing fee. This fee can be as high as 500–1,000 Bitcoins. Because most cryptocurrency companies cannot afford to pay this fee, traders are stuck dealing with low liquidity and high spreads on the secondary market.

After recognizing that ICO hurdles are limiting the growth of cryptocurrency markets as a whole, Cobinhood decided to solve the liquidity issue by offering an ICO underwriting service. Cobinhood’s dedicated ICO review team will only underwrite high-quality, promising ICOs that have passed stringent due diligence, smart contract code reviews, and legal compliance reviews. ICO tokens underwritten by Cobinhood can be immediately traded on the Cobinhood exchange after the ICO, which solves the liquidity issue.

In addition, the COBINHOOD ICO Spark Program will help well-known enterprises, successful startup companies, and celebrities launch their very own ICOs.

The COBINHOOD ICO (COB)

COBINHOOD believes so strongly in its underwriting service and its cryptocurrency platform that it is launching its very own ICO. The COBINHOOD ICO token, COB, is available for purchase until October 22nd.

COB is based on the Ethereum ERC20 token standard. 500 million COB tokens will be issued for the ICO and can only be purchased with Ethereum.

The tokens are being offered on a tiered schedule:

9/13–9/19: 1 ETH for 5,600 COBs (40% bonus)

9/20–9/26: 1 ETH for 5,200 COBs (30% bonus)

9/27–10/3: 1 ETH for 4,800 COBs (20% bonus)

10/4–10/10: 1 ETH for 4,400 COBs (10% bonus)

10/11–10/22: 1 ETH for 4,000 COBs (no bonus)

50% of all COB tokens are offered to ICO participants

After the ICO, the COBINHOOD exchange is scheduled to go online on November 1st, 2017. COB tokens can be immediately traded on the COBINHOOD exchange once it is live.

100% of the proceeds from the COBINHOOD ICO will be used to fund the development of the exchange platform.

Join the COBINHOOD ICO today

If you are interested in learning more about the COBINHOOD exchange, platform, or ICO, please visit the COBINHOOD website as soon as you can.

Click here to join the COBINHOOD ICO

If you’re interested in buying COB tokens during the ICO, don’t wait — they’ll be gone before you know it.

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and we can help each other succeed :)

P.S.: My Recent Post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit