Like many crypto investors I am always looking for projects with exciting hidden value. That usually means identifying quality teams with innovative solutions, but one easy metric for identifying investment potential is exploring staking rewards for your favourite tokens.

Not every coin offers proof of stake rewards, but if it does, that certainly peaks my interest. Today I want to talk mostly about what Proof of stake is, and staking, and the highly coveted "masternode".

Introduction:

Today I will look at cryptocurrency staking, attempt to explain proof of stake, consensus algorithm, and I will mention some cryptocurrencies which may hold an exciting hidden value in that they offer affordable masternodes today.

However, in order to review the value proposition of such coins we must first set out some basic terminology around consensus algorithm and proof of stake vs. proof of work.

Definitions & Important Terminology:

Proof of Stake vs. Proof of Work:

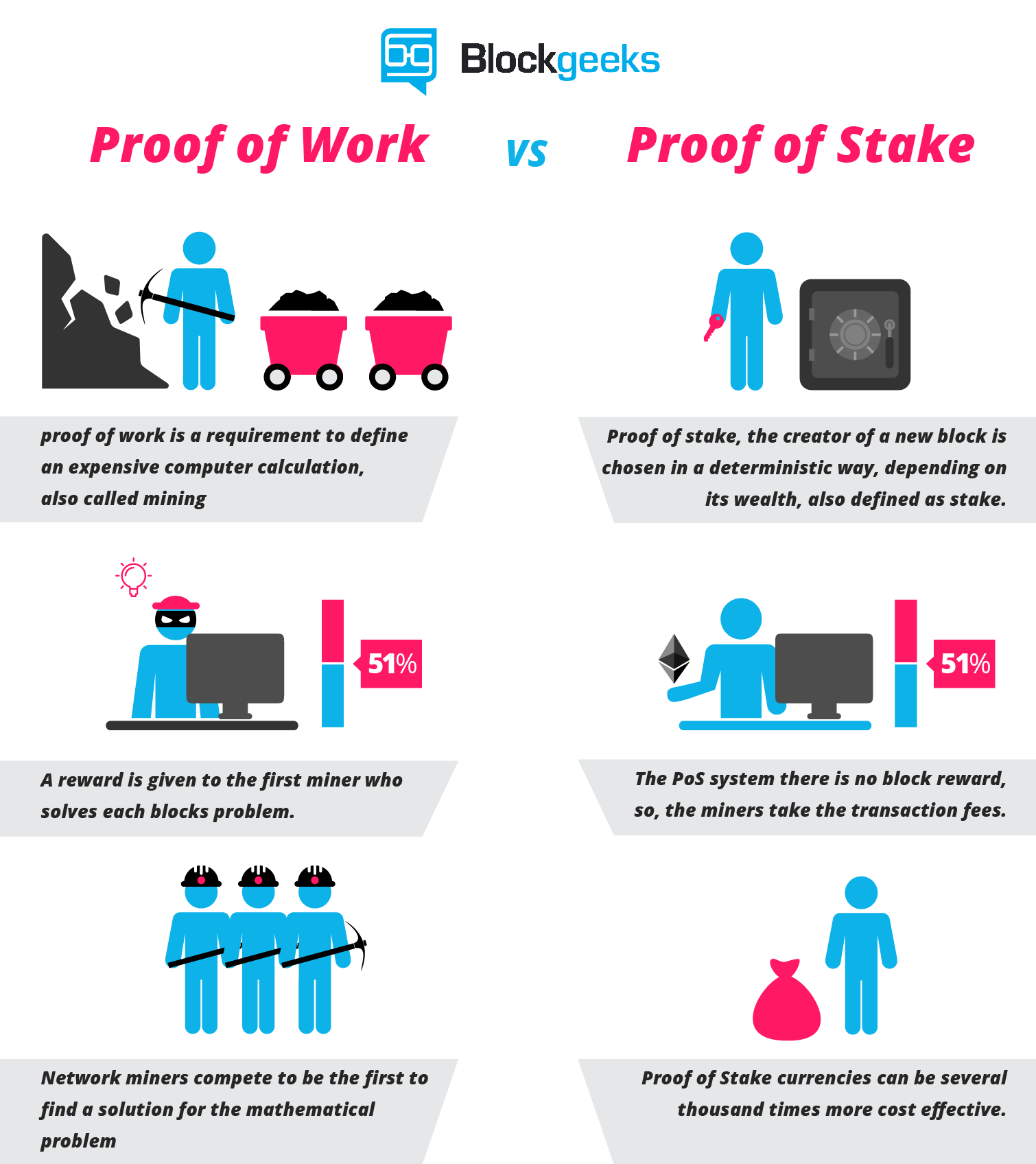

For those who do not know, PoS & PoW are two different approaches to "consensus" within the decentralized ledger that is a blockchain. Suffice it to say, PoS works on the back of the wallets/computers/nodes that are staking coins, and Proof of Work works itself out through the computing power "miners" allocate to the network. Both are aiming to achieve the same end, namely: agreement within the network about what is happening, when and where.

Today we are just talking about proof of stake and masternode staking, but some coins use proof of work mining AND proof of stake, so each approach of consensus is a unique.

For a bit more on the differences between PoS and PoW you might enjoy the following illustration from BlockGeeks.com or you can follow the link and read their very informative article on the topic.

PoW vs PoS:

What is a "Consensus Algorithm"?

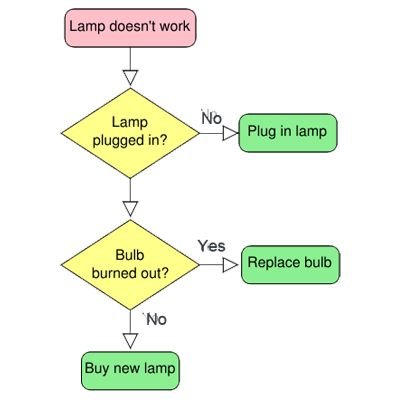

A "consensus algorithm" is really just the program a network runs to achieve the secure, reliable, accuracy of the decentralized ledger.

Basic Algorithm:

It is a mechanism by which a blockchain network achieves agreement across all "nodes" (aka, computers/wallets) as to what is happening on the blockchain. Therefore, "consensus" is another word for that agreement on who owns which coins.

Example:

For the network to work properly, we need to track, and accurately record when Jim send $1.00 to Jane. We need to know and agree, that it happened, when, and that the value sent was in fact $1.00, not $2.00. This data is packaged, verified and recorded on the blockchain by the work done by that "algorithm" mentioned above, so that all the users can have faith in the ledger's accuracy.

If you want to hear more about Consensus then check out this 2 minute video from my hero, Julian Hosp, Co-founder and CEO of TenX.

Julian Hosp, TenX explains "Consensus":

Staking Rewards?

Staking rewards are payments made to incentivize a user to store coins in a specific "staking" wallet, which while open helps support and secure a blockchain network.

The users commitment is rewarded with new, free coins, because their "staking" enables the network to operate, through that algorithm running via your open wallet. So reward is paid to all stakers because the network relies on their staking wallet's being open, so that the underlying code (ie., consensus algorithm), can operate and securely and reliably verify, process and record transactions on the chain.

As a payment for the user's commitment the algorithm will "reward" the user. The user will received X reward for staking supporting the network. Where X is a percentage of total block rewards multiplied by your total number of coins being staked.

Masternodes:

A masternode is just a term which refers to a staking wallet that contains a specific, required number of coins.

Sometimes projects allow you to stake regardless of how few you own, others require, a minimum investment. A stake which includes the companies specified threshold is called a masternode.

Why should you care?

Simple, proof of stake algorithm enables people like you and me to earn free crypto.

If you like the idea of earning passive income you should explore cryptocurrency staking.

Should I buy a Masternode Today?

So, now that you know what Proof of Stake is, and what a Masternode is, should you buy one?

I personally am spending a lot of time investigating the coins I know of that offer a stake reward, particularly where they offer a masternode option that is what I would call affordable. I will mention a few today but this is not intended to be a coin review, or endorsement, I am just mentioning some that I have begun investigating.

If you are interested in staking, comment below with whichever coins you are interested in and maybe I will review it.

More Resources:

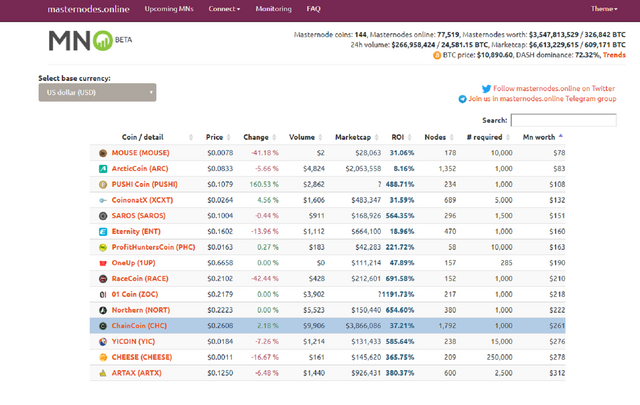

First if you ever want to see some basic data on coins that offer masternodes, you can find that info at this site, its great to check into, but keep in mind the ROI they suggest is not 100% accurate.

From that site you can search possible masternodes, organized by cost to set up, or ROI, or other criteria. Here is a list of their top results for lowest cost to set up the masternode.

Again this is not an endorsement, just some data for you to mull over.

Low Cost Masternodes:

Some of the projects I have considered for my own investment include:

Masternode Cryptos:

- Payfair – 10,000 tokens

- Social Send – 6,250 tokens

- XIOS – 1,000 tokens

- Footy cash – 5,000 tokens

- Crave - 5,000 tokens

- Eternity (ENT) – 1,000 tokens

Warnings:

After doing some preliminary research I would recommend you stay away from Eternity, everything about it seems unprofessional and unfinished.

Of these tokens, and after my preliminary research I would only seriously consider investing in Payfair, SocialSend, and maybe XIOS. But each of these are MICRO cap coins, their developers are not house-hold names and their progress could suddenly stop at any moment, and I wouldn't be surprised. Meaning, be very careful with any of these.

Do your due diligence:

If you want to know more on these, or any other, start by searching Youtube for reviews of that coin. Watch as many different reviews as are available, and also search their social media presence. That can give you a good indicator of their commitment to the project, or lack there of.

I am personally trying to buy Social Send as of today. It seems interesting. I will do a seperate post about that as it progresses.

Thanks for listening.

As always if you enjoy the content, please up-vote, comment, resteem and follow.

Great post. I like how you explain topics that others just assume everyone understands like algorithms, staking, and masternodes. Keep it up!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I just started this crypto journey last september and so very recently I was totally lost in a sea of terminology and felt clueless. I studied for countless hours everyday, still do, and from that I know noy everyone gets this stuff. Thanks for the encouragement. I appreciate it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Actually, I haven't seen the better post...thanks for making Steemit even better place :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much. I take this platform very seriously. I want very much to succeed at providing meaningful quality content so as to attract great conversation and attention to Steemit.

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I know, I read your posts regularly...because crypto world isn't easily understandable I think your follower or anyone must appreciate the way you explain crypto stuff.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow aun no sabia el significado, gracias por siempre darnos una información diferente a diario amigo @infidel1258 :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit