The post "How an Algorithm Feels from the Inside” is one the highlights of rationality. It has a lot packed into it, so here is my take on it.

There is a program in your brain. I call it Classification.exe. It sorts things into buckets, establishing “is-a” relationship. It answers questions like “is computer a machine?” or “is this table sturdy?” or “is this ICO a scam?” and a variety of other questions. Classification.exe is a useful program. After you make classifications you can proceed to make more high-level decisions.

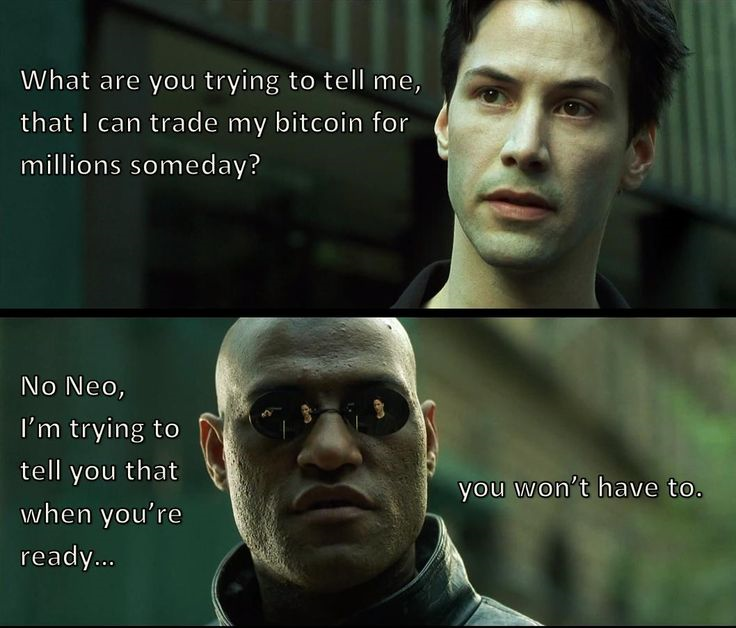

However, there are some questions for which we overuse Classification.exe. There is one question which has been frustrating people in crypto for some time. You know it, I know it, but I’ll say it anyways.

Is cryptocurrency a bubble?

You are probably tired of this already. Let me rehash some of the arguments that have appeared against it.

a) It has been a bubble for 4 years already. Basically, people have been talking about crypto being a bubble for some time now and this has not necessarily lead to a decrease in price, thus the statements are not that trustworthy. While this certainly calls into question the validity of the speaker, it’s not a full-proof argument against it. People who say "it’s a bubble" could be bad at predicting, but also, prices could also fluctuate regardless of that.

b) Money itself is a bubble. This is a complex post saying that the essence of "bubbliness" is present in the dollar, and thus any essence of “bubbliness” does not prevent a currency from becoming a dominant form of payment. This is also true, but it’s a strange biting of the bullet. Yes, crypto is a bubble, but some bubbles can win, you know.

You are coupling a technical question of classification of assets with the question of prediction about the future. If somebody tries to come up with a bunch of technical specifications to measure what bubbles are “objectively”, then they fit those specifications to Bitcoin, then they find out this is fact a bubble. What’s important to note here, so is the dollar. All currencies are “technically” bubbles, however this classification fails to predict anything else about them. Some currencies collapse and some don’t. If you want to be more dramatic about this:

OR

Bitcoin isn't a bubble, it's the pin.

c) There is another problem. In addition to coupling classification and prediction un-necessarily, the bubble question is coupling a question of status as well.

This coupling is less complicated, but more frustrating. You see, the word “bubble” conjures up an image of a low status person. Perhaps you knew some girl who got involved in a pyramid scheme and god she was annoying. Low status people invest in bubbles, and maybe they still make money from even dumber people. So, by conjuring up the word, there is a not-so subtle connotation of the person you are talking to being irresponsible and beneath the speaker. As you can imagine, this doesn’t go well, especially with people who are in fact fairly sophisticated investors.

This means that answering “yes” to the bubble question gives the wrong impression about way people perceive their relative status in the broader world. Answering “no” could make it seem that someone doesn't quite agree with your definition of speculation.

I am going to present another way to think about this. The problem is that this question is basically mousing over Classification.exe, putting a parameter “crypto” and “bubble” and asking your mind whether it wants to establish an “is-a” relationship. If you have been following the market, this process will produce some uncertainty in both directions. You might alternate back and forth, spending many brain cycles or even debate cycles. This is a common rationality cue that you are trying too hard to solve the classification problem instead of your real problem. Basically, I suggest that this entire approach is the wrong way to think about crypto. What I mean:

Taboo the word “bubble” and Don’t run Classification.exe at all.

If you are not used to people talking about mental algorithms, you might instead say: oh, I am going to make a list of pros and cons and see what columns outweighs another. This is better, but still not perfect. Why not? Because some of things that make bubbles more likely also make crypto more valuable.

For example, you have probably heard about the famous incident with a shoe-shine boy. A stock trader heard his shoe shiner talking about stocks, went home and sold everything. The market crashed shortly after. This story is now used to give you a sense – if your Uber driver knows about the financial asset you are investing in, maybe it’s time to divest.

At this point some of my Uber drivers don’t just know about crypto, they know about this story as well. Does that mean I should stop using the story as guidance? (This question is left as an exercise to the reader).

However, what’s more important is that crypto is not just a financial asset. It is also a piece of software. More-over, some cryptos, especially Ethereum have an ecosystem that has network effects. More developers making apps means more users and more demand for gas, which means higher Eth price, which means more developers making apps. Even simpler currencies have network effects. Also, crypto has cross-currency network effects. If an exchanges list 100 coins, the 101st coin is easier to get in front of people.

Think about other software with network effects. Is people knowing about Facebook evidence for divesting from Facebook or evidence for investing in Facebook?

So, getting back to Classification.exe. The issue of Uber drivers knowing about crypto as a potential currency is potentially positive evidence that the prices will rise. Uber drivers knowing about scams or hacks and the DAO-type failures would be negative evidence. In the stock market world, regular people wanting to get into the latest craze does generally point to a the crash.

In other words, by including the mere word “bubble” in your considerations, you have potentially turned positive evidence of improving network effects into negative evidence of something being “over-valued”. Basically, even asking the question is trying to run the wrong program. It’s like storing a SQL database in a Word document. It's like a farmer who has only seen birds and cows asking if a snake is a bird or a mammal. The debate of "but it lays eggs" - "but it flies" could go on a for a long time without helping you understand how to deal with snakes. In fact, are we part of the classification or a "bubble" bubble, where this mental algorithm is over-valued? (This is also left as an exercise to the reader)

What’s a good idea to do instead? There are many programs you can run by pointing to them with different questions?

Decision.exe - What should my asset allocation be? How much risk can I take?

Prediction.exe – What is my current subjective probability that crypto will go up?

Outside view.exe - Do I think things are inefficiently priced? How do existing theories of finance say about crypto returns in the next year? Do I have better information about crypto than the hodler of the average dollar in it?

Causality.exe – What world events will happen that could affect this and how?

Falsifiability.exe – What would have to change for me to believe the opposite?

In particular, the set of questions you are most interested in is

Will crypto dip in 2018? Will some cryptos win over others?

I don't want to give any investment advice to anyone especially on the internet, so I am not going to be answering those. All I wish to point you to is using your precious brain and social cycles in a more efficient manner than running Classification.exe over and over again.

also we need to be careful not to get viruses in any of those exe programs

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit