Kiva makes it clear that they take due diligence and monitoring very seriously but in the end all the risk lies with the lenders.

This is understandable since they are only the facilitators of the lending process.

Obviously to much loss passed onto the lenders will result in reputational harm to Kiva and so that is why they will try their best to weed out bad apples and vet new field partners.

The process of vetting new field partners appears quite rigorous, as does the ongoing monitoring.

If all these processes are followed to the letter then in reality the risk to the lender is quite reasonable reduced.

An emerging aspect of kiva is the direct loan.

This is closer to a true peer-to-peer lending model which eliminates more middlemen.

These are a great step forward from the borrower perspective.

The interest rates are 0% or close to that.

However due to the absence of a vetted field partner, risk to the lender may go up significantly.

This is mitigated through some intriguing prerequisites:

- Social underwriting

- Use of Trustees

- A private fundraising period

- and ongoing monitoring

Direct loans are enabled using paypal and there are costs relating to these and fees associated with them. This is where I would like to see a blockchain/cryptocurrency facilitating cost reduction at this layer.

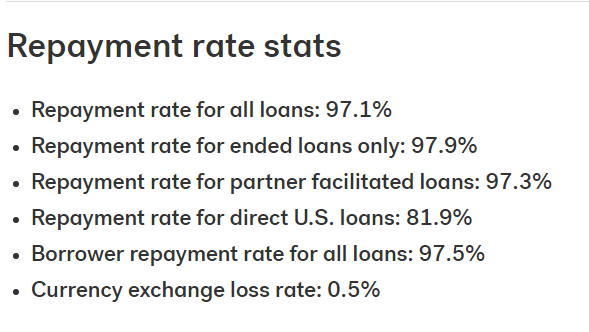

In spite of all this talk about risk, kiva.org prides itself in the following statistics:

There are also things like country risks, currency risks and even risks that kiva might fold.

My suggestion in this regard, to mitigate all these risks is to spread the risk around by:

- making many small loans

- loan across multiple field partners

- loan across multiple countries

- loan across multiple currencies

- loan across lending sites

Great post thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Even micro lending sites has its own risk ^^

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Kiva.org sems like a good site, but is it better than bitbond?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So if interest rates are 0% then why would any1 lend their hard earned dollar? No gain for their risk or am I missing something?Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

all are 0% for all lenders, no lender gets any other return other than the good feeling that accompanies helping others.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why are the rates so high? Are these interest interest rates for loans collected? So unfair

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good stuff

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @sme! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit