I've noticed a trend whereby a growing number of exchanges join the block producing ranks of DPoS blockchains (see STEEM and EOS as two examples, and possibly others that I'm not following). The trend has been toward a greater and greater pooling of control by exchanges (i.e. centralization).

It is true that exchanges offer the fantastic services of marketplaces and liquidity providers.

But just because they offer a marketplace and liquidity does not mean they should be entitled to a seat at the round-table of consensus for every blockchain they provide liquidity for, if they are voting with tokens they didn’t buy in the first place. That’s against the spirit of DPoS whereby consensus and the power of decision-making is supposed to be decided by those who genuinely hold value in the system.

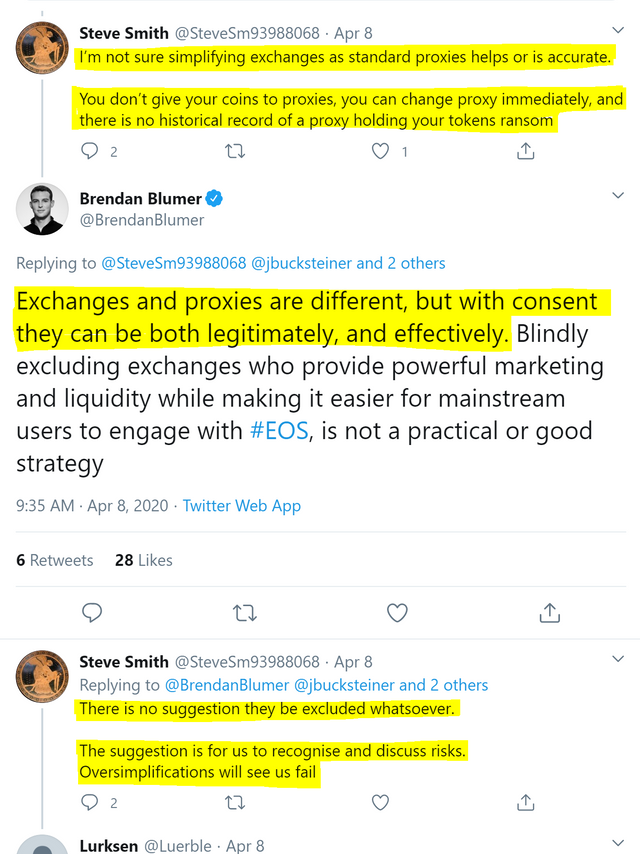

I've heard it stated that "exchanges are acting as proxies when they are voting with user funds". To me, this is a semi-fallacy that exchanges are truly valid proxies when the voting of user funds is often not actively opted in and consented to by the owners of those tokens.

I've also heard the rebuttal that because Exchanges' terms of services state that users lose control of tokens when on the exchange, that this somehow justifies the effects. To me, this doesn't make the failure of DPoS any less real. It just means the exchanges have covered their asses. An exchange's best interest is not in the health of the DPoS of any one blockchain.

(Tweet source)

Brendan Blumer, CEO of block.one, himself correctly clarified on this point: "Exchanges and proxies are different, but with CONSENT [emphasis my own] they can be both legitimately, and effectively."

I agree with this. Ensuring that voting with tokens on exchanges is OPT-IN (so they can act as valid proxies) is the only way preserve DPoS when exchanges hold such a lion's share of a blockchain's total token supply.

The problem lies herein: You cannot actually enforce that exchanges offer strict OPT-IN voting. Because exchanges hold such a large percentage of total tokens, I see this unenforceable element as an inherent flaw in DPoS (at least as currently implemented) which depends upon tokens voting for its consensus model and for its censorship resistance.

In the same tweet above, Brendan also went on to say: "Blindly excluding exchanges who provide powerful marketing and liquidity while making it easier for mainstream users to engage with EOS, is not a practical or good strategy". Again, just because an exchange offers a marketplace and liquidity does not mean they should be entitled to a seat at the round-table of consensus for every blockchain they provide liquidity for, if they are voting with tokens they didn’t buy in the first place.

I remain cautiously optimistic about EOS:

- I have high hopes for EOS's capability and speed, as one of the most advanced smart contract blockchains.

- But at the same time, the slowness to improve my governance concern (and the question if it ever will be improved) is off-putting to me.

I still hold all my original EOS due to the 1st factor above (speed & capability), but I am also paying attention to the 2nd factor (slowness to improve governance).

Let's reduce exchange dominance via voting with user funds on EOS by:

• Dan's staking pool idea

• 1 token, 1 vote (The current 30 votes per token exacerbates exchange's voting power which they also trade)

• Incentivize explicit OPT-IN voting on exchanges.

It's taking a long time to get these changes put into effect.

My concern is that BPs may currently be too entrenched for effective changes in governance to occur.

Come next month, May 2020, I’m hoping B1’s voting influence will improve this with the standards they put forth in order for block producers to be eligible to receive block.one's votes.

However, to play devil's advocate, this hope in block.one's behavior and standards is to rely on a central entity. That’s why incentives must be aligned on layer 0 such that the blockchain natively accounts for an exchange’s ability to vote with user funds.

Summary

I love the technology and performance that EOS offers. Please, let us be effective about ensuring its long-term viability with an alignment of incentives that lasts many years. In my opinion the way we accomplish this is by upgrading the governance model to be lasting, and we halt the tendency toward centralization for fear that we end up like the STEEM and HIVE split.

Sincerely,

Totally agree.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit