The emergence of blockchain technology has proven to us that its has come to stay. Recently, some gainsayers arose and expressed skepticism about the longevity of the technology, but the blockchain technology keeps advancing. The emergence of blockchain technology has obviously enhanced financial sector in that the technology connects everyone together and making the economy more feasible.

The financial and banking sector over time has been one of the major fore sectors,and development of the financial technology is one that cannot be over emphasized. There is great potential for blockchain technology in the banking/financial sector. This is very true when it comes to solving some of the major problems affecting the financial and banking sector as we know it today.

A financial-driven society such as ours today is ladened with numerous opportunities and significantly improves the financial sector. This is however disrupted by the fact that the financial sector in each country is filled with loopholes at every phase of the process such as digital assets not widely recognized as financial assets which therefore cannot not serve as a means of collateral,selling and buying of cryotocurrencies becomes a risky business due to the high volatility rate, delay in getting loans in the banks, even creditors not willing to accept digital currencies/assets as pay-backs for loan they granted etc. These glitches partly lie in the low adoption of digital assets/currencies as a means of financial payments and settlements.

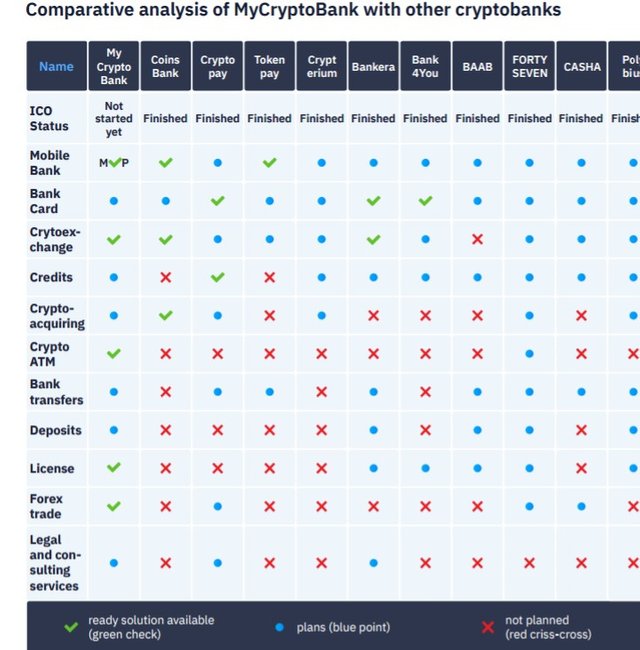

There are many projects that has been built on blockchain technology which seeks and focuses on disrupting the financial sector but however, failure became theirs as they couldn't achieve a bit of the milestone underlying the financial sector. A future for an underlying public financial technology, hinging on blockchain becomes more and more needed. Hence, a new and advanced virtual banking and fin-tech, the "MYCRYPTOBANK" presents a new and convenient way to conduct business in the financial and banking sector. This ecosystem boasts of being more than a traditional financial system,but rather an integrated ecosystem creating a global network that lends fiat money to

individuals and small businesses using crypto assets.

WHAT IS MYCRYPTOBANK?

MyCryptoBank is an online bank allowing any client registered in the electronic bank

system to make a full range of bank operations, additional operations with cryptocurrency

(payment processing, debit cards, credits and cheap investment products, use

of cryptoassets as credit security and many others based on Blockchain technology

without visit of department.

Mycryptobank is a blockchain ecosystem for banking and

financial services which seeks to disrupt and integrates crypto and fiat together in a unique platform.

FEATURES OF MYCRYPTOBANK

To every ecosystem, something exists to make it outstanding from other ecosystems. The case however is not different from Mycryptobank as it unleashes it's key features such as;

ATM cards for withdrawals and purchase of goods and services anywhere in the world.

Supporting cryptocurrencies adoption and utilities.

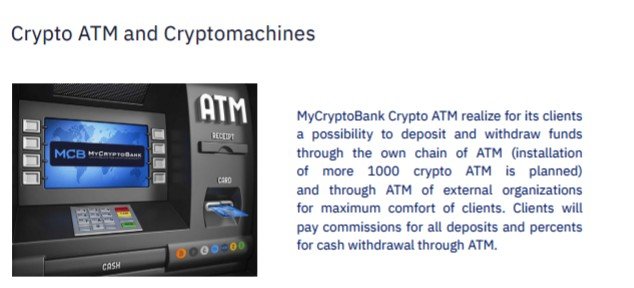

Instant fiat exchanges deposits and withdrawals through its wireless ATM

International and forex trades become easier

Creating an infrastructure which will

allow setting acquiring and merchants for goods payment for companies and online service.

TOKEN INFORMATION

Total Coin Supply: 795,500,000 Tokens.

Soft Cap : 3 million dollars

Hard Cap : 100 million dollars

Token price:

$0.20,$0.22,$0.24,$0.26. The token prices differs as the ICO progresses.

Accepted Cryptocurrencies:

Btc, Eth, Ltc, Bch, Eos and Bank card

USEFUL LINKS:

Website: https://mycryptobank.io/

White paper: https://mycryptobank.io/docs/MyCryptoBank-white-paper.pdf

Telegram: https://t.me/MyCryptoBank

Medium: https://www.reddit.com/user/MyCryptoBank

LinkedIn: https://www.linkedin.com/company/my-cryptobank/

Instagram: https://www.instagram.com/mycryptobank/

Medium: https://medium.com/@news_87035

Author: Annexia

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2014957;sa=summary